Investing in a brand new asset class like bitcoin can be a daunting undertaking, but the market for bitcoin has matured, and with it comes certain benefits. For one, you no longer have to purchase it from rather dingy-looking websites with arbitrary limits on how much you can purchase. Today we have large centralised exchanges that act as platforms where buyers, sellers and market makers can trade, reduce or increase their positions.

When moving into an asset, you want to have confidence that if you wish to purchase or sell, there is enough supply or demand to match your order. The easier it is for an investor to move in and out of any asset without taking a loss on slippage, the more attractive it becomes to trade that asset, and this is where liquidity plays a role.

The concept of liquidity has many facets and plays a large role in influencing the price of bitcoin.

- Liquidity can be defined as the ability of an asset to be converted to cash on demand.

- While another view is that liquidity is determined by the bid-ask spread, and an investment with a lower bid-ask spread has higher liquidity.

In either definition, the crux remains that liquidity reduces the likelihood that there will be discounts or premiums attached to an asset during buying or selling, making it easy to enter and exit the market.

Defining liquidity and illiquidity

Let’s start with the basics—what makes an asset liquid or illiquid? Liquidity is used to describe how ready an entity is to spend. A highly liquid asset, then, would be one that is free to be used to cover expenses.

Illiquid assets, on the other hand, would be those that won’t be as easy to sell at their appropriate value. This could be attributed to a few factors, one of which is the expense involved in selling the asset. This doesn’t mean that they don’t hold value well—it could be quite the opposite, in fact. This only means that it might take longer for you to find the right opportunity where you can sell off the asset at the right price.

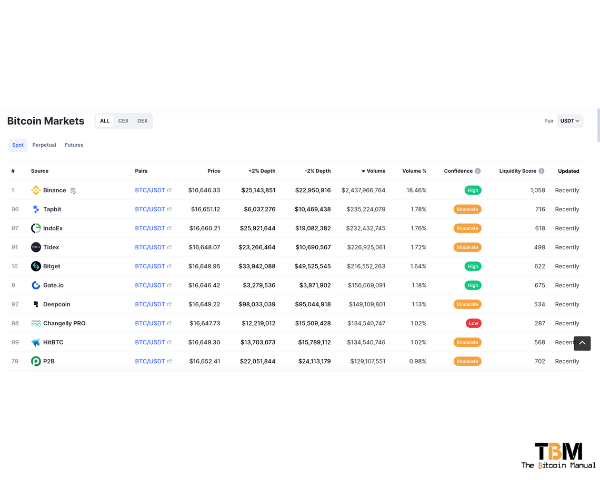

As you can tell from the image below, not all exchanges are created equal, and some are fair more liquid than others. Now, this shouldn’t be too much of an issue for any humble pleb buying a new hundred dollars at a time. You don’t have the buying power to move the market, but for large traders, taking a position in bitcoin becomes more onerous depending on liquidity.

They might be forced to trade over several exchanges or leverage OTC desks to settle on a price.

Measuring Liquidity

Liquidity, unlike other trade analysis indicators, has no fixed value; no figure states if, over this number, that market is deemed liquid. As a result, calculating the exact liquidity of the exchange or market is difficult.

When determining the liquidity of a market or an exchange, you need to rely on specific indicators such as:

Bid-Ask spread

The gap between the highest bid (selling) price and the lowest ask (purchasing) price in the order book is known as the bid-ask spread. The narrower the spread, the more liquid the bitcoin market is said to be.

If a market for a digital asset is illiquid, investors and speculators would expect to see a wider bid-ask spread, making it more expensive to transact in that digital asset. You can quickly compare bitcoin with other altcoins to see this spread in action.

Trading volume

Trading volumes are an important factor in determining liquidity in the bitcoin market. It refers to the total amount of bitcoin exchanged on an exchange over a given period; normally, publically available data will give you the 24-hour volume, but you can source volume trends from market analysis tools.

The indicator impacts the market players’ direction and behaviour. A higher trade value indicates more trading activity (buying and selling), implying greater liquidity and market efficiency. Lower trade volume means less activity and low liquidity.

Market size

Despite holding a market cap that is in the hundreds of billions, the size of bitcoin is still quite small. Market capitalisation is calculated as the amount of an asset outstanding multiplied by the price of each one of that asset. As far as history is concerned, the highest total market capitalisation was around $1.3 trillion.

While those might sound like huge amounts of money, bitcoin is far from being as large and liquid as other financial markets that professional investors normally participate in.

Let’s look at the market capitalisations of some other assets out there:

- US Equity, or stocks: $40 trillion USD

- US Fixed Income, or bonds: $47 trillion USD

- Global Equities: $106 trillion USD

- Global Fixed Income: $124 trillion USD

- Gold: $12 trillion USD

If we have a look at these established markets, then we can consider bitcoin has a long way to go before it can clear position sizes that these markets can do without moving the price a percent or two.

Liquidity in a down market

Liquidity is not an element of the market that is constant, and when there is panic, doubt and fear, market participants might hunker down on their positions or get out and refuse to trade the asset. As traders refuse to participate and withdraw their orders/demand, this drives a lack of liquidity, which is what happens in bear markets, a time when liquidity is vital.

As an economy slows down or a market contracts, people wish to move from illiquid assets into more liquid assets or cash to preserve their gains. This causes liquidity to shrink, which can cause extreme price fluctuations, especially negatively, as supply and demand find a new equilibrium.

In the mad rush to exit a relatively illiquid market, many cannot convert their assets into cash. You’ll often see this happening in the altcoin market, where investors are sitting on 1000s of coins but cannot sell because the buy side is so thin that if they tried to sell, they would clear out the entire order book and send the coin for all intents and purposes, to zero.

So many altcoin investors get stuck in a liquidity trap that they can never get out of, which is why it’s best to steer clear of these illiquid markets.

The more liquid a market is, to begin with, the less damaging this flight to liquidity can be.

How does bitcoin’s illiquidity improve?

As more investors come into bitcoin with the intention to buy, sell or trade, this demand drives scale and to meet that demand, you will find both centralised businesses and peer-to-peer markets rise up to meet that demand.

The increase in frequency and volume of trading helps to enhance liquidity. As the exchange of bitcoin becomes more secure, more holders are willing to trade their bitcoins, which adds buyers and sellers who trade the float.

Fragmented liquidity

Today we have an altcoin industrial complex churning out easy-to-reproduce coins every day. There is no limit to the number of coins that can be created. Still, there is a limited demand for those coins because they offer no value apart from gambling. Today billions of dollars worth of demand slosh around in a game of musical chairs, with investors hoping they never get stuck holding the hot potato.

As these coins trend towards zero, more investors accept their losses and transfer the value they can salvage into bitcoin and remain in bitcoin. They continue to increase their position in bitcoin, driving deeper liquidity.

Do you take self-custody of your stack?

If you’re new to bitcoin and have not ventured down the self-custody rabbit hole, what is stopping you? If you’re already self-sovereign, how has the experience been since you took hold of your funds? Let us know in the comments down below.

We’re always keen to hear from bitcoiners from around the world.