It’s no secret that your Rands aren’t going as far as they used to. Despite interest rates from savings accounts and government bonds, very few South Africans can admit to not feeling the pinch when it comes to their spending and maintaining a certain standard of living year after year. The purchasing power of the local currency, the ZAR (South African Rand), continues to erode at a faster pace due to the compounding effects of inflation.

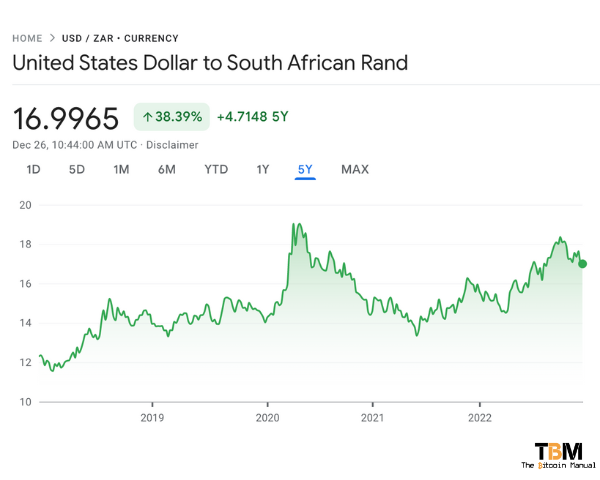

To give you some context, the South African Rand continues to falter, losing 38% of its relative purchasing power to the dollar in the last five years.

As South Africans look for alternative means of storing their wealth outside a failing currency, a failing state and a lack of access to inflation-offsetting assets, many citizens are turning to bitcoin as a form of wealth preservation.

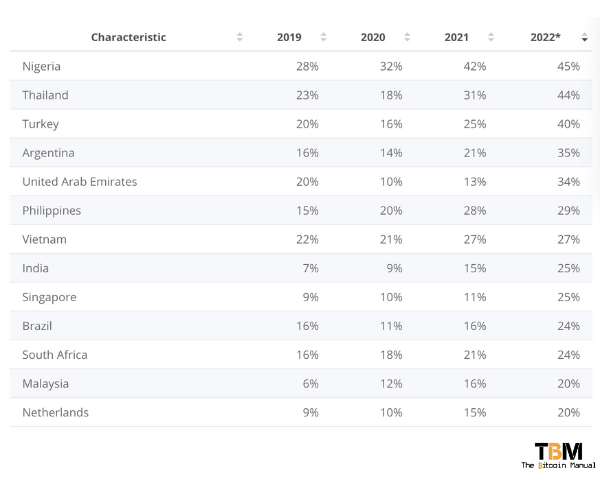

According to reports, South Africa ranks in the top 13 countries for bitcoin adoption. With that level of demand, we’ve seen several companies rise to meet the local populations growing appetite for bitcoin.

Purchasing bitcoin in South Africa

Purchasing bitcoin in South Africa has gotten much easier over the last five years, with several centralised exchanges popping up and providing on-ramps for citizens. While these services offer competitive pricing, access to deeper pools of liquidity and integration with retail banks, these are still walled gardens.

Users who want to access these services need to have a registered bank account and then provide KYC data to the exchange they prefer. These services do a lot of the heavy lifting regarding education and onboarding, but they have trade-offs.

One man’s convenience is another man’s paper trail, and those looking to maintain their financial privacy might want to avoid exposure to these centralised exchanges.

These institutions also make it far easier for government entities like SARS to keep track of how you enter and exit your bitcoin positions, and you can be assured that they will want their piece of your pie declared on your IRP5 come tax season.

So how do you buy bitcoin without having to show and tell all? There are several options; you could purchase vouchers and exchange them for bitcoin, use a Bitcoin ATM or access the peer-to-peer market with something like an FNB eWallet.

What is an FNB eWallet?

The FNB (First National Bank) eWallet is an instant money transfer service that allows FNB customers to send money to any person with a valid South African cellphone number. The eWallet money transfer can be done via the bank’s smartphone app, an online platform, mobile banking, or via the vast network of FNB ATMs.

For your convenience, you can also transfer money from your eWallet to your account. A user of an eWallet can either move those funds to their bank account or pull it out in cash at an FNB ATM. These FNB eWallets are great for smaller transactions, with FNB allowing users to hold a maximum balance of R5 000.

The eWallet eXtra account has no monthly maintenance fee but does charge for specific transactions. The transaction fees are tied to the value of the transaction – with R1,000 dividing the two set values.

- For sending money, withdrawing money or depositing money under R1,000, the set fee is R10.95.

- For all transactions over R1,000, the fee is R13.95.

- Cash@Till withdrawals are free at participating Spar stores and other retailers.

- EFT payments are R3.75 per transaction.

- For prepaid airtime transactions under R10, the fee is R1.00 – and for over R10, the fee is R2.00.

- Prepaid electricity purchases are R2.50.

It depends on the channel you’re sending from with the maximum amount you can send to an eWallet changing as follows:

| Transaction type | Maximum transfer |

|---|---|

| Online Banking | R3 000 |

| Cellphone Banking | R1 500 |

| FNB Banking App | R3 000 |

| FNB ATM | R1 500 (subject to cash withdrawal limit) |

Why use an FNB eWallet?

eWallet is an instant, easy and affordable money transfer service that allows you to send money to anyone.

- Send money from your FNB account to any phone number

- Money is transferred securely and immediately

- The recipient receives an SMS after receiving money in the Wallet with a pin to access it

P2P exchanges

There are several P2P exchanges where you can exchange your FNB eWallet balance to buy bitcoins in South Africa. You can convert your ZAR into BTC in a fast, easy, and secure way by contacting vendors on platforms like:

- Paxful.com

- p2p.binance.com

- symlix.com

Simply filter by the payment method FNB eWallet to find vendors willing to accept a trade and contact them directly through your preferred platform.

Compare prices from different sellers.

Before you purchase bitcoin from one of these vendors, it’s best to check the order book on all platforms first to see which vendors are offering you the lowest markup. Usually, vendors with few sales/track records will offer you the lowest price so they can build up a record of users and establish trust signals on a specific platform.

The vendors with hundreds of transactions trend to command a higher price because their liquidity is in high demand, given that they have a good track record of honouring transactions. So while cheaper bitcoin is great, you also need to factor in the likelihood that a vendor isn’t in it for the long run, so be careful when using P2P exchanges.

Once you’re ready to make a trade:

Start trading.

- Choose the offer that works best for you and enter the quantity you want to buy, select an FNB eWallet method, and click on Buy BTC.

- Transfer the money directly to the seller based on the seller’s payment information provided within the payment time limit. You can use the chat box to communicate with the seller.

- Make sure that you send the money to the seller and tap on “Transfer” next.

Receive your Bitcoin.

- Tap on Confirm. Please do not click Confirm if you have not made any transactions. Doing this will violate the P2P User Transaction Policy.

- The status will change to “To be released.”

- Congratulations! You have completed a trade and got your bitcoin!

The data you’re doxing

The P2P markets available are not total bastions of privacy, and with any digital transaction, there will be data points that are captured.

- When you use a P2P marketplace, you must provide an email address and a phone number to sign up.

- You will communicate directly with the seller using the platform chatting service so that the platform will have logs of your trades.

- FNB will have records of your transfers, but they won’t know what you used them for; you could be paying a family member, buying boerewors or buying apolitical hard money; they won’t know the difference.

If you’re comfortable with this trade-off in securing bitcoin, then you’re going to find peer-to-peer markets quite the playground.

How can you make money on privacy arbitrage?

If you spend 20 minutes or more checking out the various sellers on peer-to-peer marketplaces, you’ll notice they can charge anything from 5% up to 25% higher than the going rate for bitcoin. Sellers of peer-to-peer bitcoin are covering fees on-chain and fees on the platform they use and also want to make a nice profit for their services as well as offset taxes.

Since there are so few sellers willing to exchange bitcoin for ZAR via FNB eWallets, you can come in service that demand.

The way you would do this is to have an account with a KYC exchange and purchase bitcoin at market rates, so you get the lowest price and then go ahead and resell that bitcoin on peer-to-peer exchanges at the higher price.

Remember, if you’re buying from a KYC exchange, there is a record of you purchasing that bitcoin, so if you don’t have it in your possession and made a sale, regardless of that being on another platform, you’ve created a taxable event tied to your name.

If you plan on playing the arbitrage game with large amounts, you may want to consider speaking to a tax professional first. Explain the nature of the business and the size of the spreads, then review the personal tax implications if you’re conducting operations with a personal bank account.

Flooding the P2P market

The more people supplying bitcoin liquidity on peer-to-peer markets, the more others can benefit from pulling bitcoin out of regulated entities and into a grey market for bitcoin. Grey markets allow people to conduct transactions without government oversight and, if done properly, can give you greater protections for financial privacy.

While owning bitcoin is a fantastic hedge against currency debasement in South Africa, having bitcoin the government and banks don’t know you own is an even better asset and even worth the additional premium you pay to acquire it.

Are you a bitcoin privacy advocate?

Are you using non-KYC bitcoin exchanges? Which app is your favourite? Do you have one you’d like us to cover? Let us know in the comments down below.