As we approach the point of the cycle, where the anticipation of another Bitcoin bull run begins to attract more capital, speculators and media attention, we find that risk is no longer a factor and all that matters is “Number Go Up“.

Despite being around for over a decade, this market is still very much the Wild West, and investors can get themselves into all sorts of risky products to try and make a quick off Bitcoin’s latest round of repricing.

During this time of rampant speculation, anything goes, meme coins, DEFI Ponzis, and a host of other flawed platforms and products offering you yield, assuming there will be no top to the amount of money flowing into Bitcoin and altcoins.

The mistakes and naive assumptions regarding how these so-called “investments” work are likely to repeat this time around; as new users come into the space, their hubris, coupled with their lack of experience, will see many a fool and their money parting ways.

While I think many things will remain the same or closely resemble what we saw in previous cycles, some parts of the ecosystem are changing, namely the introduction of institutional-grade products like a regulated futures market and spot ETFs.

The institutions are coming

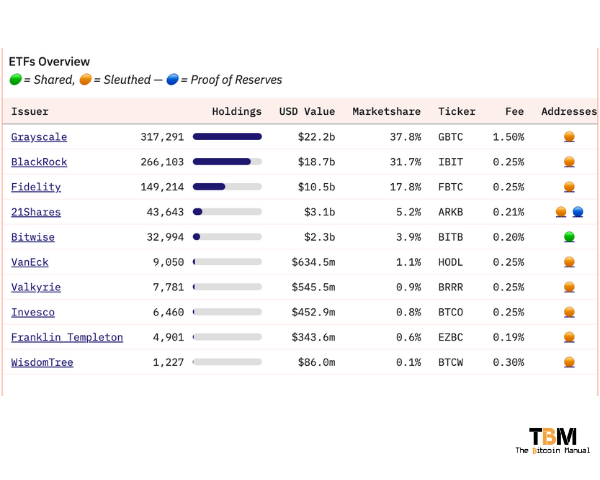

The spot ETF has been a welcomed addition to the market of Bitcoin products, ₿839 000 worth of Bitcoin would suggest that plenty of investors were keen on having some exposure to the asset but refused to self-custody or risk using one of the many custodians and exchanges available.

The spot ETF offers those who feel third-party custody is an acceptable method of holding Bitcoin a chance to enter the market.

While Bitcoin can offer you price appreciation, as a digital commodity held on-chain, it cannot offer you cash flow, so those who don’t understand or appreciate CAGR might not find the spot ETF attractive investment.

The fact remains that normies love yield; it is all they’ve ever known; instead of thinking about how to get out of depreciating cash, they’re concentrating on how they can outpace that devaluation by increasing the amount of cash I have.

We can see the appetite for yield is massive if you look at how many people aped into CEFI Ponzi’s like Celsius offering absurd returns on Bitcoin and Stablecoins, or the doomed from the start Luna Ponzi, we can glean that if you provide yield people will come.

This is why I think it’s only a matter of time before an ETF tries to tap into this demand to drive AUM from the cohort looking for a way to generate income from their Bitcoin.

It’s a tried-and-failed strategy, but that doesn’t mean we won’t see repeats of it in different forms.

Dividend-paying ETFs exist in other markets like stocks but aren’t always the most attractive bet as the yields may not be as high as those obtained by owning a high-yielding stock or group of stocks. The risks associated with owning ETFs are usually lower than those of individual stocks since you’re not contracting your bet on our returns but rather hoping a basket of stocks will net you a certain average return.

Given the level of competition between the 10 ETF issuers, the demand for cash flow and the history of dividend-paying ETFs seeming like a safe regulated bet, I think it might be the next step up as ETF issuers try to one-up each other.

What are dividend-paying ETFs?

An ETF (Exchange Traded Fund) is a basket of investments that trades like a stock on a stock exchange. Dividend-paying ETFs specifically focus on companies with a history of paying out dividends to shareholders.

These dividends are a portion of a company’s profits that it distributes to its investors.

Dividend-paying ETFs are typically passively managed, meaning the fund manager tracks a specific index that focuses on dividend-paying stocks. When the companies in the index pay dividends, the ETF collects that money and distributes it proportionally to its shareholders.

As an investor, you receive this payout based on the number of ETF shares you own.

Why would investors consider a dividend-paying ETF?

There are several reasons why dividend-paying ETFs can be an attractive investment option:

- Income Generation: Regular dividend payouts can provide a steady stream of income, which can be helpful for retirees or those seeking additional cash flow.

- Diversification: By investing in a single ETF, you gain exposure to a variety of dividend-paying companies, reducing risk compared to picking individual stocks.

- Compounding: You can choose to reinvest your dividends back into the ETF, allowing your investment to grow over time through compounding interest.

- Lower Fees: ETFs generally have lower expense ratios than actively managed mutual funds, which can save you money on investment fees.

Dividends don’t come without its own set of pain points

Dividend-paying ETFs aren’t without drawbacks. Here are a few things to keep in mind:

- Dividend Yields: Dividends are not guaranteed, and the yield (the annual payout as a percentage of the share price) can fluctuate.

- Growth Potential: While dividend-paying companies offer income, they may not experience the same level of growth potential as high-growth stocks.

- Taxes: Dividends may be subject to capital gains taxes, depending on the type of dividend and how long you’ve held the ETF.

Where does the yield come from?

In the crypto space, there are all sorts of exotic products that generate yield; many of these products, which have troublesome mechanics such as staking and borrowing services, have caught the eye of the U.S. Securities and Exchange Commission (SEC).

So if the yield can’t come from magically making up ways to generate inflation and fees without a real cost, where will it come from? The SEC and regulators need to know that before products like this can be rolled out.

But where does the yield come from? https://t.co/MbdXJHzko8 pic.twitter.com/tWeBA2gM4z

— RD ₿TC (@RD_btc) July 13, 2022

The financial regulator who approved the spot ETF is trying to bring digital assets under its remit and has been aggressively pursuing increased regulation. It has even gone as far as suing large cryptocurrency exchanges and custodians.

Earlier this year, Kraken, a U.S.-based crypto trading platform and custodian, settled with the SEC and agreed to discontinue its “Crypto Asset Staking-as-a-Service” program in the U.S. and to pay a $30 million fine; many other exchanges will see this as a call to fall into compliance so it leaves the door open for regulated products instead like ETFs with different mechanisms from levered ETFs to yield baring ones.

Today @SECGov charged Kraken for the unregistered offer & sale of securities thru its staking-as-a-service program.

— Gary Gensler (@GaryGensler) February 9, 2023

Whether it’s through staking-as-a-service, lending, or other means, crypto intermediaries must provide the proper disclosures & safeguards required by our laws.

Covered calls

A covered call is an options strategy in which the seller of the call option owns an equal amount of the underlying asset. The writer of the option holds a long position on the underlying asset and sells the right for someone else to buy it at a given price, typically slightly higher than the current price of the asset.

This strategy is commonly used by investors who want to hold an asset for the long term, do not expect a significant price appreciation in the near term, and want to generate income or have a slightly defensive posture in the short term.

Covered calls are not a guarantee of income, and premiums are affected by factors such as the moneyness, time to maturity, and volatility of the underlying asset.

The higher these factors are, the higher the options premiums tend to be.

The Lightning Network

Another option for generating a return without giving up custody of the Bitcoin is to run a Lightning Node. As a routing node, you assist others in transferring payments and charge a fee for your service. Suppose you build out a well-connected node with a lot of traffic between exchanges and popular applications. In that case, you can generate a return by route payments between popular destinations with sizable capacity using Wumbo channels.

ETF issuers can instruct their custodians to use some of their capital as part of a series of routing nodes for regulated entities like exchanges or payment providers.

By utilizing protocols like UMA, ETF issuers can ensure that their funds are fully compliant with OFAC regulations. This not only reduces concerns about deploying capital to route payments but also enhances the security and trustworthiness of the entire process.

ETFs have no shortage of Bitcoin and can quickly fund channels should the demand for Lightning capital increase. Issuers can monitor metrics like the LINER index and if there are attractive opportunities and deploy liquidity to capture returns from those advertising a need for channel capacity.

In theory, the Lighting Network offers a possibility of returns, but it is by no means an infinite source of yield or acquiring is a given; it requires technical knowledge and constant management. The amount you could make from routing payments also has a limit based on the network’s current size and the demand for layer two payments.

If we are in a low-fee environment, L2s will see little traffic, resulting in lower possible returns for a Lightning node. An effective and high-return Lightning node relies on constantly inundating the base chain with demand.