In the past few months, there has been much noise about the changes being made to the South African retirement system and what those changes mean for your retirement savings. The South African government continues to look for ways to juice the economy following the kneecapping it faced via lockdown measures, Eskom’s failures and the usual theft and corruption.

Many South Africans are playing it close to the chest. With no sign of lowering interest rates due to inflation or the government’s ability to lower taxes, there is little avenue for relief from traditional fiscal and monetary policy.

The flatlining economy and individuals need a little capital injection, and there is one place we can look toward, our retirement savings, which many have been diligently contributing to each month without much thought or review. For years, you’ve been setting aside a little nest egg, growing steadily through your monthly deposits and whatever is compounding your asset manager and squeezing out.

Across State and private pensions sit trillions of Rands, ready to be tapped into, and so we shall. The government has introduced a new two-pot retirement system in a bid to enhance retirement savings and provide more flexibility for individuals in South Africa.

President Cyril Rhamposa signed the latest bill into law.

This significant change aims to address some of the shortcomings of the previous system and empower individuals to better plan for their financial futures, or so it says based on the PR material posted on various local media publications.

Can we take a minute to bask in the absurdity of it all? I know boomers and Gen X will give you the whole Stockholm syndrome-induced speech about saving for retirement and how these vehicles are more “tax efficient” while completely ignoring the concept of opportunity cost or compounding rates of currency debasement.

You defer your spending, and the government gets to tell you how much of it you can access and when as if you’re some child who has no concept of responsibility. You were responsible enough to earn that capital and put it aside but not responsible enough to choose when to access it until you’re 55, 60 or 65; no, you need permissioned access to the fruits of your labour.

Make it make sense!

What is the Two-Pot Retirement System?

The two-pot retirement system essentially divides retirement savings into two distinct pots:

The savings component and the retirement component.

The amendment, which goes into effect on 01 September 2024, will allow private and public sector workers to access limited portions of their pensions without resigning.

Instead of having your contribution head off into one vested amount, it will now be split into one-third going into the savings pot and two-thirds going into the retirement pot. At any time prior to retirement, members will be entitled to access a withdrawal of up to 100% of the amount that has been accumulated in the savings component, subject to a minimum withdrawal of R2 000.

Reasons for the Two-Pot Retirement System

The introduction of the two-pot retirement system in South Africa offers several benefits for individuals:

Flexible access to capital

The savings portion allows individuals to access their retirement savings early once a year when needed, without sacrificing the tax benefits associated with retirement savings.

Many South African salaried workers have little disposable income after paying their bills. Now, they’re struggling with higher living or interest rates, trying to skimp on certain expenses despite having savings they can’t touch; it can be frustrating.

So what do people do? They find ways to access that capital, even if it costs them future cash flow and an additional tax burden.

The two-pot system aims to combat or reduce the incentive for individuals to resign from jobs so they can access their retirement savings early to cover a major shortfall or emergency.

Tax efficient savings

Contributions to retirement annuities are tax-deductible, helping individuals reduce their taxable income while simultaneously saving for retirement.

Now, you could do this with a tax-free savings account and still have access to the money, but the incentive here is that your retirement pot savings should net a higher return than your banks offer.

Emergency fund

Big Daddy government is encouraging you to save an emergency fund instead of relying on a new alphabet soup program to bail people out in times of distress. It will also allow fund members access to a portion of their savings during emergencies, such as those seen during the COVID-19 pandemic.

Some people like not thinking for themselves and prefer the government or company to deduct money from their paycheck and automatically deposit it into a savings scheme they can access later.

It’s like those jobs that ask you if you want your salary cut up into 12 payments or 13. Those who choose 13 tend to be the worst at saving and would rather be programmatically forced to save through the issuance of a 13th cheque.

Spend to appease the economic gods

To usher in the change, the new laws will allow South Africans to tap into R30 000 tax-free once September rolls around, which should act as a stimulus for the economy.

You can be damn sure if you’re telling South Africans they can pull a 30k mahala from their savings in the current climate, they’re not going to blink twice, now what they do with it, that’s another story.

Coronation predicts a R70 billion outflow from retirement savings in September, as everyone and their ouma collects their R30 000 stimulus.

The hope is that it will be spent on consumption, entertainment, travel, renovations, car and house deposits, and debt reduction. This new influx of cash will help consumers get out of the hole they find themselves in and generate economic activity, which in turn creates new employment.

Self-directed investment

If you are one of those brave souls who actually take the time to look at how your retirement savings are growing, you’ll likely see a trickling in of capital meant to compensate you for investing this money.

The problem here is South African markets. IE—The JSE hasn’t been kicking off returns that compete with international markets, and the government also limits money managers from offshore exposure, so your returns are capped below what someone sitting in an SPY index gets every year.

Never mind the outstanding returns from the only asset outpacing central bank balance sheets, aka Bitcoin. While everyone wants to maximise their returns, the goal is mainly to outpace currency debasement, which local fund managers struggle to achieve and need help to achieve.

If you’re unhappy with the returns you’re getting, why leave that one-third to underperform the market? You already have majority share exposure, so pulling some of that capital out and directing it to preferred assets might also become a trend.

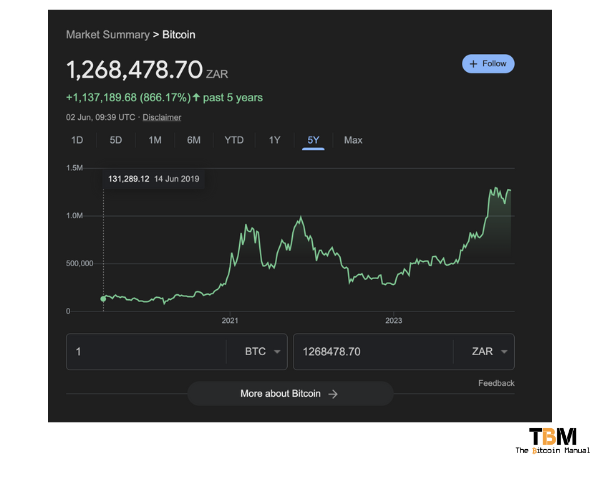

The obvious choice would be to migrate your capital from a poor-performing vehicle to an absolute rocket ship like Bitcoin, which has increased 800% in Rand terms over the last five years.

Your pot of gold under the rainbow nation

The introduction of the two-pot retirement system in South Africa is yet another ploy to bribe you with your own money. People are going to fall for it hook, line, and sinker, and it will solve very little in the lives of the average South African.

Fiat encourages high-time frame thinking, and accessing capital early to drive consumption today will likely be offset by increased consumer price inflation. If you’re seeing billions in outflow each year, and all that capital competes in the market for goods and services, you can be sure the cost of living is going to have to adjust with the additional currency units floating around.

While previously, the funds were used to bid up asset prices and drive asset price inflation, they will now move towards labour, driving up consumer prices and not solving the core issue, which is faster currency debasement, stagnant wages and high cost of living.

Saving is not a bad thing, despite its poor returns for South Africans; it is not a reflection of the habit but rather the money you’re choosing to save. If you’re saving in Rands, you’ll always fall behind over a long period, and you will have to face the reality that you need to save in another medium.

While you might get some relief with these cash payouts, they won’t solve your problem and act as a band-aid for those with access to these reserves.

Many will have to learn this lesson the hard way, regardless of those of us who are actively sounding the smoke alarm now.

Speaking of warnings, If you plan to make significant changes to your retirement savings strategy, conducting thorough research and seeking professional advice is essential. Remember, using a reputable broker, not just anyone off the street, is crucial. This approach will empower you to make informed decisions and protect your savings.