Two years have passed since Pick n Pay introduced Bitcoin as a payment option; even months after the announcement, it wasn’t uncommon to walk into a Pick n Pay and ask to pay in Bitcoin, and the cashier would look at you with glaring eyes.

You could choose to pay in fiat and move your arse along to try again another day or call the manager, who would reluctantly show the cashier where to find this new QR code.

If you insisted on paying in Bitcoin, you would end up being the “Bitcoin poephol” disrupting the queue.

The experience above isn’t the norm at every Pick ‘n Pay. Some were better prepared than others. I only want to prepare you for the reality on the ground so you don’t feel like you’re taking crazy pills when you get to the cash point.

The launch wasn’t all that smooth, as with most fintech innovations, disruption takes time to permeate the market. The amount of Bitcoin settled transactions per month across a national footprint of over 2000 stores; the retailer only managed to settle around R25,000 (US-$1,350) per month.

That trend has been broken as Pick n Pay has recently been making headlines for a surge in Bitcoin payments at its stores across South Africa.

The retailer is now reporting monthly sales of R1 million (US-$54,000) from customers who are purchasing groceries, data, airtime, and settling their municipal bills using this digital currency.

While the total amount is still a small fraction of its overall sales, it represents a significant 40-fold increase month over month, so what gives? Why are South Africans suddenly interested in spending their Bitcoin?

But what are the factors that might be driving this trend?

We started from a low base of around R25 000 per month, and it has grown exponentially every month over the past year”

Deven Moodley, executive head for Pick n Pay’s value-added services, financial services and mobile division

Tech-Savvy Shoppers Embrace Innovation

Of course, novelty is one driver. People want to see if this works.

Is this Bitcoin thing “real money”? If people call this a currency, what legitimises that claim more than walking into your local supermarket and using BTC to buy your groceries seamlessly?

Can you do that with your other assets? Bonds, stocks, EFTs?

Then, it’s not just some speculative asset; it could be a medium of exchange. Think about it.

Pick n Pay is the only major retailer in South Africa currently accepting Bitcoin. This position positions them as the only market maker providing liquidity between your Bitcoin and groceries. As more South Africans start to generate wealth in this alternative medium, they will look for easier avenues to leverage that wealth.

Pick ‘n Pay proves that if you eliminate the friction of first having to sell your Bitcoin, transfer the Rands to your bank account, pay extra fees and wait a few days to settle, people will opt for the shorter and cheaper route and spend their Bitcoin directly.

South Africa's 🇿🇦 largest grocery store and supermarket, Pick n Pay now accepts #bitcoin pic.twitter.com/ZI2iLXyjeE

— Documenting ₿itcoin 📄 (@DocumentingBTC) November 2, 2022

Safety in digital payments

In South Africa, cash is still king, especially in the informal markets, but in large retail chains, cash is dwindling as a percentage of trade settlements compared to debit and credit cards.

People are becoming familiar with digital payments and are all too aware of the hazard of holding piles of cash. If you’re walking around with cash, you’re asking to get “klapped over the kop” and robbed.

By offering Bitcoin payments, Pick n Pay allows customers who might not have a bank account or access to a credit or debit card to make digital payments. All you need is a basic smartphone, a Bitcoin wallet or local exchange app, and the QR scanner app, and you’re set.

Bitcoin’s ripping against the Rand

Over the last year, interest rates have been hiked to remain in line with international markets. The current REPO rate is around 8.25%, the highest it’s been in decades, and citizens are feeling the pinch as this translates to higher fees for credit card purchases and any other debt you may be servicing.

Money is tight along with access to credit.

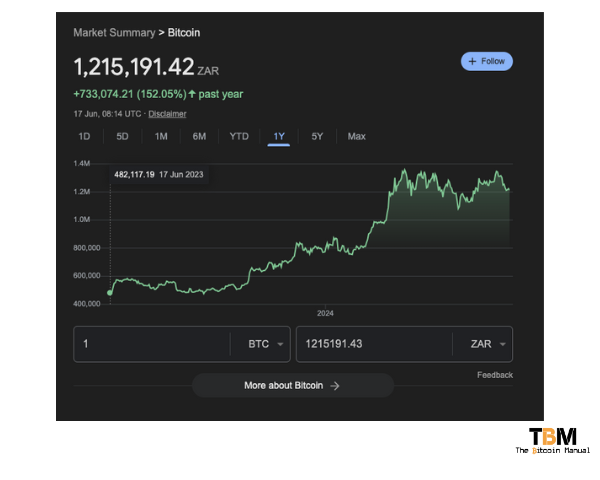

Yet over the same period, Bitcoin has been absolutely ripping in local currency terms, up %150+, chilling between R1.2 – R1.3 million in 2024.

If you’re sitting on some juicy gains versus your crappy Rand-based savings account, of course, you’re going to be tempted to tap into that Bitcoin wallet.

It’s your choice.

Do you want to eat Maggie’s 2-minute noodles, or do we braai tonight?

South Africans hou van lekker eet, and It looks to me like a lot more people are funding their braai day with Bitcoin.

The market for Bitcoiners (and shitcoiners) is growing

Ramaphosa’s Ranjties are just not getting you very far these days, and very few of us can afford to stick our Dollars under our couches in Phala Phala and hope for the best. Since Cyril took office, the Rands has lost about 30% of its purchasing power to the US Dollar.

So it’s been bleak not only for the local currency but also for investing in Rand-based assets.

People are looking around for places to find a better ROI, and Bitcoin’s track record has attracted more South Africans to hedge their bets outside of the Rand. According to reports, around 10% of the country or 6 million people, have some exposure to Bitcoin or a digital asset.

As this user base grows and if their balance sheets continue to increase, some of that capital will be deployed into the economy for consumption.

The learning curve and lowering barrier to entry

During the initial launch, the friction was quite high; customers would first need a Bitcoin Lightning Wallet (custodial or non-custodial), figure out how to fund that wallet, and have the companion CryptoQR app developed by Money Badger.

You would then scan the QR code at checkout, translating into a Lightning invoice that you could settle with the Bitcoin wallet on your phone.

Now, asking people to run their own Lightning node is already a non-starter, so most people would use a wallet like Wallet of Satoshi or Blink, send Bitcoin from a local exchange on-chain, fund the wallet and then use it to pay at Pick ‘n Pay.

This was way too laborious and only catered to a dedicated crowd of Bitcoin users.

That has since changed with local exchanges like VALR and Luno embedding the QR code reader into their mobile apps and settling the transactions on their backend.

Additionally, one of Africa’s largest offshore crypto exchanges, Binance, added Lightning Network support. At the same time, Strike launched in Africa, making it easier for users to move from fiat to Lightning rails.

Interestingly, the surge in Bitcoin payments is most prominent in the Western Cape, followed by Gauteng and KwaZulu-Natal. This might reflect a higher concentration of tech-savvy individuals in these areas.

Small transactions, big interest

According to Pick ‘n Pay’s reports, the majority of Bitcoin transactions at Pick n Pay are for R500 (US-$27) or less, suggesting customers are using Bitcoin for everyday purchases rather than large investments, like electronics. The retailer does allow for purchases of up to R10,000 (US-$550) in Bitcoin.

Additionally, South African Bitcoin owners also have to consider capital gains tax at the point of purchase; these smaller transactions fall under the tax threshold of R30 000 annually on capital gains.

So most spenders will be in the clear.

Still, if you exceed that spending threshold, I recommend checking with your accountant, especially if you’re spending directly from exchanges like Luno or VALR, as they’re already sending that data directly to SARS.