Investing is like navigating a vast ocean of rough tides and murky waters. The primary compass that guides investors through these financial waters is the potential yield or the anticipated rate of return on investment. This yield forms the basis of all investment decisions, underlining the commitment of time, energy, and capital in pursuit of lucrative opportunities.

In essence, the pursuit of yield is the pursuit of profit. In a fiat world, we’ve been conditioned, nay forced to seek our yield to reduce the impact of inflation on our personal wealth, while in Bitcoin, it’s much less of a need, despite the speculative nature of the Bitcoin market.

As a hodler, you could sit on your stack and bank on the future price appreciation of the asset as it continues to monetise, or you could seek out an additional return on that capital by taking on additional risk.

Weighing risk vs return:

However, the landscape of investment isn’t as straightforward as simply hunting for the highest yield. Those who lend their Bitcoin to CEFI services and exchanges or placed their Wrapped Bitcoin into DEFI protocols soon found out the hard way.

Sure, there was a yield to be made, but that expected rate of return didn’t tell you the full story of the risk you were taking and was not properly compensated.

Consider someone who thought they could set 4 -8% with a CEFI lender and handed over their Bitcoin; they could end up with nothing or, at best, a few cents on the dollar as their return. So was the 4-8% worth the risk?

Of course not, but that’s in hindsight; during times of financial fervour, we do not think of the risk we’re taking, only the potential profit.

Much like in any expedition, dangers lurk in these waters – the risks associated with investments. The risk-return trade-off principle states that the potential return rises with an increase in risk.

Low levels of uncertainty (low risk) are associated with low potential returns, whereas high levels of uncertainty (high risk) are associated with high potential returns.

Thus, assessing risk is a critical aspect of determining where to deploy capital. Smart investors don’t just chase yields blindly; they weigh them against the associated risks, aiming for a sweet spot where the return justifies the risk taken.

Role of yield in liquidity movement

Yield plays a pivotal role in dictating the movement of liquidity in markets. Higher yields attract investment, and in an interconnected global financial system, this often means capital moving across borders, sectors, and asset classes.

In effect, the rate of return on capital acts as a guiding light for liquidity, leading the charge towards sectors that promise the best risk-adjusted returns. But establishing a reliable yield curve is another story altogether. In fiat markets, yields are set by central banks, which dictate the price of money.

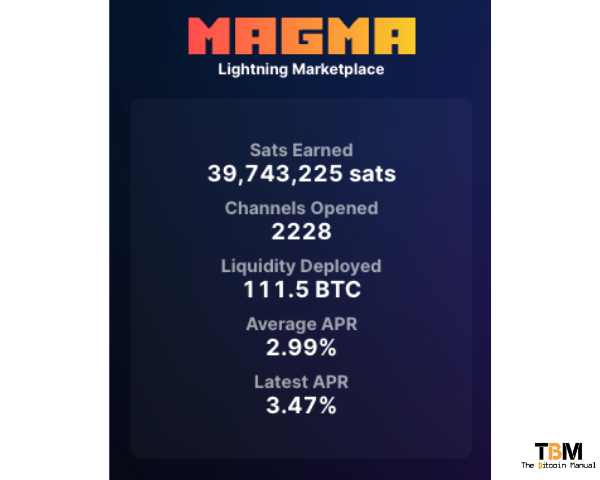

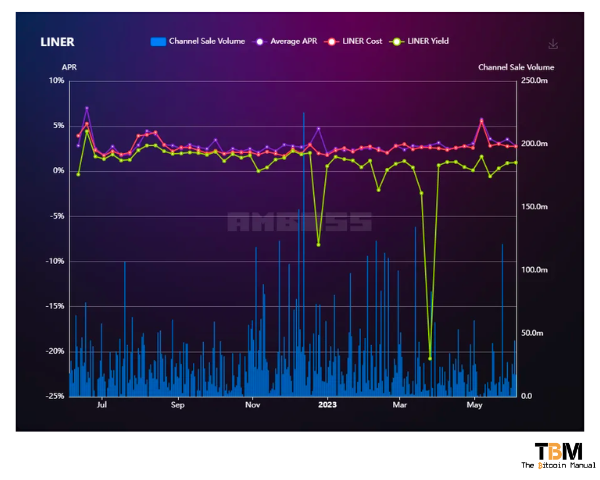

Bitcoin, the first form of a yield curve, has begun to take shape in the form of attracting capital out of cold storage and into Lightning channels to help route payments. To help formalise the idea of a yield curve for Lightning, Magma by Amboss has introduced LINER (Lightning Network Rate), an innovative index designed to measure bitcoin returns on the Lightning Network and showcase its potential for low-risk enterprise yield.

What is LINER?

LINER stands for Lightning Network Rate and can be considered a “LIBOR” for the Lightning Network, which distils the cost to attract capital into L2. Lightning node operators allocate liquidity in the form of lightning channels to one another in various duration channels or various sizes, which provides a valuable service to the network.

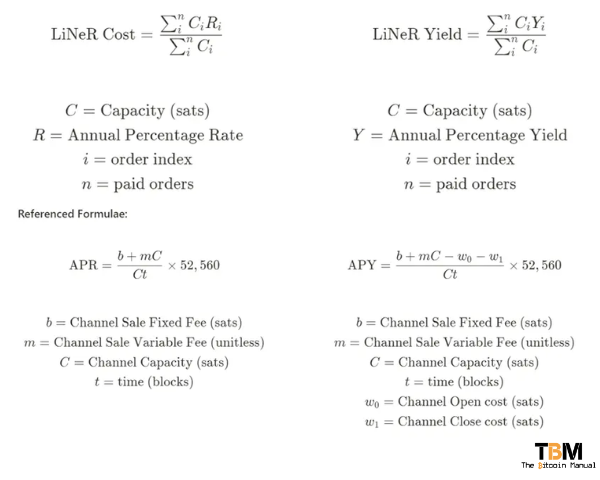

LINER comprises two insightful metrics: LINER Cost and LINER Yield, which provide enterprises with valuable insights into the Lightning Market. These metrics allow for comparisons between LINER Cost and traditional payment card fees, empowering large Bitcoin holders to make informed decisions regarding their Bitcoin holdings.

Using LINER as a benchmark allows liquidity providers to determine whether committing their capital will be worth their while or if they are better off sitting on layer two. Similarly, purchasers of liquidity will be able to determine the cost of leasing channel capacity. LINER Yield will cater to liquidity providers, while LINER Cost will target those seeking liquidity.

By communicating real yield rates from bitcoin held on the LN, enterprises will recognize the strategic error in trusting CeFi yield platforms while capturing the benefits of payment network disruption that is decades overdue

Jesse Shrader, co-founder and CEO of Amboss

How Is LINER Calculated?

The LINER Cost is calculated using a capacity-weighted average of the Annual Percentage Rate (APR) paid for a lightning channel with a duration of one week to several months. The LINER Yield is calculated using the Annual Percentage Yield (APY) instead of the APR.

The calculations below aim to simplify the complexity of duration, fee structures, and the lightning network to create easily digestible metrics for tracking the emerging Lightning Network economy.

It’s worth noting that LINER does not speak for the Lightning Network as a whole and is merely a benchmark based on a sample. Due to the decentralised and private nature of the lightning network, it is impossible to have perfect visibility of the global LINER. LINER comprises available data from the Amboss Magma channel marketplace for our calculations. LINER could be added to different marketplaces in the future and then combined to create aggregated LINER figures.

Where does the yield come from?

LINER currently shows yields ranging from roughly 2% to 3%. But it’s important to note that these “self-custodial yields,” meaning returns, are only generated from the provisioning of liquidity without any Bitcoin changing hands, as you remain in control of your funds in the channels you create.

The yield is generated from the willingness to pay for access to liquidity, along with the fees generated from routing payments using that liquidity. The turn does not come from thin air; you are getting paid in the native asset of the network. Those satoshis are earned from the hops taken by payment packets looking to traverse the Lightning Network.

If you’re the average crypto bro, you’re probably looking at LINER and thinking, is this a yield for ants? You’re right, but this is a dynamic market with rates set by the demand from different participants and cannot be compared to ponzi DEFI yield farming returns.

Yield farming, also known as liquidity mining, is a way to generate rewards with cryptocurrency holdings. In simple terms, it involves lending your crypto assets to a platform through smart contracts, and in return, you earn fees or tokens, effectively generating a yield from your investment. Here you’re handing over your capital, suffering an impermanent loss on the pairs you select, and hoping the fees and third-party token you earn will compensate you after you’ve subtracted all the on-chain fees to participate and remove yourself from the pool.

In these DEFI ponzis, the yield comes from the hope that the centrally planned return of the 3rd party token printed out of thin air is enough to attract capital that will allow a select few to realise a return.

Low risk does not mean any risk and is not a guarantee of profit.

The Lightning Network offers intriguing possibilities for returns through the opening of payment channels. While this may initially seem like a low-risk investment with potential steady returns, it’s important to clarify that it’s not a guaranteed return or a path to passive income.

Like any other financial venture, running a Lightning Network node comes with its own unique set of costs along with operational risks.

Sunk cost or startup costs.

First, running a Lightning Node is not free, so you will have startup costs you need to cover in the beginning either with a dedicated server as your node, an old laptop you can afford to try or paying a cloud node provider to manage the infrastructure while you manage the node operations.

The unpredictability of the Lightning network

The profitability of your node also largely depends on its ability to route payments efficiently, which requires careful and active management of your channels. It’s also important to note that the fees earned for routing payments won’t always remain the same, meaning substantial profits are not guaranteed. Liquidity will flow in ways that might not be expected as services go down, new services spring up, and your channels might miss out on these new capital flows.

Operational risk of the Lightning network

Furthermore, funds tied up in Lightning channels are subject to potential loss through various risks such as channel closure costs, possible bugs or attacks on the network, and the reliability of channel partners.

Hence, participation in the Lightning Network should be approached with an understanding of these complexities and risks and not merely seen as an effortless income generator that can be left to a ham sandwich to operate. If you ask any routing node that has done it for some time, even with the toolsets and automation available today, it is no easy task to rebalance your channels, prune channels, open new ones and always remain profitable.

While LINER offers us a benchmark metric, it can never tell you the full story of what it takes to get involved in the Lightning Network and your ability to secure a profit.

Do your own research.

If you want to learn more about yield farming on Bitcoin, use this article as a jumping-off point and don’t trust what we say as the final say. Take the time to research, check out their official resources below or review other articles and videos tackling the topic.

Are you a Bitcoin and Lightning fan?

Have you been using Lightning to make micro-payments? Stream sats or engage with apps? Which app is your favourite? Do you run a Lightning node? Have you tried all the forms of Lightning payments? Which one do you prefer?

Let us know in the comments down below.