Since the launch of the ordinals protocol, we’ve seen a flurry of new activity on the Bitcoin network. Some see these new transaction types as a way to generate extra revenue for the miners as block space is filled more often. At the same time, ordinal users are willing to pay higher fees than the average Bitcoin user.

It’s a fact that ordinals have brought more transaction activity and generated additional fees to Bitcoin during the bear market, but supporting this new activity comes at a cost.

Blocks are being filled with arbitrary metadata, bloating the size of the Bitcoin blockchain and increasing its size faster than the previous rate. This will only affect some node operators now, but eventually, storage space for Bitcoin nodes will need to increase, or you will have to prune your node.

The other contentious issue with ordinals is how users make money through speculation, either by creating NFTs or tokens on the Bitcoin blockchain and trying to resell them on exchanges or secondary markets. The goal of ordinals is to find a buyer who will pay you more than the ordinal user spent minting and transferring these tokens.

Attack of the ordinals

The speculative nature of ordinals activity has rubbed some Bitcoiners the wrong way; they feel that ordinals attract degenative behaviour to Bitcoin and distract individuals from the true nature of the network and its killer use case as a store of value.

The ordinals protocol and its transactions do not break the current consensus, so nodes or miners cannot stop them. Bitcoin is a censorship-resistant network, and as long as you pay the fees and compile transactions correctly, you won’t be prevented from securing block space. This can be annoying to those who, despite ordinals, but that doesn’t mean nothing can be done, and developers have come up with ways to protest against it or poke holes into the ordinals’ theory.

Developer Supertestnet was one of the first to attempt to break ordinals; he did so with the ability to mess up the number ordering while developer Luke Dashjr launched Ordisrespector, a patch Bitcoin nodes can use to ignore ordinal transactions.

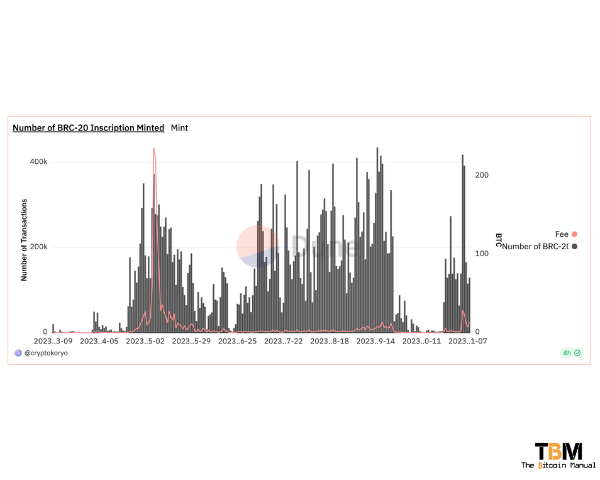

These attempts at reducing ordinals activity did very little until recently; we’ve seen a bit of a bear market in the BRC-20 token minting space with the launch of the minting sniper bot Sophon.

Do you like the sophon? Would you like to fuel it up with sats to go hunting?

— Rijndael (@rot13maxi) October 5, 2023

bc1p6ughy452hr65hxr8e8j2mvn2dkpmrhs5ct6ugptzl933y5zju6js3mu7qj

More, smaller UTXOs is more useful than fewer larger UTXOs.

When/if it ever shuts down, any funds left will be donated to opensats

How BRC-20s work?

NFT collection creation was the first use case for ordinals, but this later required you to come up with images to mint, and people are lazy, so eventually, they moved to something even easier to reproduce: tokens, of course.

BRC-20 tokens are a type of token that can be minted on the Bitcoin blockchain using the Ordinals protocol. This token standard proposed by domo, while having plenty of flaws, reached over $100 million in market cap as speculators took the idea and ran with it, spinning up hundreds of new Ponzi schemes and meme tokens.

Many have criticized how the standard works, including Casey Rodarmor, the creator of Ordinals, because of its negative effects on Bitcoin’s UTXO set and the token standard’s ability to be front-run. Casey has even proposed an alternative implementation in the form of Runes.

BRC-20 tokens are issued with a “deploy” inscription that includes the token supply, max amount to mint, and ticker name. The first deployment that gets included in a block becomes the official ticker.

There is no limit on how high or low the token supply can be, but most BRC-20s have common supply amounts like 21 million, 100 million, and 1 billion. It really doesn’t matter. Once the deployment inscription has been created, other speculators will follow by inscribing to claim a piece of that total supply of tokens before the hard cap is reached.

Once the hard cap has been hit, these early inscribers will then try to sell their tokens on secondary markets to latecomers and try to profit.

The “sophon”, a BRC-20 sniping bot

As this speculation rallied on, we saw the mempool stuffed with these types of transactions, and during these frenzies, it made it hard to use the Bitcoin network for the average transaction or to open a lightning channel.

Eventually, the novelty wore off, and overbidding for block space did reduce, but ordinary transactions never truly went away until last month.

On October 3, Rijndael released the “Sophon”. The Sophon bot watches Bitcoin transactions for BRC-20 deploy inscriptions and then broadcasts a similar inscription for the same token ticker, with a supply of 1. The bot would bid at a higher fee rate to ensure it would front-run the deployment of the token and effectively render it useless (if it wasn’t already).

Rijndael named it the “Sophon” after a similar tool (or weapon) concept in the science fiction book series, The Three-Body Problem.

The bot worked surprisingly well, with a few contributors providing funds to keep the mempool clear and as a result, we saw the lowest minting of BR-20 tokens since its introduction.

Running Sophon isn’t cheap.

Sophon had done it; it had achieved what ordinal haters had always wanted: Cleared the mempool of trash. While existing BRC-20 tokens trading continued, new BRC-20-related inscriptions dropped to only a handful per day as the entire on-chain BRC-20 activity effectively stopped.

The problem is, this peace would not last, as in Bitcoin, everything has a cost. It’s not cheap to run the bot, and for its time of BRC-20 snipping, the bot had spent 0.0129 BTC since inception with a 75% success rate.

While not a lot of Bitcoin, to keep this running month after month, it can quickly pile up, and is this a good use of people’s Bitcoin? Alternatively, you could let BRC-20 users burn their capital over time instead of trying to get in their way.

After running the experiment in October, Rijndael decided to shut down Sophon and donated the remaining Bitcoin in the UTXOs to OpenSats, and since then, BRC-20 token transactions have returned with a vengeance.

the sophon ran out of gas earlier this week. gave it a few more days and then shut it down. don't have near-term plans for it. But you never know what else is lurking in the mempool…

— Rijndael (@rot13maxi) October 27, 2023

Thanks for playing!

Ordinal fans won’t take it lying down.

Sophon has proved that a community can stop ordinal transactions should they put up some capital, and despite shutting down, we could see a future where versions of this bot appear to pick up from where Sophon left off, but that remains to be seen.

If a bot or bots do spin up to take out ordinal transactions, we could also see stronger responses from the ordinal community. Ideas like private mempools have been floated along with transaction accelerators and out-of-band transactions to avoid bot front running.

Do your own research.

If you want to learn more about Sophon, use this article as a jumping-off point and don’t trust what we say as the final say. Take the time to research, check out their official resources below or review other articles and videos tackling the topic.