Bitcoin always captures the imagination of normies when it starts rising in price, and the headlines surely follow. These FOMO epochs bring in a bunch of new investors who seek to acquire their fortunes over a short space of time. Those that wish to make a quick buck trading bitcoin IOUs on exchanges aren’t interested in the technology or the network; they’re only interested in acquiring some of that fresh capital flowing into the asset.

However, 1 in 1000 or 10 000 (making up numbers here) will dig deeper and want to play around with the asset, and these are the people who eventually find their way to self-custody. Every year a cohort of bitcoiners get suckered in with the price and eventually learn to put their bitcoin on ice (cold storage).

During my time as a bitcoin evangelist, I’ve found that very few people want to learn about self-custody, let alone try it; while I continue to preach it, the message will mostly fall on deaf ears. I’ve found that my yelling self-custody has a pretty abysmal conversion rate, but what convinces people to take the leap is bitcoin’s relative purchasing power.

Hosted wallets never existed.

It’s with rich irony that bitcoiners need to promote the idea of self-custody since bitcoin was designed to eliminate custodians. In the early days of bitcoin, there was no such thing as “custodial wallets”; if you were mining, trading, buying or selling items for bitcoin, you had to have an on-chain wallet; there was no other way to do it.

Hosted wallets, while a pretty common on-ramp today, is a product of exchanges and, like the name states, should only be used to “EXCHANGE” funds, not for long-term storage.

Sadly, people are slaves to convenience and would rather leave bitcoin with a third party than learn how to hold it themselves. Some have learned this was a poor decision by being customers of exchanges that have gone bankrupt, while many still believe that it won’t happen to them.

Price is the spice.

99.9% of people, myself included, have no idea what they own when they first take the plunge and buy their first bitcoin. It’s some weird nerd money, figures on a screen, and hopefully, if it goes up in fiat terms, I can use it for needless consumption.

When the bitcoin price begins to take off, it’s exhilarating your first time around, and you’ll be faced with a decision.

- Do I sell my position, take the fiat, pay the taxes and call it a day?

- Or do hold on a lot longer, I don’t need the money right now, and if it keeps going this way, I’ll have way too much for me to feel comfortable trusting it with a third party.

At this moment, people realise that security matters and begin to look at options.

Let’s say you had $1000 on an exchange and bitcoin 4x’s in price, which is not uncommon; you might have felt okay with having $1000 worth of exposure, but now you’re feeling overexposed.

Do you want to leave $4000 on some sleazy-looking website or app on your phone, where the only thing standing behind a hacker and that money is your email and password and maybe a shoddy 2FA code?

Do you want to leave $4000 with an exchange with no deposit insurance, nor do you have oversight into their balance sheet and solvency?

Now you’re starting to sweat, which is funny, because it’s still the same amount of bitcoin you had 6 – 12 months ago, which you didn’t care about, but now that you see its increased purchasing power, the gears are starting to click into place.

Price as a motivator for security

Bitcoin’s price has always been a critical motivator for improving security and prioritising security measures. When the value of bitcoin rises, so does your need to protect it.

You don’t want to lose what you have nor gift this value as a potential reward for cybercriminals looking to steal it, and you actively seek to make it harder to lose. This heightened risk can incentivise users to look closer at their security practices and invest in tools that offer better asset protection.

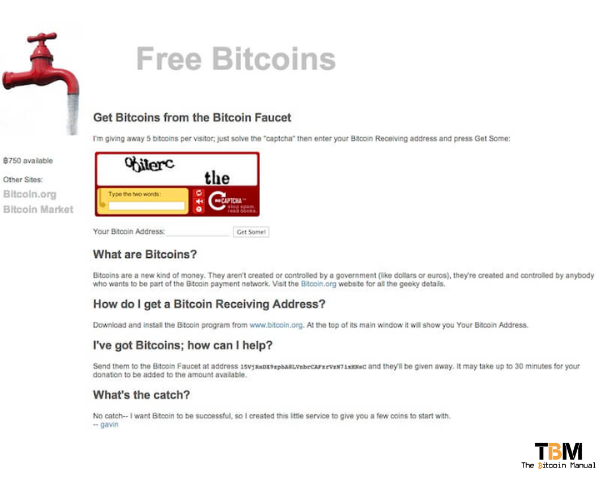

We’ve seen this thought process play out throughout the history of bitcoin. In the early days, when you could pick up a bitcoin for completing a CAPTCHA or a survey, people didn’t care to hold it safely.

They would generate wallets on their computer with random software downloaded from GitHub, create keys, they left in text files on their device and would store 1 to 100 bitcoin without blinking an eye.

Something that seems nearly unthinkable today due to bitcoins’ relative value.

You are taking control of your funds in a hot state.

Let’s go back to the example of the $1000 bitcoin purchase; let’s say you made that purchase back in 2017; that $1000 would roughly net you 1 Bitcoin. If you kept hold of that bitcoin on an exchange that didn’t go bankrupt over the last six years, you would have been sitting with $69 000 worth of exposure on that exchange at bitcoins peak price.

While in previous years, you could sleep soundly having $1000 on an exchange, having $10 000, $20 000 or $69 000 out there as an IOU might give you sleepless nights.

You would want to take ownership of that bitcoin or at least reduce the amount of exposure back to $1000 at the very least. Your first step would be to take those IOUs and turn them into hot funds.

One such tool is the software wallet, the lowest barrier to entry when it comes to self-custody. All you need to do is download a wallet app, create a set of 12 – 24 words, and you’re all set up. In a matter of minutes, you would be ready to take your funds off the exchange and have the peace of mind that you have the final say and control over those funds.

Hardware wallets, taking physical custody.

Let’s go back even another year; it’s 2016; you made a $1000 purchase of bitcoin, which bagged you 2 Bitcoin. The price begins to run up, $10k, $20k to $69 000. You’ve pulled your funds from an exchange; it’s now on a desktop or mobile wallet.

Sure, you have control over the funds, but do you seriously want to keep $138 000 on the family computer or your smartphone? I can’t speak for everyone’s temperament, but walking around with over 100 grand on your iPhone might make most of us feel rather uneasy.

To give yourself peace of mind, you’ll have to look for something robust; if you’re protecting $ 100k, you’re not really going to think twice about spending $150 on a hardware device to generate a set of cold keys and a steel plate to store your keys are you?

These small, physical devices allow users to store their private keys offline, making them much less vulnerable to hacking and cyberattacks than online wallets or exchanges. By keeping private keys offline, hardware wallets are able to prevent unauthorised access to a user’s bitcoin holdings, making them a must-have for anyone looking to achieve greater security and self-custody over their Bitcoin assets.

Hardware wallets work by generating a private key offline and storing it securely on the device. Whenever a user wants to send bitcoin, you can either plug the device into their computer or sign a PSBT and transfer it to software on a device like a laptop or a smartphone.

This means that even if an attacker manages to gain access to a user’s computer or mobile phone, they will not be able to steal their Bitcoin without access to the hardware wallet. In addition to offering superior security, hardware wallets also provide users with a greater degree of control over their Bitcoin assets. By storing their private keys offline, users can be sure that their Bitcoin is not being managed or manipulated by a third party.

They can also access their Bitcoin from any device with a USB port or a compatible mobile app, making them a convenient and portable option for anyone looking to manage their bitcoin holdings on-the-go. Overall, hardware wallets are an essential tool for anyone looking to secure larger amounts of bitcoin in self-custody.

Multi-sig wallets, a distribution in risk.

Suppose you purchased your bitcoin in 2015, you spent $1000, and you’re keeping it on a single signature hardware wallet. If you did do that, you’re sitting with around 5 BTC living on a single private key. Now, this wouldn’t be a problem when bitcoin was at $200 when you bought it, but today it’s hovering at its peak of $69 000.

Do you honestly feel comfortable leaving $345 000 worth of bitcoin behind a single key that, if lost or stolen, would mean your funds go bye-bye?

Probably not!

Your first option would be to spin up five different single-signature cold wallets; at least if one of them gets stolen, lost or hacked, you have four more lying around, hopefully in different places.

Alternatively, you could maintain one wallet for all that bitcoin but turn over control of that wallet to several keys instead of one. Multi-sig, short for multi-signature, is a type of wallet that requires multiple signatures or approvals before any transaction can be made. This means that even if a hacker can access one private key, they still cannot access your Bitcoin without the other required signatures.

Multi-sig wallets offer additional security and control over your bitcoin. By distributing the private keys among multiple trusted individuals or devices, you can ensure that no one person or entity has complete control over your funds. This approach also reduces the risk of losing your funds if one key is lost or stolen as long as you still have access to the other required keys.

When sats become your standard and unit of account.

Measuring your bitcoin in fiat only serves to give you a delayed appreciation for what you already own. If you’ve already migrated to satoshis being your unit of account, you already understand the need for self-custody and the urgency to execute it.

It makes no difference between one million satoshis, 10 million satoshis, or 100 million satoshis. When sats your standard, you wouldn’t want to lose any amount if you can help it.

The price and self-custody remain correlated.

Bitcoin’s price increase may be a blessing in disguise for security and self-custody. Motivated by the value of their assets, investors may shift towards better security practices and take control of their own keys by utilising hardware wallets, multi-sig wallets or distributed keys.

This shift towards better security practices could ultimately benefit the bitcoin ecosystem as a whole. As we navigate this new landscape, let us continue to encourage ownership of our assets and prioritise security.

Let us not forget that the true value of Bitcoin lies not in its price but in its potential to empower individuals and foster innovation. This innovation can only be unlocked if people always have access to their stored purchasing power through space and time.

Do you take self-custody of your stack?

If you’re new to bitcoin and have not ventured down the self-custody rabbit hole, what is stopping you? If you’re already self-sovereign, how has the experience been since you took hold of your funds? Let us know in the comments down below. We’re always keen to hear from bitcoiners from around the world.