2024 has been the year of liquidation. First, the German government decided to offload the 50,000 coins it seized from Movies 2k. During those 27 days, the market took a 25% dip, hitting a low of $ 54,000, while buyers tried to absorb this influx of coins.

After the German government emptied its coffers, the market began to recover. We moved back over $65,000, and you could hear the collective relief from those close to liquidation on their longs.

But just when you thought it was safe to quit your job at Micky D’s, it looks like we’ll get a second round of large-scale dumping.

This time from Mt Gox creditors.

Long before most of us ever heard about Bitcoin or purchased our first satoshis on a centralised exchange, there was one order book to rule them all. Deep in the fires of Mt Gox, the Dark Mark Karpelès forged a master seed phrase, and into this private key, he poured his cruelty, malice, and will to dominate all life.

Launched in 2009, Bitcoin was a nascent digital currency with a tiny, experimental community.

Amidst this landscape, Mt. Gox emerged. Initially a platform for trading Magic: The Gathering cards, it pivoted to Bitcoin in 2010. Mt. Gox rapidly gained prominence, becoming the world’s largest Bitcoin exchange by 2014.

At its peak, it handled over 70% of all Bitcoin transactions globally. The platform was the gateway for many individuals to enter the world of Bitcoin, offering a “relatively” easy-to-use interface for buying, selling, and trading Bitcoin.

It was still a pain in the arse to wire money to Mt Gox, and it looks pretty archaic versus what we have today, but at the moment, it was the most efficient way to get Bitcoin other than mining it yourself.

However, in 2014, it collapsed under the weight of a massive hack, leading to the loss of hundreds of thousands of Bitcoin and a prolonged legal battle to return funds to its creditors.

Fast forward ten years, and creditors who did not sell their claims to a third party can now put this chapter behind them as the first payments are due for redistribution over the coming month.

MtGox customers have finally started receiving Bitcoins! After over 10 years I wasn't sure anymore if it'd finally happen, but here we are finally!! This has been a long journey and I'm happy to see we're finally getting there, only a bit more…

— Mark Karpelès (@MagicalTux) July 5, 2024

The Early Days of Mt. Gox

Mt. Gox was founded by Jed McCaleb in 2010 as a platform for trading Magic: The Gathering cards. Soon after, he pivoted the site to become a Bitcoin exchange, and it quickly gained traction.

By 2013, Mt. Gox had grown to handle over 1.5 million accounts and became the go-to exchange for Bitcoin enthusiasts. The Bitcoin boom fueled its popularity during the first halving, which saw prices rise dramatically, drawing more traders to the platform.

Despite its initial success, Mt. Gox faced numerous technical challenges. The exchange struggled with scaling issues as the influx of users strained its systems.

Security vulnerabilities also plagued the platform, leading to multiple incidents of hacking and theft. Nonetheless, Mt. Gox’s management continued to assure users that their funds were safe, culminating in this gem of a Bitcoin meme.

The Collapse of Mt. Gox

The reasons for Mt. Gox’s collapse are multifaceted. Primarily, the exchange was a victim of sophisticated cyberattacks. Hackers exploited vulnerabilities in Mt. Gox’s system, stealing a staggering amount of Bitcoin. The exchange’s security practices were evidently inadequate to protect against such advanced threats.

Beyond security breaches, mismanagement played a significant role. Reports emerged of questionable accounting practices, inflated trading volumes, and potential embezzlement. The exchange’s leadership, particularly CEO Mark Karpeles, faced intense scrutiny and legal repercussions.

In February 2014, the situation took a catastrophic turn. Mt. Gox suspended withdrawals, citing issues with a “bug” in the Bitcoin software that allowed hackers to exploit the exchange.

Shortly after, it was revealed that approximately 850,000 Bitcoins—worth around $450 million—had been stolen from the exchange. The news sent shockwaves through the Bitcoin community, leading to a dramatic decline in Bitcoin’s price.

Basically, it was the FTX of that cycle.

Bankruptcy Filing

Following the hack, Mt. Gox filed for bankruptcy protection on February 28, 2014. The exchange’s CEO, Mark Karpeles, became controversial, facing accusations of negligence and fraud. The bankruptcy process initiated a lengthy legal battle over the missing Bitcoins and the fate of creditors, who were left in limbo as they awaited restitution.

Remember that this was the first Bitcoin bankruptcy ever declared, so everyone involved was in uncharted territory and figuring out how to recover funds, custody them and allocate them was not as well known as it is today.

Granted, we’ve now experienced several exchange failures since Mt Gox, all of which were resolved much faster; the first failure will always be the hardest one to deal with, and having to wait over a decade is evidence of that.

Why Did It Take 10 Years for Creditors to Be Repaid?

The aftermath of the Mt. Gox collapse was a complex and protracted legal battle. Creditors, who lost substantial sums of money, were left in limbo, uncertain about the possibility of recovering their funds. The process of bankruptcy and liquidation, complicated by the unprecedented nature of the case, dragged on for years.

A significant turning point came in 2021 when a rehabilitation plan was approved, marking a crucial step towards returning lost Bitcoin to creditors.

However, the distribution process is complex, requiring the identification and verification of creditors and the valuation and transfer of Bitcoin.

Legal and regulatory hurdles

The road to repaying creditors was fraught with challenges. The legal complexities surrounding the bankruptcy and the substantial losses incurred required extensive investigations.

Creditors filed claims, and a significant portion of the proceedings involved determining the rightful ownership of the lost Bitcoins.

The Japanese legal system, where Mt. Gox was based, also added layers of bureaucracy to the process.

Investigation and asset recovery

One of the major hurdles was the investigation into the hack and the recovery of assets. The trustee, Nobuaki Kobayashi, worked tirelessly to locate and return as much of the missing Bitcoin as possible.

In 2023, the U.S. Department of Justice charged two Russian nationals with “conspiring to launder approximately 647,000 Bitcoin from their 2011 hack of Mt. Gox.”

The investigation led to a recovery of 140,000 Bitcoin, and Kobayashi made efforts to ensure that the remaining assets were accounted for. You must admire that Japanese dedication and work ethic driving the desire to complete a job properly and the incentive to maximise the fees you can generate from a larger pool of assets.

Class action lawsuits

Additionally, creditors pursued various class action lawsuits against Mt. Gox and its executives, further complicating the resolution process. Settlements and negotiations often took time, adding to the delays in repaying creditors. The need for transparency and fairness in distributing assets meant that the process was far from straightforward.

Market conditions

Market conditions also played a role. The volatility of Bitcoin’s price during the past decade influenced the decision-making process regarding repayments. The value of recovered assets fluctuated dramatically, impacting how and when creditors could be compensated.

Processing claims

It’s been ten years, and each year adds another layer of complexity: People die, opt to cut their losses, sell their claims to third parties, and forget they had an account only to hear they might be eligible for a payout, adding further admin to the process of distributing the coins that were salvaged.

“We have taken time to ensure safe and reliable repayment to creditors, including technical remedies for safe repayments, compliance with financial regulations in each country, and discussion of repayment arrangements with the cryptocurrency exchanges,”

Mt. Gox Rehabilitation Trustee Nobuaki Kobayashi

Wrapping up the rugging

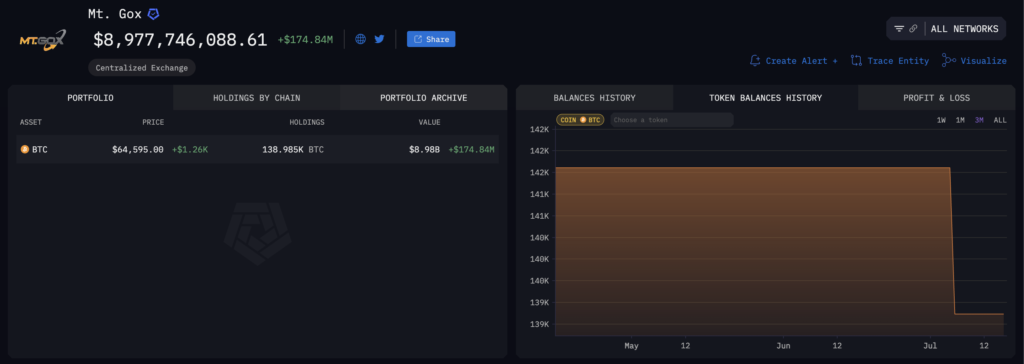

In 2023, Nobuaki Kobayashi announced a structured plan to start repaying creditors, distributing approximately 140,000 BTC. This distribution is expected to occur through cash payments, Bitcoin, and Bitcoin Cash (A fork of Bitcoin) returns to the rightful owners.

On 16 July 2024, Mt. Gox’s cold wallet transferred 140,000 Bitcoin worth over $9 billion within three hours, signalling asset consolidation ahead of the repayments.

Bitcoin exchange Kraken has also confirmed that it’s received 48,000 coins from the Mt Gox wallet and is preparing to distribute them to eligible account holders.

Implications for the Bitcoin Market

The eventual return of a substantial amount of Bitcoin to Mt. Gox creditors raises questions about its potential impact on the Bitcoin market. Some analysts fear a “Mt. Gox dump,” where creditors rush to sell their recovered Bitcoin, flooding the market and causing a price decline.

While we have had a trial run absorbing 50,000 coins in one month, the situation is more nuanced than one seller trying to liquidate their position.

Some holders might choose to continue to hodl; if you’ve lived without those funds for ten years, you’re likely in a position to continue to hodl for the future.

However, this is just an assumption; considering the fact that Mt. Gox’s creditors will receive an asset that has appreciated over 8,500% in the ten years, it could be all too tempting to realise that fiat returns, especially from those funds who purchased the bankruptcy claim finally able to release a return on their bet.

The timing of the Bitcoin release is staggered, reducing the likelihood of a sudden, massive sell-off. This, coupled with the fact that the Bitcoin market has matured into a 1 trillion dollar asset class since 2014, with increased liquidity and a broader investor base, instils confidence in the market’s ability to handle the Bitcoin distribution.

You now have a global cohort of cyber-hornets all too happy to pick up cheap sats.