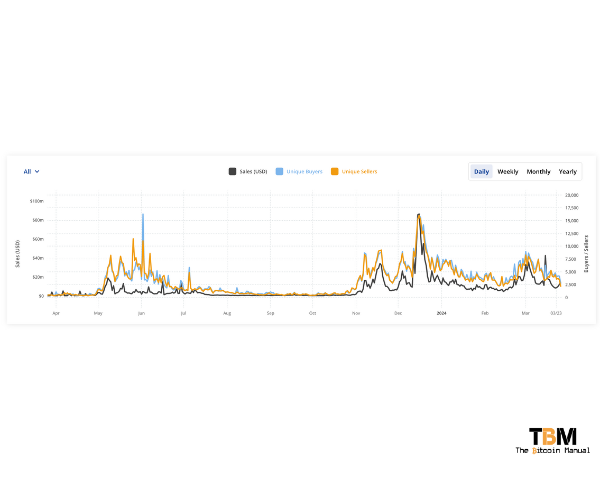

It’s been a quiet few months when it comes to on-chain graffiti; it seems like a lifetime ago, Ordinals enjoyers claimed they broke Bitcoin, and the mempool was stuffed to the brim with inscription-based transactions. For a while, the mempool was more of a meme pool as the trend of stuffing JPEGs and JSON files into blocks had its brief moment in the spotlight.

The popularity of these transactions and the resulting spike in fees for the privilege of locking a transaction into the next block kicked off debate after debate; if it wasn’t an argument for tail emissions, then it was mempool filtering policies and block template policies as well as how best to support off-chain scaling for those users priced out of blocks.

Now, that’s not to say these transactions have been completely eradicated from block space; they’re still lurking around, but it has lost some of its star power with the fickle community that is the degen meme pump and dumper and NFT flipper. It seems these altcoin opportunists are waiting for the subsequent narrative to take hold or for Bitcoin to run up in price, which should bring some added liquidity, dumb money, and a higher propensity to speculate on capital flows head next.

If we look at on-chain trading activity for Ordinals, it’s been trending downward, and that’s reflected in the cost of a Bitcoin transaction; with fees well below 30 sats/vbyte lately, users can consolidate UTXOs, open and close Lightning Channels at affordable rates and all is well with the world of Bitcoin.

For now…

An M on the block

The Taproot Wizards, DickButts and the never-ending plethora of BRC-20 tokens remain hosted on-chain, and we’ve made peace with it for now, but peace is temporary, and the cyber hornets nest only needs a slight jostle to get it riled up.

And here we do again. This time, it’s not Ordinals, but quite the branding statement from Marathon Digital, a Bitcoin mining company. They achieved this by harnessing the unique data structure of Bitcoin blocks to create “block art.”

Traditionally, miners prioritise processing transactions with the highest fees. However, Marathon showcased the potential for a different approach. By strategically ordering transactions within a block, they were able to influence how the data on blockchain explorers is visualised.

This specific block, visualised on block explorers, displayed the company’s logo—a testament to the creative possibilities within Bitcoin’s structure. The firm dubbed it the M block and wanted the visualisation to demonstrate its template-building capabilities and technology stack.

How is block art created in the first place?

Bitcoin transactions are typically visualised on blockchain explorers as coloured squares, with the size and shade representing the transaction amount and fees. Miners can manipulate this visual representation to form an image by including strategically crafted transactions (often using OP_RETURN outputs for embedding data).

The technical challenges of this were insane.

— Portland.HODL (@PortlandHODL) March 26, 2024

1. The algo does support pulling txs from the mempool in real time.

2. Template validation and feedback to wiggle txns into the right spot during the prioritization process.

3. Pull ?audit=false in https://t.co/m8KpQQdU8g

Creating block art requires a miner to modify their software to select specific transactions that will form the desired pattern instead of prioritising transactions that maximise profit based on the fee density or satoshis per byte.

In the example of Marathon’s M, the transactions were carefully curated to source outputs with specific fees paid for each of those squares:

- Green = $0.08

- Orange = $11.21

- Maroon = $149.46

Once enough transactions are sourced to create the block; they are arranged to render an image when the block is confirmed on-chain. Interestingly, the block in question managed to cost a total fee of $122,542

Using blocks for on-chain PR

Using block space to make a statement and garner media attention seems to be working; the fact that I am writing about this is proof that it works; I’m a sucker, a pawn in the system, working to promote Big Block Space.

But regardless of my affiliations and lack thereof, it is concerning to see the world’s most powerful and robust monetary network used for cheap thrills.

Recently, we saw a rapper use block space to promote a song no one has or will listen to. Yet the song got a lot more media attention than it deserved simply by being stuffed on all our nodes.

Now, Marathon stamping its branding on the blockchain for eternity is making the rounds, and it’s definitely getting them social mentions and media coverage.

Why did Marathon Digital Holdings' MARA Pool just mine a block with their logo on it?

— ₿itcoin Gandalf (@BTCGandalf) March 26, 2024

I'll get to that, but first here's some things I haven't seen anyone talk about yet.

1⃣ Each coloured square represents a transaction in the block.

2⃣ To achieve this visual effect, the block… pic.twitter.com/LFIqSfsiSf

While it cost Marathon a pretty penny to pull off this block art, the marketing and media they’ve generated are probably well worth it.

Challenges and considerations for block art

Marathon explained that by owning its mining pool, it can craft the order of transactions to create a form of block art. While not offering this specific output capability as a service, the mining company speculated that this could present a wave of creative potential yet to be explored in the Bitcoin space.

However, this might have to come at a premium.

Marathon could use this as a revenue generator to stamp blocks for companies to use to make an on-chain statement, and just thinking about that makes me cringe.

Creating block art requires significant mining power and careful planning. Miners would need to prioritise artistic vision over maximising profits from transaction fees, which might not sit well with pool members if you’re making pretty blocks, but they’re getting fewer Sats for their hashing.

Additionally, the complexity of the art form might limit its widespread adoption and relegated to niche use cases.

Hashers need to become miners again

While block art has announced its arrival, this is an experimental use case that is pretty hard to pull off and isn’t without its costs. That might deter others from trying to do something similar, or perhaps I’m hoping incentives prevail.

Regardless, Marathon’s demonstration gives a fascinating glimpse into how much power miners and mining pools have over block space and warns that mining needs an upgrade. It could be a wake-up call to get cracking in distributing the responsibility of mining back to individual miners, turning them from mindless hash producers to active participants in the mining process.

Giving individual miners control over block creation with the help of upgrades like Stratum V2 would be a great start.

As technology evolves, the entire Bitcoin stack will have to add layers of autonomy and decentralisation, or we might see the emergence of a new art movement built on Bitcoin’s foundation—and I, for one, don’t want to see a decentralised, secure, and transparent ledger turn into someone’s canvas.

Miners are all in on blockchain graffiti.

Block space is a hot commodity, and it feels as if the ability to use it as you please is quite the flex; with a few trying to one-up each other on how they can leave a unique mark on the time-chain, it’s weird use of the network, but hey it your money and resource do with it as you, please.

Miners have taken to inscriptions and on-chain art like flies to shit, and why wouldn’t they? The more transactions these users make, the more they bid up the fee market and the more revenue miners make, so they actively encourage it.

We’ve seen miners and mining pools invest in Ordinals tool kits and wallets and even launch trading platforms, front ends to interact with the Ordinals protocol and even auction off rare sats.

So I doubt this kind of on-chain fuckery will be subsiding anytime soon.