The Bitcoin ecosystem is witnessing one of its most contentious debates in years, centred around Bitcoin Core version 30 and its controversial expansion of OP_RETURN data limits. What began as a technical discussion about mempool policy has evolved into a heated battle over Bitcoin’s fundamental identity:

Should it remain primarily a decentralised database that records monetary transactions and is used as a record for medium of exchange, or is it acceptable to transform it into a data storage platform for arbitrary data such as messaging, meta protocol entries and files like images and video that risk regulatory capture?

The Technical Change at the Heart of the Controversy

Bitcoin Core v30, scheduled for release in October 2025, removes the long-standing 80-byte limit on OP_RETURN data, effectively expanding the default OP_RETURN data limit from 80 bytes to 100,000 bytes. This represents a 1200x increase in the amount of arbitrary data that can be embedded in Bitcoin transactions by default.

OP_RETURN is a script opcode that allows users to embed small amounts of data in Bitcoin transactions. The data is provably unspendable, meaning it doesn’t create UTXOs that need to be maintained in Bitcoin’s active set, but it does consume block space and bandwidth.

The Bitcoin Core mempool policy change is set to take effect in the implementation’s v30 release, scheduled for October 2025.

What Is OP_Return?

OP_Return is a script opcode that allows users to embed arbitrary data into a Bitcoin transaction, marking that part of the transaction as unspendable and enabling users to store a small amount of data on the Bitcoin blockchain without interfering with the Bitcoin network’s core functionality.

However, the bitcoin associated with that output becomes unspendable and essentially burns those coins.

Originally introduced as a way to prevent Bitcoin spam and enhance efficiency, OP_Return now serves a variety of purposes, such as timestamping, document verification, and issuing tokens. While creative uses exist for this method of Bitcoin transactions, it is limited by the amount of data which can be included alongside the transaction, around 80-83 bytes.

Why is there a need To Increase this limit?

The primary technical argument is that OP_RETURN outputs are unspendable and therefore don’t bloat the Unspent Transaction Output (UTXO) set that all Bitcoin full nodes must track for transaction validation.

- The UTXO set is the most expensive resource for Bitcoin nodes to maintain

- It must be kept in fast memory for quick transaction validation

- Bloating it slows down the entire network and increases node costs

2. Harm Reduction Strategy

Proponents argued the restriction had outlived its usefulness and that lifting the cap would encourage less harmful on-chain behaviour by shifting users away from unprunable data techniques. The logic here is that people are already storing large amounts of data on Bitcoin through various workarounds like Ordinals and STAMPS, but these methods are more harmful to the network:

- Ordinals/Inscriptions: Store data in witness fields, which still consume block space but are harder to filter

- Fake UTXOs: Many modern protocols, such as STAMPS, are forced to use “fake” transaction outputs to store data. These remain in the UTXO set, complicating network operations

- Multi-transaction schemes: Breaking data across multiple transactions, which is less efficient

3. Bypass Argument – “It’s Already Happening”

“The restrictions are easily bypassed by direct substitution and forks of Bitcoin Coree

Developers argue that:

- The current limit is trivially bypassed by anyone who wants to store large amounts of data

- Modified Bitcoin Core versions already exist without the limit

- The restriction only inconveniences legitimate users while failing to stop malicious actors

4. Code Simplification

Proponents of the size increase claim that it would streamline Bitcoin’s codebase, potentially improving operational efficiency without compromising network integrity.

The argument is that maintaining arbitrary limits adds complexity without providing real benefits.

5. Network Evolution and Future Scripting

Speaking of benefits, the size increase will allow expanding the Bitcoin network with proposals like Citrea, requiring additional data to support its method of bridging funds between the main chain and this layer.

6. User Sovereignty Philosophy

The developers emphasise that Bitcoin is fundamentally a network defined by its users, and as such, the core contributors are “not in a position” to impose mandates on software or policy choices. This philosophical argument suggests that artificial restrictions go against Bitcoin’s permissionless nature and that individual nodes will decide what policies to run and what data they wish to relay into their local mempools and propagate across the network.

Why This Matters More Than You Think

The implications of this change extend far beyond technical specifications. Critics argue that this modification fundamentally alters Bitcoin’s attack surface and opens the door to several concerning scenarios:

The Regulatory Honey Trap

One of the most serious concerns raised by critics is the potential for regulatory capture. If Bitcoin becomes an easy repository for arbitrary data, including potentially illegal content, it creates a perfect pretext for lawmakers to reclassify full nodes as “content distributors” or “publishers.”

This scenario isn’t theoretical. As one analysis points out, once the first high-profile incident occurs—such as illegal content being embedded on-chain—cloud providers will likely update their Acceptable Use Policies (AUPs) to ban default Bitcoin full nodes or require approved builds with content filters and logging capabilities.

The regulatory pathway becomes clear: Node operators could face licensing requirements, KYC obligations, takedown orders, or even criminal liability for stored or relayed contraband. This transforms Bitcoin’s decentralised network into a collection of registered, monitored endpoints—precisely the opposite of Bitcoin’s core value proposition.

Economic Warfare Through Fee Engineering

Another critical concern involves the weaponisation of Bitcoin’s fee market by well-funded adversaries. With large OP_RETURN payloads becoming standard, state actors or other adversaries with deep pockets could sustain fee-floor attacks more efficiently than ever before.

The economics are sobering: at 200 sat/vB, filling the mempool costs approximately 2 BTC per block, or roughly $32.8 million per day at current prices. For a major state actor seeking to cripple Bitcoin’s utility as a medium of exchange, this represents a manageable operational cost—especially considering the strategic value of pushing retail users toward custodial solutions and CBDCs.

OP_RETURN outputs are particularly effective for such attacks because they provide “maximum congestion per sat” without creating long-term UTXO bloat that attackers would need to account for later.

Centralisation by Infrastructure Costs

Larger data payloads inevitably mean higher bandwidth, storage, and computational requirements for node operators. This pricing pressure naturally pushes operators toward professional cloud services and away from the grassroots home nodes that form Bitcoin’s decentralisation backbone.

Critics say removing the limit could lead to network spam, while developers emphasise the importance of maintaining Bitcoin’s principles of decentralisation and censorship resistance. However, the practical reality is that increased operational costs and legal risks create a centralising pressure that favours professionally managed infrastructure over home nodes.

The Narrative Battle

Perhaps most insidiously, embedding arbitrary data on Bitcoin’s blockchain creates opportunities for reputational attacks. If Bitcoin becomes publicly associated with hosting illegal content, mainstream institutions will likely deem it “brand unsafe,” pushing adoption toward ETF wrappers and custodial solutions rather than direct blockchain interaction.

This transforms Bitcoin from “digital cash” into a “messy blockchain that only technical enthusiasts interact with directly”—a fundamental shift in its social and economic positioning.

The Rise of Bitcoin Knots: A Network in Rebellion

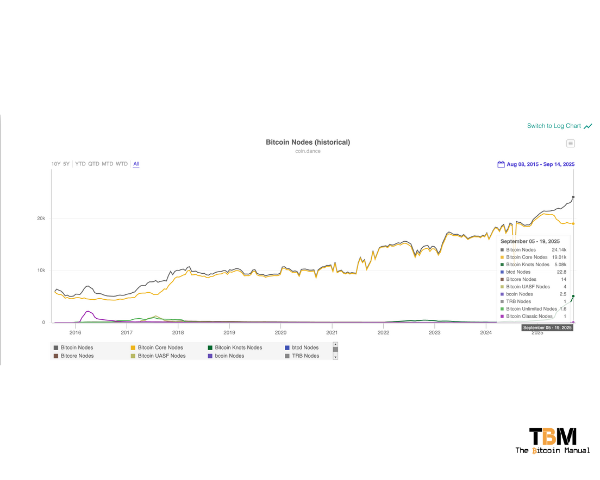

The controversy has sparked an unprecedented migration to alternative Bitcoin implementations, particularly Bitcoin Knots. Developed by Luke Dashjr in the early 2010s, Bitcoin Knots has grown from 394 nodes to 2,909 nodes as of June 19, 2025, marking a 638% increase since the start of the year.

Knots 29.0 and Core 29.1 were released at pretty much the same time.

— Mechanic #FixTheFilters #300kb (@GrassFedBitcoin) September 12, 2025

> 2000 have updated to Knots 29.0

The number of people to update to Core 29.1 hasn't even been enough to show up on the stats. pic.twitter.com/3xoSRLAT1G

Since early 2024, Bitcoin Knots has experienced unprecedented growth, now comprising over 14% of the network’s nodes. This surge reflects a growing faction of Bitcoin operators who question Bitcoin Core’s unilateral control over protocol policies.

This growth represents more than technical dissatisfaction—it signals a philosophical schism within Bitcoin’s community. Bitcoin Knots maintains stricter data policies, effectively serving as a firewall against the data expansion that Bitcoin Core v30 enables.

The Nuclear Option: Network Fragmentation

The situation escalated dramatically when a contributor posted a public bash script designed to auto-ban nodes running Bitcoin Knots, a policy-opposed implementation. This script, if widely adopted, could isolate nearly 3,000 publicly reachable nodes, significantly undermining Bitcoin’s decentralisation.

Created a standalone script to ban connections to Knots nodes that can be easily ran on any bitcoin core node.

— noosphere888 🏴 #FREESAMOURAI (@noosphere888x2) September 12, 2025

Don't connect to nodes that won't relay your valid transactions. 🛡️

🧵👇https://t.co/G4vYuaQsMi

This development represents a concerning escalation from technical disagreement to active network balkanization. If Bitcoin Core nodes begin systematically excluding Bitcoin Knots nodes, the network could fragment into incompatible policy islands—a scenario that would fundamentally compromise Bitcoin’s permissionless nature.

The Developer Funding Question

Critics have also raised pointed questions about the incentives driving Bitcoin Core development. Many core developers struggle financially despite their crucial role in maintaining the world’s most valuable cryptocurrency network. This raises uncomfortable questions about whose interests ultimately influence development priorities.

When developers working on a $2 trillion asset repeatedly seek donations for basic maintenance work, it suggests a potential misalignment between those making technical decisions and those bearing the economic consequences of those decisions.

Who Benefits, Who Loses?

The beneficiaries of expanded OP_RETURN limits are clear:

- Analytics and compliance companies (more data to index and monetise)

- Large-scale miners (higher fees from data transactions)

- Ordinals marketplaces and data storage services

- Approved node provider services

- Custodial platforms (as self-custody becomes more complex and risky)

The losers are equally apparent:

- Home node operators (higher costs, legal risks)

- Small miners (higher orphan risk, policy complexity)

- Medium-of-exchange use cases (crowded out by data transactions)

- Grassroots payment businesses (unreliable fee environment)

- Bitcoin’s decentralisation (fewer independent nodes)

Looking Forward: A Critical Juncture

The controversial change increases data storage on Bitcoin to 100,000 bytes, a move that has stirred debate among its community for months. As October 2025 approaches, Bitcoin faces a critical decision point that will likely define its trajectory for years to come.

The technical change may seem modest, but its implications are profound. If Bitcoin Core v30 ships as planned, it will represent the most significant shift in Bitcoin’s data policy since its creation. Whether this proves to be a minor adjustment or a fundamental transformation will depend on how the market, regulators, and the broader ecosystem respond.

For users concerned about these implications, the options are clear: run Bitcoin Knots instead of Bitcoin Core, or simply avoid upgrading to v30. The choice represents more than a software preference—it’s a vote for Bitcoin’s future identity.

The drama surrounding Bitcoin Core 30 ultimately reflects deeper questions about governance, incentives, and Bitcoin’s role in the global financial system. As state actors and institutional players increasingly focus on cryptocurrency regulation, these seemingly technical decisions carry weight far beyond their code implementations.

Bitcoin’s promise has always been to provide a permissionless, censorship-resistant alternative to traditional financial systems. Whether that promise survives the current controversy may well depend on how many users choose to run alternative implementations that preserve Bitcoin’s original design principles.

The network’s response to this challenge will serve as a crucial test of Bitcoin’s antifragility and decentralisation—a test whose outcome will reverberate through the Bitcoin space for years to come.