For over twelve years, FreeBitco.in stood as one of Bitcoin’s most enduring success stories—a simple faucet site that paid out free satoshis to millions of users worldwide, becoming synonymous with accessible Bitcoin adoption.

Faucets were an early feature of Bitcoin’s distribution model: sites would spin up and offer free Satoshis to attract traffic and users who were looking to earn Bitcoin.

It worked for a while, but eventually faucets dried up, leaving only a few, with FreeBitco.in among the largest active ones.

But in late 2025, what began as minor withdrawal delays has spiralled into what many users are calling one of crypto’s most brazen exit scams, with hundreds of Bitcoin in user funds frozen indefinitely and the platform’s operators largely silent.

The collapse of FreeBitco.in is a case of platform deterioration and failing to adapt to a changing landscape: regulatory pressure, aggressive monetisation through a proprietary token, mounting legal bills, and finally, a suspiciously timed “shutdown” that left users unable to access their funds.

So how did we get here? Let’s begin!

The Platform: What FreeBitco.in Was

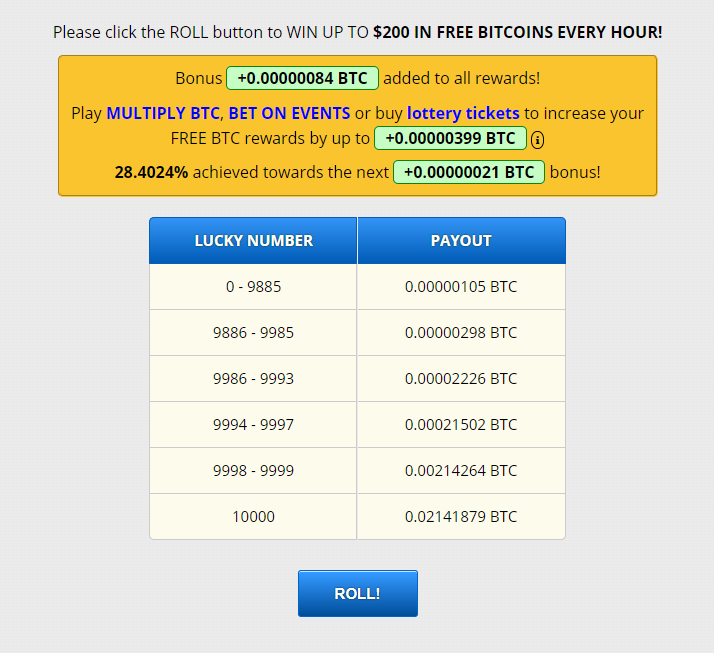

Launched in 2013 during Bitcoin’s early frontier era, FreeBitco.in built its reputation on a simple premise: claim free Bitcoin every hour by solving a captcha and playing a simple “roll” game.

Users received small amounts of satoshis based on their roll number, with higher rolls earning larger payouts. It was simple, it worked, and most importantly—it actually paid out.

Over the years, FreeBitco.in expanded beyond the basic faucet to include:

- Interest on Bitcoin holdings: Users could deposit Bitcoin and earn interest (up to 4% annually for large balances)

- Hi-Lo gambling games: A card game where users bet on whether the next card would be higher or lower

- Lotteries and jackpots: Weekly drawings with Bitcoin prizes

- Multiply BTC: A hi-lo betting game allowing users to multiply their satoshis

- Sports betting: Users could wager on the outcome of certain matches or sporting tournaments

- The FUN token: A proprietary cryptocurrency tied to platform benefits. (First major warning when entering the altcoin space)

By 2025, the platform claimed over 54 million registered users globally, making it one of the largest Bitcoin-focused gambling platforms in the world. But size, as FreeBitco.in would learn, doesn’t guarantee survival.

The Growing Achilles Heel: The Faucet

In its early days, the faucet was the key driver of attention, traffic, and users, and remained a generous offering in Satoshi, with hourly rolls available.

The hourly rolls remained, but as the price of Bitcoin increased, the number of Satoshis per roll had to be reduced until it reached a low of 1-2 Satoshis per roll.

The faucet was the onboarding tool and worked well for the site. Some users would fall off and give up on claiming, leaving funds behind, others would try to gamble the funds to try and speed up the process to reach a withdrawal limit, others would leave it to gain interest, and some faucet users would eventually turn into depositers.

The process worked well for a few years, but the internet has changed, with more bots running the show. Bots have always been an issue for these faucet sites, but with AI and cheap cloud storage available, spinning up an army of bots has never been cheaper.

And no, the little Google Recaptcha is not going to stop them.

Looking at Freebitco.in as a bot, it costs very little to spin up a new email address, create an account, and generate a referral link that you will use to build an army of referral sign-ups, all claiming every hour on the hour and sending you 50% commision up your spam tree of fake accounts.

GitHub – Cliam bot – https://github.com/vishakh567/fbtc-claimer

Bots aren’t like humans; they don’t give up on a task, they don’t get tempted by potential higher returns on another product, they are there to do one thing, and that is to drain the kitty.

This faucet model has clearly become unsustainable under these conditions and is the primary reason behind the shutdown, according to their official communications.

The Second Warning Signs: KYC and User Exodus (2023)

The first crack in FreeBitco.in’s facade appeared in 2023 when the platform abruptly implemented mandatory Know Your Customer (KYC) verification for withdrawals. This represented a dramatic departure from the platform’s decade-long tradition of allowing anonymous Bitcoin claims and withdrawals.

For many users, KYC requirements fundamentally violated the ethos that made FreeBitco.in attractive in the first place. Bitcoin faucets appealed to users precisely because they offered a no-strings-attached introduction to Bitcoin—no personal information, no documentation, just claim your satoshis and learn about Bitcoin.

The sudden KYC implementation had three immediate effects:

- User Abandonment: Long-time users who valued privacy abandoned the platform rather than submit identity documents to claim small Bitcoin amounts. The friction of KYC for micro-earnings made the economics nonsensical.

- Increased Regulatory Scrutiny: Rather than protecting FreeBitco.in from regulators, KYC implementation seemed to have the opposite effect—attracting more attention from gambling authorities who now had clearer evidence the platform operated as a gambling site rather than a promotional faucet.

- Trust Erosion: The reversal of a decade-long policy without warning signaled that FreeBitco.in’s promises were negotiable and subject to change without user consent. If “no KYC” could disappear overnight, what other assurances would prove illusory?

The FUN Token: Aggressive Monetisation and User Exploitation

Central to FreeBitco.in’s eventual cracks was its aggressive push of the FUN token—an altcoin that promised enhanced benefits, higher interest rates, and premium features to users who bought and locked tokens on the platform.

The FUN Token Pitch

FreeBitco.in marketed FUN tokens as the key to unlocking the platform’s full potential:

- Premium Accounts: Purchasing and locking FUN tokens upgraded users to “premium” status

- Higher Interest Rates: Premium users earned higher yields on Bitcoin deposits

- Increased Lottery Tickets: More entries in weekly drawings

- Better Bonuses: Enhanced rewards on the faucet and multiply games

- Exclusive Features: Access to special promotions and VIP support

The platform required users to lock FUN tokens for extended periods (often one year) to receive these benefits, creating illiquid positions that couldn’t be quickly exited if problems emerged.

The User Trap

What made the FUN token particularly concerning was its role as a value extraction mechanism.

Users report several disturbing patterns:

- Immediate Devaluation: Users who purchased FUN tokens report the value being “cut in half” immediately upon deposit, suggesting the platform manipulated internal pricing to disadvantage users.

- Locked Liquidity: The requirement to lock tokens for extended periods meant users couldn’t exit or even move funds as red flags multiplied.

The FUN token appears to have served as a last-ditch revenue stream as regulatory fines mounted, allowing FreeBitco.in to extract value from loyal users who believed their decade of consistent payouts meant the platform was trustworthy.

To add insult to injury, FUN token has also lost 90% of its value and trades at $0.001733 per token, so whatever Hail Mary this was is clearly dead and buried.

The Regulatory Hammer: Netherlands and Australia

While users grappled with KYC and FUN token problems, FreeBitco.in faced regulatory actions that would prove fatal to the platform’s viability.

The Dutch Gambling Authority (KSA) Offensive

The most severe blow came from the Netherlands’ gambling regulator, the Kansspelautoriteit (KSA), which launched an extensive investigation into FreeBitco.in starting in January 2023.

The Investigation: KSA conducted multiple inspections throughout 2023 and 2024 (in April, June, and November), finding on each occasion that Dutch players could easily access the site, create accounts, deposit funds, and gamble. One KSA inspector successfully registered as a player, deposited Bitcoin, and placed bets on football matches—demonstrating that FreeBitco.in had taken zero effective measures to block Dutch users.

The Penalty Order: On November 15, 2024, KSA imposed a penalty payment order requiring FBC B.V. (FreeBitco.in’s operator) to immediately cease all operations targeting Dutch users. The penalty structure was crushing:

- €280,000 per week for continued violations

- Maximum cumulative fine of €840,000 ($871,364)

- Deadline of December 13, 2024, to achieve full compliance

Additionally, some reports indicate KSA issued a separate €6.1 million fine to CB Investments B.V. (another entity associated with FreeBitco.in) for the cumulative period of illegal operations.

KSA’s Assessment: The regulator characterised FreeBitco.in’s violations as “very serious” breaches of Dutch gambling law, emphasising that the Netherlands maintains a regulated market specifically to protect players from unregulated operators.

The Australian Warning

As if Dutch troubles weren’t enough, the Australian Communications and Media Authority (ACMA) issued a formal warning to FBC B.V. in December 2024 for illegally providing unlicensed gambling services to Australian customers through FreeBitco.in.

While Australia’s action didn’t carry the same immediate financial penalties as the Dutch enforcement, it represented another jurisdiction closing the door on FreeBitco.in’s operations and further fragmenting the platform’s accessible markets.

The Financial Hit

The timing of these regulatory actions is critical to understanding FreeBitco.in’s collapse.

The platform faced:

- €840,000 Dutch fines and penalties

- Complete loss of the Dutch market (and potentially others in the EU)

- Ongoing legal fees fighting multiple jurisdictions

- Reputational damage making banking relationships difficult

- Users withdrawing funds en masse as news spread

These pressures created a classic liquidity crisis: mounting obligations, contracting revenue, and accelerating withdrawals—the perfect storm for platform failure.

The Withdrawal Crisis: August 2025 Onwards

By mid-2025, user complaints about withdrawal delays began multiplying across Trustpilot, Reddit, and BitcoinTalk forums. What started as isolated incidents quickly revealed a systematic failure.

The Pattern of Frozen Funds

Users report a remarkably consistent experience:

- August-September 2025: Withdrawal requests submitted with “instant” or “slow” options sit in “pending” status indefinitely. No transaction IDs provided. Support tickets are unanswered.

- October 2025: The domain expires on October 10, 2025, briefly knocking the site offline. While quickly renewed, users face continued difficulty accessing accounts and processing withdrawals. The site comes back up, but withdrawals remain frozen.

- November 2025: Withdrawals submitted months earlier remain pending. Users report reward points being cut in half without explanation. Support representatives TheQuin and CSFBC, previously active on BitcoinTalk, go completely silent.

- December 2025: The platform posts a shutdown announcement indicating withdrawals will be “re-enabled by early 2026” while the platform manually reviews “tens of millions” of accounts to separate “genuine users” from “abusers.”

The “Shutdown” Announcement: Freeze Disguised as Closure

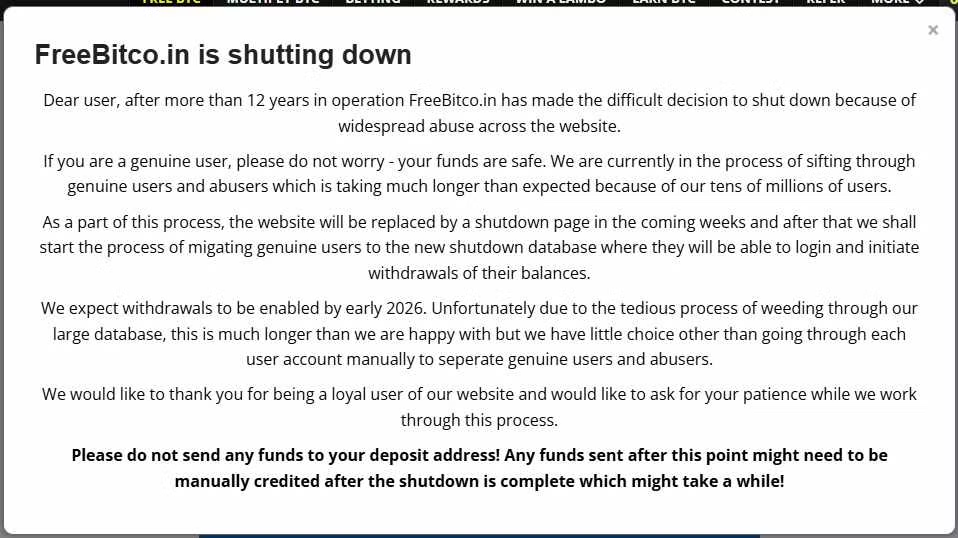

In December 2025, FreeBitco.in posted an announcement that many users interpret as confirmation of an exit scam disguised as an orderly shutdown.

The Official Statement

The announcement claims FreeBitco.in “is shutting down” after more than 12 years, citing “widespread abuse across the platform” requiring “manual review of tens of millions of accounts” to identify “genuine users” versus “abusers.”

Key claims in the statement:

- Withdrawals are “temporarily disabled” while the review occurs

- Withdrawals will be “re-enabled by early 2026”

- “Genuine users” will be migrated to a “shutdown database”

- The review process is necessary to prevent abusers from withdrawing funds

- Users should be patient and trust the process

The Red Flags

Nearly every aspect of this announcement raises alarm bells:

- Timing Coincides with Regulatory Pressure: The shutdown announcement comes immediately after FreeBitco.in failed to comply with Dutch regulatory deadlines and faced escalating fines.

- Vague Justifications: The “widespread abuse” claim provides no specifics. What abuse? How widespread? Why now after 12 years? The vagueness suggests a pretext rather than a genuine operational concern.

- Indefinite Timeline: “Early 2026” is deliberately vague. Does this mean January? March? When in early 2026? The ambiguity allows unlimited delays without technically breaking promises.

- Backward Security Logic: Legitimate platforms freeze suspected abuser accounts while allowing honest users to withdraw. FreeBitco.in inverted this—freezing everyone while promising to eventually identify the good guys. This makes no operational sense for genuine fraud prevention.

- No Independent Verification: There’s no way to verify that any “review” is actually occurring or that a “shutdown database” exists. Users are asked to trust blindly while their funds remain inaccessible.

- Continued Operations: Despite claims of shutting down, FreeBitco.in continues actively promoting lotteries, jackpots, and other gambling features on social media. The site remains functional for new deposits, but not withdrawals.

The Freeze, Not Closure

As one analysis notes:

“The keyword here is not ‘shutdown’.

It is ‘freeze’.”

The announcement doesn’t close accounts or process final withdrawals—it indefinitely suspends access to funds while making vague promises about future restoration.

This is the hallmark of an exit scam: maintain enough ambiguity that users don’t immediately panic and take legal action, while buying time to move assets, restructure entities, or simply disappear.

The Exit Scam Allegations: Weighing the Evidence

Is FreeBitco.in’s collapse a legitimate business failure under regulatory pressure, or a deliberate exit scam? The evidence points disturbingly toward the latter.

Suspicions Supporting Exit Scam Theory

- Selective Payment Pattern: FreeBitco.in allowed small withdrawals to process (building trust) while freezing larger amounts—exactly the pattern seen in previous crypto Ponzi schemes that used new deposits to pay early withdrawals until the model collapsed.

- Fake Transaction Hashes: Providing users with invalid blockchain transaction hashes that don’t exist is not an error—it’s fraud. Legitimate platforms experiencing technical issues don’t fabricate transaction data.

- Disappeared Support: Active representatives suddenly going silent across all channels while the site continues operating suggests intentional abandonment rather than operational difficulties.

- FUN Token Manipulation: The pattern of immediate devaluation, disappearing deposits, and fake withdrawal confirmations indicates deliberate theft rather than technical problems.

- Regulatory Timing: The withdrawal freeze began before Dutch penalties were imposed, suggesting FreeBitco.in anticipated the financial hit and decided to exit rather than pay.

- Continued Deposits Accepted: Exit scams commonly keep deposit functionality active to extract maximum value before final collapse. FreeBitco.in continues accepting deposits while blocking withdrawals.

- No Legal Compliance: If FreeBitco.in intended to eventually pay users, it would provide regular public updates with timelines, potentially engage an independent auditor to verify reserves, or establish escrow arrangements. None of this has occurred.

Bitcoin talk discussion: freebitco.in not sending withdrawals

Alternative Explanations

To be fair, alternative explanations exist:

- Liquidity Crisis: Regulatory fines and bot farming may have genuinely depleted capital, leaving FreeBitco.in unable to meet withdrawal demands. The “shutdown” could be a last-ditch attempt to achieve an orderly wind-down once capital is recovered.

- Technical Incompetence: Perhaps FreeBitco.in’s team genuinely can’t handle the volume of fraud on the platform and lacks the technical sophistication to separate legitimate users from abusers efficiently.

- Acquisition Negotiations: The platform might be negotiating a sale or restructuring, requiring temporary withdrawal freezes until deals close. The domain clearly has some value, so selling it to an exchange or Betting company could be one way to replenish the coffers, make players whole, and walk away with some profit.

The Verdict

While alternative explanations are technically possible, they don’t explain the disappeared support, selective scamming of larger withdrawals, and FUN token manipulation. These factors indicate intentional fraud rather than operational difficulties.

The most charitable interpretation is that FreeBitco.in operated legitimately for years, faced crushing regulatory pressure, realised it couldn’t survive, and chose to extract maximum value from remaining users rather than wind down honourably.

The least charitable—and more likely—interpretation is that FreeBitco.in saw regulatory walls closing in and executed a planned exit scam, using the “shutdown” as cover for theft.

The Broader Lessons: What FreeBitco.in Teaches About Crypto Custody

FreeBitco.in’s collapse reinforces classic Bitcoin Maxi truths about Bitcoin risk that bear repeating:

Not Your Keys, Not Your Coins

FreeBitco.in users learned this lesson painfully. By holding Bitcoin on the platform to earn interest or play games, they surrendered actual ownership for convenient access. When FreeBitco.in froze withdrawals, users discovered their “Bitcoin” was merely a database entry the platform could modify or erase at will.

True Bitcoin ownership means controlling private keys. Everything else—exchange balances, platform credits, wrapped tokens—is someone else’s IOU that can be revoked unilaterally.

Interest and Yield Come With Counterparty Risk

FreeBitco.in’s offer of 4% interest on Bitcoin deposits should have raised immediate red flags.

- Where did this yield come from?

- How was it generated?

- What risks were being taken with user deposits?

As is the case with most Bitcoin yield products, what starts yielding eventually tops yielding.

The truth: there’s no free lunch.

Risk-free Bitcoin yield doesn’t exist.

Platforms offering outsized returns are either offering teaser rates they cannot sustain, taking significant risks with user funds, or running Ponzi-like schemes in which new deposits pay early withdrawals.

Long Track Records Don’t Guarantee Future Performance

FreeBitco.in operated for 12 years, paying out consistently and building trust. This historical performance made the eventual collapse more devastating—users who had successfully withdrawn for years assumed the platform was permanently trustworthy.

But in crypto, past performance genuinely doesn’t predict future results.

Platforms can operate honestly for years, can legitimately fail or enter exit scam mode overnight when circumstances change.

Vigilance can never be relaxed.

What Happens Next?

As of December 2025, FreeBitco.in remains in limbo—the site is still live, but withdrawals are frozen, until “early 2026” when restoration promises are meant to be honoured.

Best Case Scenario

In the most optimistic outcome, FreeBitco.in actually conducts its promised review, identifies genuine users, and eventually processes withdrawals with or without significant haircuts. Users get all or some portion of funds back, the platform winds down, and operators face accountability.

Probability: Low. The pattern of behaviour doesn’t support this outcome.

This is not their first shutdown.

Mind you.

In August of 2019, their sister site Freedogeco.in was shut down for similar issues of faucet abuse; however, that shutdown went a lot smoother. Users could withdraw Dogecoin balances of 100 or more without issue, and smaller amounts could be converted to credit on a FreeBitco.in account.

Second Probablity

FreeBitco.in continues stringing users along with vague promises and delayed timelines through early 2026. “Early 2026” becomes “mid-2026” becomes “under review” until the site eventually goes dark entirely.

Users lose everything, operators disappear into jurisdictions without extradition treaties, and authorities prove unable or unwilling to pursue prosecution.

This is the standard exit scam playbook—delay, deflect, disappear.

What Users Should Do?

If you have funds trapped on FreeBitco.in:

- Stop Depositing Immediately: Do not send any additional Bitcoin or FUN tokens to the platform under any circumstances.

- Document Everything: Screenshot account balances, withdrawal requests, support ticket conversations, email confirmations, and transaction hashes. These may be useful for law enforcement or civil litigation.

- Monitor Community Forums: BitcoinTalk, Reddit’s r/pennypay, and Trustpilot host ongoing discussions where users share information and coordinate responses.

- Manage Expectations: Realistically, recovery is unlikely. Focus on documenting losses for potential tax write-offs rather than expecting funds to be returned.

- Learn the Lesson: Use this experience to inform future decisions about custody, yield products, and platform selection.

Regardless, it’s Still The End of an Era

FreeBitco.in’s collapse marks the end of crypto’s Wild West era, where platforms could operate globally without licenses, avoid KYC indefinitely, and face minimal regulatory oversight. The platform’s 12-year run bridged Bitcoin’s early frontier days and today’s increasingly regulated landscape—a transition it ultimately couldn’t survive.

Whether FreeBitco.in represents a genuine business failure under regulatory pressure or a deliberate exit scam theft, the result is the same: millions of users introduced to Bitcoin through the platform learned a painful lesson about the difference between holding Bitcoin and holding claims on Bitcoin.

The platform that helped onboard a generation of Bitcoiners with its hourly faucet will be remembered not for its years of consistent payouts but for its spectacular collapse and the hundreds of thousands of dollars in frozen user funds that may never be recovered.

For the crypto community, FreeBitco.in serves as yet another cautionary tale—proof that no platform is too established, too trusted, or too long-running to fail catastrophically. In Bitcoin, the only true security is self-custody.

Everything else is just someone else’s promise, subject to revocation whenever convenient.

Did You Get Caught Slacking?

Do you have sats stuck in freebitco.in? How much exposure do you have? Was it deposited funds or the house money you earned? What do you think of the end of another piece of Bitcoin history?

Let us know in the comments below.