The Bitcoin market is maturing. It is now well over $1 trillion in market cap, hovering around the size of the entire silver market. The larger the market, the more attractive it becomes to sophisticated players who want to conduct sizable trades, and Bitcoin is indeed growing in its sense of legitimacy.

The interest from large institutions like hedge funds, banks, family offices and investment firms starting to offer Bitcoin-related products is clearly growing if we look at the in-flows into products like the futures contracts and now the Bitcoin spot ETF, while interest in Bitcoin mining stocks have also started to tick upward as we move close to the halving.

Bitcoin has a history of significant price volatility during its 4-year supply shock, which can translate to high returns for investors willing to take on the risk. Considering that this will be the first cycle where institutions can really access this market, Wall Street firms are looking at ways to maximise this trend by exploring new financial products like levered ETFs.

These new products offer new financial instruments and ways to invest, which allows investment firms to create new investment opportunities for their clients and diversify their portfolios, potentially reducing overall risk.

This market is no stranger to leverage

Leverage on Bitcoin has always been available in one form or another, with many a retail trader trying their luck with these products and leaving the market bruised and penniless.

One method of acquiring a level on Bitcoin is using exotic off-shore exchanges that offer traders up to 100x leverage. Platforms like Bitmex, ByBit, Deribit, and Binance are becoming popular venues for speculative traders.

One concern is the opacity of their order book and trading engines, which can be subject to flash crashes that liquidate traders. Another issue with these platforms is that you’re placing trust in the custodian, which has been a hazardous occupation. We have many examples of exchanges cooking their books, ending up short themselves, and leaving customers with losses by declaring bankruptcy.

Leveraging up via altcoins

The other path is to take a punt on altcoins; these illiquid tokens have nothing going for them other than moving in tandem with Bitcoin, and in some cases, an altcoin beta is higher than Bitcoin.

Still, the issue here is that the more illiquid the coin, the more it moves, but that can also make it harder to exit your position, so traders need to manage their liquidity risk across multiple tokens if they’re trading in large sizes.

Regulatory approved leverage

Only some traders find leveraged options attractive, and others feel that the risk is mispriced or that those markets need to be more liquid and larger. Some trading firms cannot play in these grey markets filled with unregulated securities, scams, and possible regulatory issues.

These new market participants aren’t keen on trading altcoins or using some shady off-shore exchange offering leverage; they prefer to get their account wiped out responsibly and take losses using a regulated product instead, and that’s where leveraged ETFs offer these investors a vehicle to amplify their exposure to Bitcoin.

What is a leveraged Bitcoin ETF?

A leveraged Bitcoin ETF is a type of exchange-traded fund that aims to amplify Bitcoin’s daily returns by using debt and derivatives such as options and futures contracts. This means that if Bitcoin’s price increases or decreases by a certain percentage, the leveraged ETF’s value will increase or decrease by a multiple of that percentage.

For example, a 2x leveraged Bitcoin ETF would aim to deliver twice the daily return of Bitcoin but could also deliver twice the daily losses for the ETF holder.

An L-ETF applies derivatives to magnify exposure to a particular index, in this case, the futures market. It does not aim to amplify the monthly or annual returns of the target assets but instead tracks daily changes, resetting each day.

Why do investors want leveraged ETFs?

Traders can use leveraged Bitcoin ETFs to generate outsized returns and hedge against potential losses as part of a more complex trading strategy. Investors should carefully consider these risks and review the prospectus or summary prospectus, including investment objectives, risks, charges, and expenses, before investing in leveraged Bitcoin ETFs.

Investing in leveraged Bitcoin ETFs comes with several risks, including:

Market volatility and leverage risk

Bitcoin is known for its extreme price volatility, which can result in significant losses for investors in leveraged ETFs

Leveraged ETFs use derivatives to amplify returns, which can lead to significant losses if the underlying asset moves in the opposite direction of the ETF’s leverage.

Compounding risk

Due to the effects of compounding, leveraged and inverse ETFs may experience greater losses than one would ordinarily expect over periods longer than one day.

Credit risk

Leveraged ETFs are often structured as exchange-traded notes (ETNs), debt instruments backed by the issuer’s credit that bear inherent credit risk.

Systemic risk

Bitcoin ETFs could exacerbate market volatility and create systemic risks, particularly during market stress. This could stress institutions that are heavily exposed to the products or rely on them for liquidity management.

Management fees

Leveraged ETFs charge management fees or expense ratios to cover operational costs, which can diminish returns over time.

Tracking errors

While leveraged ETFs try to closely mirror Bitcoin’s performance, tracking error differences between the ETF share cost and Bitcoin’s value can occur due to liquidity in the market, delayed rebalancing of the fund’s holdings, and management fees. Leveraged ETFs may not closely track the underlying asset over the long term due to the effects of compounding and possible correlation errors.

Where can I find leveraged Bitcoin ETFs?

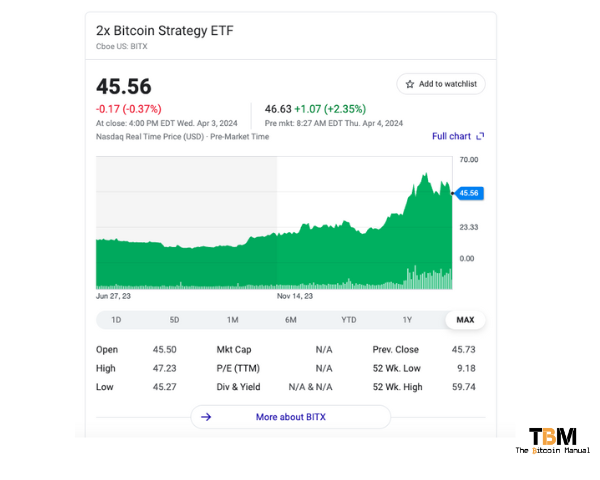

In June 2023, Volatility Shares’ 2x Bitcoin Strategy ETF (BITX) became the first leveraged digital asset-based ETF available in the United States. A leveraged 2x ETF allows customers to gain bitcoin exposure by only putting up half the value of the bitcoin. This futures-based ETF aims to provide twice the performance of the S&P CME Bitcoin Futures Daily Roll Index.

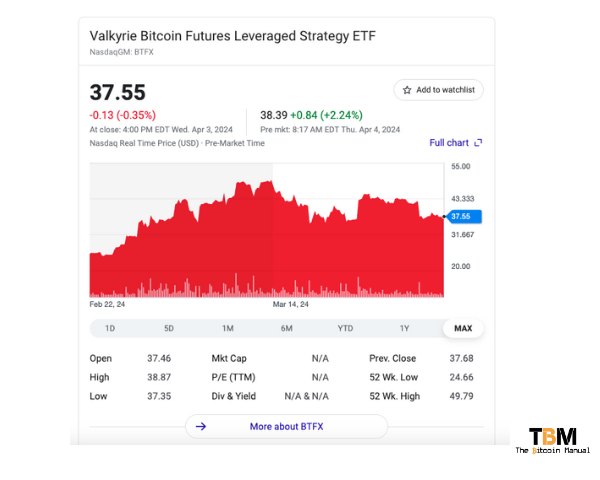

In February of 2024, Valkyrie launched a 2x leveraged Bitcoin futures ETF, which trades under the ticker BTFX. The Fund does not invest directly in Bitcoin, so it doesn’t need to deal with custody providers, as with the Spot ETF.

Rather, the ETF fund managers seek to benefit from increases in the price of Bitcoin Futures Contracts each day. The unique selling point for investors is the promise of providing, before fees and expenses, two times the daily performance of the Index, which is benchmarked against the performance of the CME Bitcoin Futures market

Leveraged buyers beware

These funds are unsuitable for all investors and should be used only by knowledgeable investors who understand the consequences of seeking daily leveraged (2x) investment results, including the impact of compounding on Fund performance.

Those looking for long-term exposure to Bitcoins should instead consider a product like a spot ETF, which closely tracks the underlying asset.

Leveraged ETFs are intended for short-term trading and should be actively managed and monitored by investors as frequently as daily. If you’re not actively managing your exposure to a product like this, losses can quickly compound, and the ETF could potentially result in the loss of the total value of your investment within a single day.

While leveraged ETFs promise amplified returns, they tend to be biased towards losses and magnified losses that happen very quickly and take far longer to recover from. In some instances, a recovery may never happen as losses are too great and positions are liquidated.