Bitcoin has matured as a global asset class, from nerd money held by hobbyists to a near Trillion dollar asset, settling Billions in value globally each day. As Bitcoin continues to show potential for price appreciation, traditional finance would demand products that provide exposure to it.

Investors in the traditional markets care very little about on-chain custody and censorship resistance. They aren’t exactly thrilled about buying Bitcoin from unregulated exchanges, so these institutions stayed out of the game.

Until now, the arrival of the long-awaited Bitcoin spot ETF was met with excitement and anticipation, with many predicting a dramatic surge in the price of the world’s leading cryptocurrency and only viable digital commodity. The bullish narrative around the spot ETF painted a picture of Billions sitting on the sidelines, waiting for a regulated product and as soon as it was available, these allocators would be flooding the market with demand for Bitcoin.

However, the event turned out to be a buy the rumour, sell the news trade, and the initial rally quickly fizzled out, losing as much as 20% of its value from the peak of the announcement, leaving some investors confused and disappointed.

The Dream of Easy Bitcoin Exposure

Spot ETFs in the US were seen as game changers, as they offer traditional investors a regulated and familiar way to access Bitcoin exposure without directly dealing with crypto exchanges or wallets.

This accessibility, it was believed, would attract institutional investors and mainstream financial institutions, leading to a significant influx of capital and pushing the price higher. Considering the US has the deepest capital markets in the world, it was essentially the SEC green-lighting the asset for the ordinary investor.

The target market for the spot Bitcoin ETF is those looking to diversify into the asset class but prefer to use their traditional brokerage accounts. At the same time, institutions can now make larger purchases without dealing with OTC desks or the issues surrounding tainted Bitcoin.

Front running the approval

The announcement of the spot ETF rumours began in October 2023, with a now-debunked CoinTelegraph article, that saw the price rocket up 10% before a retraction was posted. This bullish sentiment on the news saw Bitcoin tick higher over time as the rumours started to gain more traction.

We apologize for a tweet that led to the dissemination of inaccurate information regarding the Blackrock Bitcoin ETF.

— Cointelegraph (@Cointelegraph) October 16, 2023

An internal investigation is currently underway. We are committed to transparency and will share the findings of the investigation with the public once it is…

While the rumours were true, the timeframe was a big hit and miss, and it took nearly four months for the ETF approval to arrive.

Given the history of the price action, many had expected the long-awaited Bitcoin ETF approvals to be a sell-the-news event, with investors and miners sitting on high unrealised profits as the ETF narrative drove Bitcoin up more than 60% in just the past three months.

To some of those investors, a 60% return for one quarter was a decent trade, and they cashed out as expected.

GBTC: The Unexpected Twist

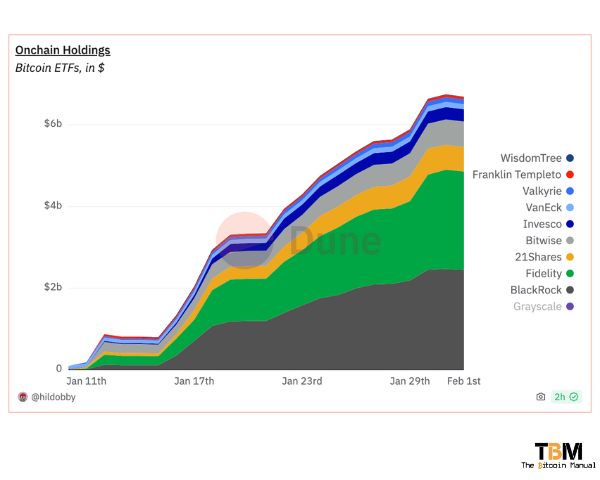

However, the narrative overlooked a crucial detail: Grayscale Bitcoin Trust (GBTC), a popular investment vehicle tracking Bitcoin before ETFs, had a greater effect than many anticipated. With the launch of spot ETFs, many GBTC investors saw an opportunity to trade their shares for cheaper, more efficient ETF products, with many of the new ETFs offering teaser rates and much lower fees.

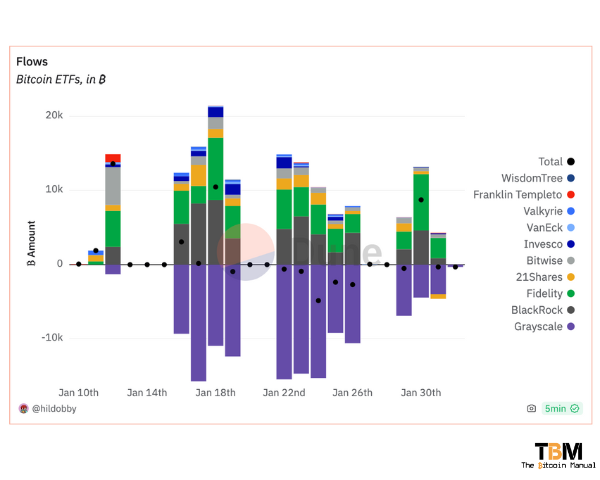

As GBTC had also converted into an ETF at the same time as the launch of the new ones, those in the fund looking to migrate forced GrayScale to sell Bitcoin on the open market to honour these redemptions. This resulted in significant outflows from GBTC, putting downward pressure on its price.

“What people didn’t realise is that you would have an enormous exit from Grayscale. If you scratch the surface, you see that most inflows are not new money, it’s just investors moving from Grayscale to another ETF.”

said Douglas Comin, a senior crypto options trader at XBTO – Source: FT

Conversion woes and Bitcoin flows

Adding to the complexity, Grayscale planned to convert GBTC itself into a spot ETF. This conversion process, however, introduced uncertainty and potential delays, further dampening investor confidence in GBTC. As a result, the GBTC premium (the difference between its price and the underlying Bitcoin value) plunged significantly.

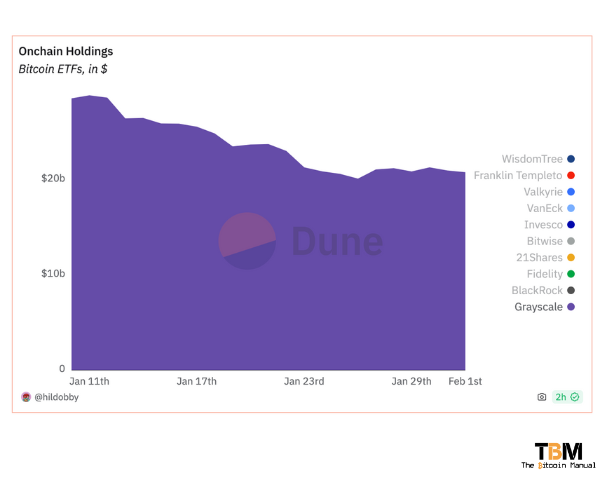

The conversion of Grayscale’s 10-year-old Bitcoin trust has allowed some of its investors — who have only been able to sell shares in the trust at a significant discount in recent years — to exit their holdings altogether. The fund’s overall size has fallen from $28bn earlier this month to $22bn by close of trading on Monday.

If we look at the flow of Bitcoin, GBTC sold approximately 60,000 Bitcoins, and other Bitcoin ETFs net purchased roughly 72,000 Bitcoins, thus offsetting the sales of BTC from Grayscale’s GBTC.

Double Whammy

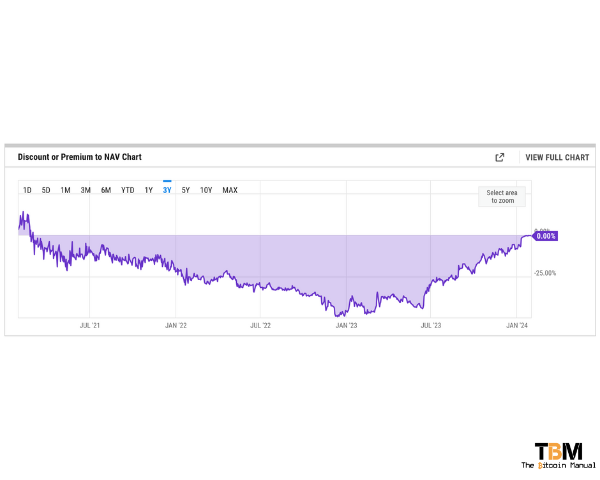

For the longest time, GBTC was the only institutional product apart from public Bitcoin mining stocks and MicroStrategy stock that investors could use to get Bitcoin price exposure. However, the nature of this close-ended fund resulted in major volatility during the bull and bear markets.

During the last bear market, we saw GBTC shares traded as low as a 48% discount to their net asset value, a tasty arbitrage trade for those willing to take the risk, stomach the volatility, and rely on the spot ETF conversion news.

The combined effect of GBTC outflows and the conversion process created a domino effect. As the GBTC premium was erased, it indirectly impacted Bitcoin’s price due to arbitrage opportunities, and those trades who took advantage of the discount could now redeem at par.

Additionally, the overall market sentiment shifted, with some investors interpreting the GBTC situation as no longer a market leader in this space, with institutions like Fidelity and Blackrock now offering their own products.

Bankrupt entities trying to recoup capital

Another unexpected seller of Bitcoin came in the form of disgraced cryptocurrency exchange FTX, the bankrupt entity looking to recoup as much money as possible to repay its creditors, and as GBTC was part of their portfolio, the capital could now be accessed at a market value. FTX did not waste time iin exploiting this change and has sold 22 million shares worth close to $1 billion in Grayscale Bitcoin Trust (GBTC), taking FTX’s GBTC ownership down to zero, CoinDesk reported.

On the crypto-front

Narratives heavily influence Bitcoin and cryptocurrency price action, and once an event occurs, traders look towards the following bullish sentiment for opportunities. Rumours of the SEC reviewing ETH ETF and other altcoin ETFs are making the rounds, and traders are already beginning to take positions in these assets to try and perform a similar sell-the-news trade.

Considering those that made out with up to 60% return in three months, the hope they can repeat this trade has some rolling out of their Bitcoin positions into altcoins they think will get the thumbs up by Garry and the SEC.

“In our view, the crypto market has already moved to the next narrative, with ETH rallying more than bitcoin, likely on the expectation that crypto’s second largest token could also see an ETF approval,”

Alex Saunders, an analyst at Citi

Lessons Learned and leveraged traders burned

While a significant milestone, the Bitcoin spot ETF launch wasn’t the instant price catalyst many expected and the God Candle meme will remain just that, a meme. It highlights the complex dynamics of the Bitcoin market, where traditional and Bitcoin-specific factors intertwine, and another example of the experts have no way of predicting the future, so take all information shilled online with a grain or two of salt.

This doesn’t mean the spot ETFs are a failure; they still hold promise for broader adoption, but this product’s impact might be more gradual than initially anticipated.