The altcoin market has all tokens swimming in a sea of red, with investors panicking about the outcome of major lawsuits that have gripped every crypto publication’s headlines. The two biggest CEXs on the block, Binance and Coinbase, have been targeted in a new round of lawsuits by the U.S. Securities and Exchange Commission (SEC) against crypto businesses.

The SEC has taken aim at 67 altcoins and labelled them as a “security” and, with that, issued a lawsuit against crypto exchanges Binance and Coinbase.

- In its case against Binance, the SEC named ten cryptocurrencies as securities,

- In its case against Coinbase, the SEC named 13 cryptocurrencies in its Coinbase suit.

- The “security” label now applies to over $100 billion worth of the market, or around 10% of the $1.09 trillion total crypto market capitalisation, which is still a tiny fraction of an ever-expanding market. Still, it does lay the groundwork for cleaning up the rest as we advance.

As the maturation of the cryptocurrency market continues and more money flows into it, it is only a matter of time before the SEC gets involved. The massive failures of CEFI like Celsius and BlockFi and exchanges like FTX have given them all the ammo they need to start clearing houses in crypto.

Many new bag holders from this previous bull cycle were hurt, and regulatory authorities have no shortage of victims to use as motivation and have shifted their focus onto this relatively new asset class.

Today we charged Binance Holdings Ltd. (Binance); U.S.-based affiliate, BAM Trading Services Inc., which, together with Binance, operates https://t.co/swcxioZKVP; and their founder, Changpeng Zhao, with a variety of securities law violations.https://t.co/H1wgGgR5ir pic.twitter.com/IWTb7Et86H

— U.S. Securities and Exchange Commission (@SECGov) June 5, 2023

The impact on altcoin market

The SEC’s increasing scrutiny raises uncertainty and concern among crypto enthusiasts and investors, with their actions signalling that regulatory leniency is fading and their advantage of playing regulatory arbitrage could soon be over.

Exchanges and altcoins named in the lawsuit and wish to play in the space will be forced to adapt or face the consequences. However, these changes are not likely to halt the growth of the crypto markets but rather redirect it.

While we have no idea what the outcome of these cases will be, the possible fallout could result in exchanges having to remove assets deemed unregistered securities and only list assets that comply with the SEC.

Alternatively, the exchanges would have to leave the U.S. market or have strict silos that comply with the SEC if they wish to service the U.S. market.

As for altcoins, they are in a bit of a bind too; they will either need to register with the SEC and make a lot of information public that would paint their tech company pretending to be a decentralised network in a bad light, or try to make it on their own without servicing the U.S. market directly.

Bitcoin, the unaffected asset

If you’re not following all the drama but have had a look at the pricing of Bitcoin, you could quickly think that because it’s down, it’s somehow involved in these cases.

It’s crucial to note that Bitcoin is not in the crosshairs of the SEC. Bitcoin, the largest cryptocurrency by market capitalisation, has been declared not a security but a commodity by the SEC and thus remains largely unaffected.

This is not to say Bitcoin will always be in the clear and that the SEC could reclassify Bitcoin and come for it at a later stage, but for now, the focus is on the altcoin market. Bitcoin just so happens to be lumped in with these bad apples, and investors who can’t distinguish between the two are trying to sell at any price to reduce their exposure to the asset class.

You’re a statist

Bitcoiners, of course, are revealing in the drama; they get an opportunity to soak up cheap sats while projects that maxis have rallied against for years are bleeding and could be the beginning of the end for some of them.

As the saying goes, “The enemy of my enemy is my friend”.

In response to Bitcoiner gloating, many sections of crypto investors, primarily those engaged with decentralised finance (DeFi) projects and altcoins, has been critical of Bitcoin enthusiasts’ responses to these lawsuits. They argue that Bitcoin supporters cheering on the SEC’s legal action are embracing statism and don’t advocate for the free market. This viewpoint contrasts with the fundamentally libertarian and decentralised ethos that underpins much of the cryptocurrency world.

It’s important to clarify that not all Bitcoin enthusiasts can be painted with the same brush. Many Bitcoiners espouse the crypto-anarchist belief in minimal state interference in economic affairs, but maxis are also realists. They understand that government is a market actor, and if your so-called “decentralised network” is as robust as you claim, it needs to be resistant to all measures of attack.

Finding alternatives routes to speculate

If certain coins are moved from U.S. markets, the deepest capital markets in the world, it will certainly be a blow for these tokens and result in a gain for the ones like Bitcoin that remain tradable in the U.S.

These regulations will make it harder for the average investor to gain access to these tokens, but it doesn’t mean it’s impossible, and a motivated degen trader will always find a way.

We have to realise that regulation and enforcement are two different things, and enforcement has its limitations. Despite the tightening regulatory environment, the market will always produce solutions for those wishing to trade in these markets.

Offshore exchanges, which operate outside the jurisdiction of U.S. authorities, have seen an uptick in usage as they offer a wider range of crypto assets, many of which are considered unregistered securities in the U.S.

Suppose you wish to trade in these unregistered securities. In that case, all you would need to do is acquire Bitcoin or a stablecoin and move those funds to an offshore exchange and continue to trade on either lax KYC exchanges, no KYC exchanges or trade on a purchased KYC account.

Dumping on those that can least afford it

The altcoin market has engorged itself on U.S. capital for some time, growing complacent, thinking that this free run at the trough would go on forever. If access to the trough is cut off, we might see these hungry dogs become desperate as they are backed into a corner.

When faced with stringent regulations and potential lawsuits in the United States, cryptocurrency projects might opt for an ‘exit strategy’ to other, less-regulated markets. This approach could, however, amplify risks and challenges for those regions, especially in the developing world.

The primary concern is that altcoin projects, no longer able to operate in the U.S. due to regulatory pressure, may target nations with lax regulatory environments and weaker law enforcement. This could lead to the aggressive promotion of their coins in these regions, potentially resulting in what critics describe as ‘dumping their bags’ – offloading large amounts of their coins onto investors.

This scenario presents a significant risk. Investors in developing countries, often with less disposable income and potentially limited understanding of the complex and volatile nature of cryptocurrency investments, might be particularly vulnerable to such practices. Furthermore, their governments might not have the resources or regulatory frameworks to protect them adequately.

This situation could create an uneven playing field where the risks of investing in altcoins are disproportionately carried by those in developing countries who can least afford to bear them.

On-chain markets

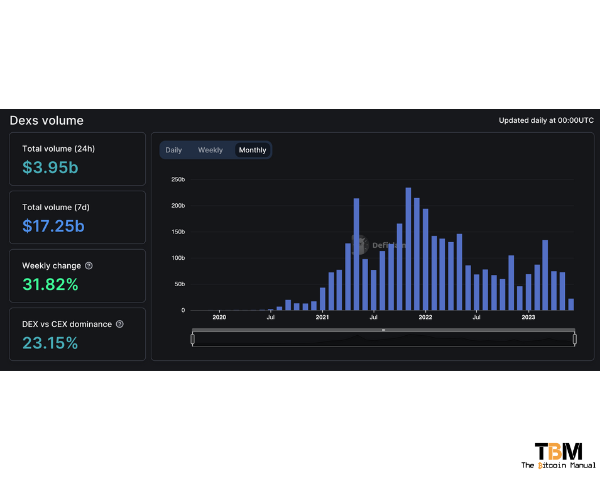

Decentralised exchanges (DEXs), which I prefer to call these on-chain markets because they aren’t exactly decentralised, received a lot of attention during the DEFI boom of 2018 but later flatlined due to on-chain fees, failure of transactions to process, MEV concerns and several wallet hacks from engaging in shoddy market contracts.

Decentralised exchanges (DEXs) that operate on-chain have seen a significant rise in popularity since the announcement of the lawsuits but are nowhere near their peak yet.

DEXs allow peer-to-peer trading of crypto assets without an intermediary, effectively allowing traders to bypass traditional exchanges altogether. Since you are not handing over funds but engaging with smart contracts, you do not need to KYC and can get access to a bunch of assets.

If users can still access stablecoins or wrapped Bitcoin from regulated markets, it will provide enough of a bridge to move those assets to a chain and DEX they prefer and continue to trade these unregistered securities.

The crypto kitty is out of the bag.

While the SEC’s increased oversight may seem daunting, it’s important to remember that the crypto market is still the wild west and will react in some fashion to bypass any regulation. There is simply far too much profit to be made from scamming retail investors that it’s far too hard to walk away from it.

While the industry is rife with scams, fraud and bad actors, it’s also one filled with innovative thinkers, and this nature ensures that it will continue to evolve and find new ways to thrive amidst changing regulatory landscapes. The growth and expansion of offshore and on-chain exchanges are just a few examples of this adaptability, and I am sure new avenues will pop up in the future.

While this action by the SEC might be deemed operation chokepoint 2.0 and might hang some tokens on the wall as trophies, not all crypto will die. The continued accessibility and utility of Bitcoin and stablecoins ensure that the crypto markets remain vibrant and open for speculation.

Do your own research.

If you want to learn more about these lawsuits, use this article as a jumping-off point and don’t trust what we say as the final say. Take the time to research, check out their official resources below or review other articles and videos tackling the topic.