If you’ve been anywhere near Bitcoin over the last decade, you’ve probably heard a lot about its price swings. It’s volatile, it’s risky, and let’s face it, it’s sometimes more dramatic than a reality TV show.

Bitcoin has its own villains, heroes, damsels in distress and, of course, a plethora of morons that provide comic relief and inspire the next batch of memes.

As a tourist, this is likely the impression you get because you’ll only get drip-fed Bitcoin content when it’s crashing dramatically or breaking new all-time highs. You don’t see the boring zones, the crab market it goes through during its quiet consolidation phases, and most don’t care.

Bitcoin usually goes through these boom and bust cycles, and now that Bitcoin is looking frothy once again, post-halving, one term is starting to make the rounds.

The Bitcoin Banana Zone.

The Banana Zone is Bitcoin’s marketing campaign; it’s the thing that attracted many of us during each of the previous cycles. We came for the gains, and some of us stayed and fought through the pain and got back into the gains again.

Don’t be alarmed if you’re new to this market; this is just the nature of the beast.

The Banana Zone isn’t some new, exotic altcoin or a cryptocurrency that promises to give you free bananas for every Bitcoin you own (though that would be a very interesting investment strategy).

Bitcoin-backed Nana’s the next killer app? Any takers?

The “Bitcoin Banana Zone” is, in fact, a metaphor—a colourful and somewhat silly way of describing the chaotic, unpredictable, and sometimes downright absurd aspects of the Bitcoin market.

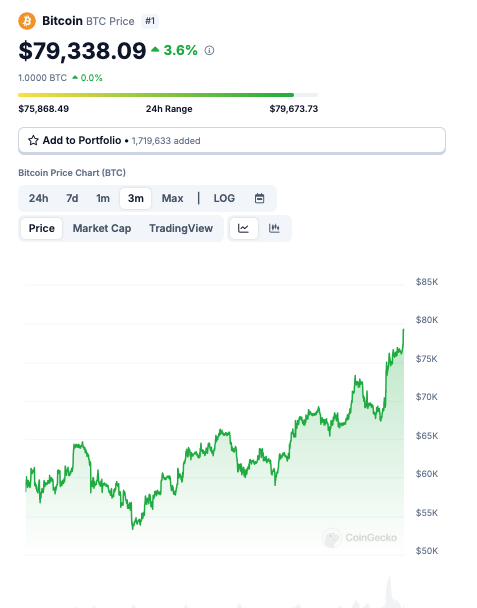

Over the past three months, Bitcoin has recently broken past its all-time highs and could soon enter a euphoric “Banana Zone” phase in 2025, which could surge its price.

So Why Does This Banana Zone Happen?

After a halving cycle, the issuance of new coins is cut in half. If the demand for Bitcoin remains constant, the number of coins produced is cut in half.

Eventually, the price needs to adjust to service that demand.

As the price of Bitcoin adjusts upward, miners need to sell less Bitcoin to fund their operations, further reducing supply hitting the market, and that seems to be the tinder that starts the fire.

But this time is different; Bitcoin is already a trillion-dollar market; it can settle far larger trade volumes and has started to gain interest from traditional finance players, especially since the launch of the spot ETF in the US.

Additionally, countries are starting to inject capital into their local markets to fend off recessionary pressures; we’re already seeing a lowering of interest rates by central banks and an injection of liquidity, starting with China adding Trillions to its market to keep it well lubricated.

Let’s also consider that investors worldwide desperately seek a market that can provide positive real returns. We start to see how these trends overlap and can turn into a frenzy or even a supercycle.

Summary of bullish factors overlapping

- Global liquidity increase

- Interest rate cuts

- Bitcoin supply crunch

- Investors looking to outpace inflation

The Bitcoin Jungle: Where Bananas (and Volatility) Grow

Before we get to the Banana Zone, let’s take a quick detour through the broader world of Bitcoin. It is generally a volatile asset class. Prices swing from $1,000 to $2,000 at a time, are normal and a crash by $10,000, then shoot up again to new all-time highs isn’t surprising.

One minute, Bitcoin is a “get-rich-quick” dream; the next, it’s the financial equivalent of a wild-eyed raccoon on espresso.

In this chaos, the Bitcoin Banana Zone is where things get extra… *bananas*.

It’s a zone of high uncertainty, ridiculous price swings, sensitivity and decisions that make you wonder if you accidentally stumbled into a finance-themed amusement park rather than the serious world of investment.

Picture yourself standing in a forest of giant banana trees, where one moment, you’re swinging from branch to branch with reckless confidence, and the next, a bunch of bananas falls out of nowhere, hitting you square in the face.

But why bananas? What do they have to do with Bitcoin?

Why Bananas?

Honestly, there’s no real reason.

I guess the obvious answer is the curve the chart takes that emulates the banana, but if we have to thumb-suck some deeper meaning from it, bananas are, in many ways, the perfect metaphor for Bitcoin’s wild price action.

History of banana zones – Source: Linkedin Pulse – Raoul Pal

Consider these fun facts:

1. Bananas Are Highly Perishable: A banana can go from perfectly ripe to completely mushy in a matter of days. In the world of Bitcoin, prices can do the same thing. One moment you’re sitting on a golden opportunity, and the next moment, you’re left holding a squishy, overripe coin with no idea how to salvage it.

2. Bananas Have A Lot of Appeal (If You Can Handle Them): Bananas are loved by many primates, and financial apes love their yellow fruit, too. But just like eating too many bananas can leave you with a stomach ache, too much exposure to Bitcoin’s volatility can lead to sleepless nights and emotional burnout.

3. Bananas Grow in Clusters (Just Like Bitcoin Markets): Bananas don’t grow alone—they grow in bunches attached to a single stem. Bitcoin’s price often follows a similar pattern: sudden, coordinated surges or crashes.

Entering the Bitcoin Banana Zone

Now that you’ve got a sense of why bananas are a fitting symbol for Bitcoin, let’s dive into what entering **Bitcoin Banana Zone** means and what it feels like.

1. The *Price Swings* Are Wild

Imagine you’re standing in the middle of a monkey-filled jungle (because, why not?), and suddenly, a monkey tosses you a banana that’s on fire. You instinctively grab it, and now you’re holding this scorching fruit, trying to figure out what to do next.

This is the Bitcoin experience in a nutshell.

In the Bitcoin Banana Zone, you can go from feeling like a genius to questioning your life choices in a matter of hours. One minute Bitcoin is soaring to new heights, and the next minute it’s plummeting down faster than a monkey’s banana peel after a rainstorm.

For instance, Bitcoin could jump 10% in a day—one of the best days of your life—only for it to lose that 10% the following morning as if it were never there at all.

2. Everyone Thinks They’re an Expert

Mistaking a bull market for brains is never more evident than during this period; it’s when every numb nut with no shame and the ability to make open-mouth YouTube thumbnails venture out of their discords, pretending to trade this asset comes into the spotlight.

It’s not just the market that’s bananas—it’s the people in it, too. In the Bitcoin Banana Zone, you’ll encounter all sorts of “experts” who claim to have unlocked the secret to predicting Bitcoin’s next move.

Whether it’s a self-proclaimed technical analyst who swears by Fibonacci retracements or an influencer claiming to know the “next big thing” in Bitcoin, there’s no shortage of voices in the jungle.

But be warned: Not all bananas are good for you. Some of these “experts” might just be trying to sell you their personal banana stand or, even worse, their own high-risk “investment strategy” (a.k.a. a banana-shaped financial disaster).

3. Expect *Unexpected* Events

The Bitcoin Banana Zone is also a place where the unexpected happens at a moment’s notice. One day, Bitcoin could go up because a billionaire like Elon Musk tweets something about it.

The next day, it could tank because a country you’ve never heard of suddenly bans it. Anything can and does happen in the Bitcoin world, and just like bananas, Bitcoin’s trajectory is sometimes hard to predict.

A good example? In 2020, Bitcoin’s price rocketed to new heights thanks to institutional investors jumping into the market. Just when everyone thought Bitcoin was going to the moon, bam—COVID-19 hits, and everything crashes.

Did Bitcoin go to zero?

Nope. It just swung wildly, like a monkey swinging from tree to tree, before eventually recovering and hitting new highs.

But never put the chance of a Black Swan event at zero, NEVER!

4. It’s a Lot of Fun (Until It’s Not)

At the end of the day, the Bitcoin Banana Zone is chaotic, unpredictable, and thrilling. It’s a place where you can make a fortune—or lose it all—and just like eating a ripe banana, it can either be incredibly satisfying or leave a strange aftertaste.

But despite the chaos, there’s something undeniably fun about watching Bitcoin grow, crash, and grow again. The dopamine rush is second to none; walking the line between broke and rich can become intoxicating.

The Banana Zone is not for the faint of heart, but for those who are brave enough to stick around, there’s always the possibility of finding the next great banana (err, I mean, Bitcoin opportunity).

5 Don’t F*ck This Up (#DFTU)

During the Banana Zone, there’s a lot of yapping going on; everyone will have a new idea, a special idea, another situation to invest in; some of it will be important to take in, and the majority you can disregard as filler and scams.

The real villain here is yourself and time; time is the portfolio killer.

The longer the Banana Zone giveth, the more overconfident traders become; they think because their allocation has grown and the more they’ve put in, it continues to grow, they can’t lose, and this is where caution is tossed to the side, and you’ll hear things like “stop losses are not a good risk management tool.”

Yes, I am talking to you, Caroline!

People will start to believe that this was the norm and that what happened during this period will continue.

So they start to take on more risk

- Handing over their coins to yield-generating platforms

- Buying shitcoins

- Taking on leverage

And you know what? The vast majority will end up underperforming the tried and tested strategy of hodling.

While it might seem like doing nothing is easy, the temptation to get sucked into the banana zone will test your resolve, and very few have the willpower and fortitude to stay the course.

Those who fail to resist their urges will end up mispricing the risk they take and end up with less Bitcoin or, worse, no Bitcoin at all, and that is not a place you want to be in, trust me!

Don’t mid-curve it > Number goes up over time. #DFTU. Good luck!

Raoul Pal

Co-Founder & CEO – Real Vision Group.

Embrace the Banana Chaos

So, what have we learned about the Bitcoin Banana Zone?

In short, it’s a place where the unpredictable, volatile, and often absurd price movements of Bitcoin make you feel like you’re living in a monkey-filled jungle.

It’s a zone where bananas can both sweeten and sour your experience and where one bad decision can leave you holding the mushy remains of an investment gone wrong.

But whether you love or loathe the volatility, one thing’s for sure: Bitcoin and its Banana Zone aren’t going anywhere anytime soon. So, if you’re brave enough to venture into this wild jungle, pack a banana (or two) and hodl on tight.

You never know when the next crazy swing will come—or when the next opportunity to swing from the trees will appear.

Happy investing, and may your bananas always be ripe!