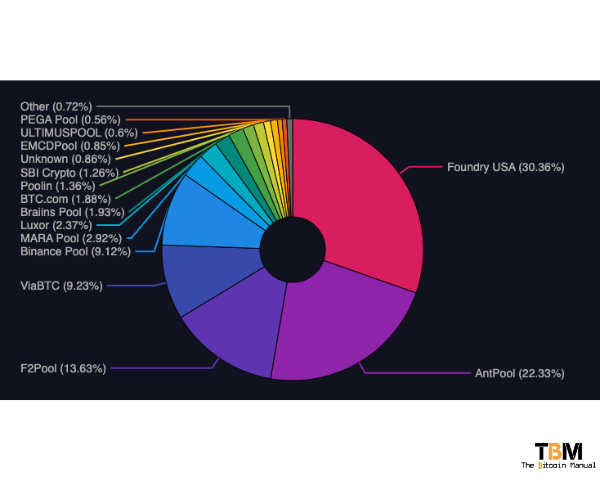

Bitcoin, the world’s first and most prominent decentralised network, has revolutionised the financial landscape by introducing an open network that anyone can join or participate in and the launch of a truly native digital currency. Despite the decentralised nature of the Bitcoin network through its many nodes and distributed Bitcoin mining structure, mining pools have emerged as a centralising force, raising concerns about the network’s long-term viability.

The Current Mining Pool Structure

Bitcoin’s mining process involves solving complex mathematical problems to verify transactions and add new blocks to the blockchain. This process is computationally intensive and requires specialised hardware known as ASICs to run the computation at a competitive level.

Even with this improvement in computation, it is still difficult for the average ASIC miner to compete for regular payout from Bitcoin blocks. As a result, miners often pool their resources together, forming mining pools.

While mining pools have increased mining efficiency, they have also introduced centralisation risks. Large mining pools can accumulate significant hashing power, giving them undue influence over the network. This concentration of power can lead to censorship, manipulation, and potential security vulnerabilities.

F2Pool Drama illustrates the need for Stratum v2

A recent reminder of how influential mining pools have become reared its ugly head this week when news broke calling out F2Pool for failing to process transactions from specific addresses and actively filtering them out.

According to pseudonymous Bitcoin developer 0xB10C of the project called “mining pool-observer”, – F2Pool, one of the largest Bitcoin mining pools, became the first to filter transactions based on the OFAC sanctions.

My miningpool-observer project recently reported six OFAC-sanctioned transactions as missing from blocks.

— 0xB10C (@0xB10C) November 21, 2023

Four of these transactions were likely filtered by F2Pool. This is the first filtering based on OFAC sanctions I've seen.

More in: https://t.co/OYouVwM2rv

F2Pools actions have raised concerns about the potential for mining pools to exert undue control over the Bitcoin network and undermine its core principles of decentralisation and censorship resistance.

F2Pool co-founder Chun Wang did state in a now-deleted tweet that the Bitcoin mining pool would deactivate the “transaction filtering patch”, but the damage to their reputation is done, and it has fostered some interesting conversions about how to keep mining pools, especially the ones with larger market share in check and in line with miner, network and user incentives.

Undermines Decentralisation

Bitcoin’s decentralised nature is a key selling point and a critical component of its security. By selectively censoring transactions, F2Pool is essentially acting as a gatekeeper, deciding which transactions are valid and which are not.

While F2Pool might ignore these transactions, this doesn’t mean the transaction won’t be processed since another mining pool would take up the transaction to earn those fees. This centralised control goes against the very ethos of Bitcoin and could lead to a more controlled and manipulated network.

Erodes Censorship Resistance

Censorship resistance is a fundamental principle of Bitcoin, ensuring that no single entity can control or block transactions. F2Pool’s actions directly contradict this principle, raising concerns about the potential for other mining pools to follow suit and further centralise the network.

Sets a Dangerous Precedent

If F2Pool’s actions are allowed to go unchecked, it could set a dangerous precedent for other mining pools to follow suit, potentially leading to a de facto censorship regime on the Bitcoin network. This would significantly undermine Bitcoin’s core principles and make it susceptible to manipulation by governments or other powerful entities.

Undermines User Trust

Bitcoin users rely on the network’s decentralisation and censorship resistance to ensure their transactions are processed fairly and without interference. F2Pool’s actions erode this trust and could make users hesitant to use Bitcoin if they fear their transactions could be censored.

Overall, F2Pool’s decision to censor transactions is a concerning development that threatens the core principles of Bitcoin. It is crucial for the Bitcoin community to address this issue and ensure that mining pools do not undermine the decentralised and censorship-resistant nature of the network.

Stratum V2 is here

Bitcoin mining company DEMAND announced this week the launch of the world’s first Stratum V2 mining pool, built using the open-source Stratum Reference Implementation (SRI).

DEMAND’s mining pool claims to focus entirely on solo miners, allowing them to find blocks independently and receive the full mining reward. DEMAND also enables hash power resale through a marketplace, so users can maximise profits by mining themselves or reselling hash power.

The launch of DEMAND’s Stratum V2 mining pool comes at an opportune time for the Bitcoin mining industry, with claims of centralisation creeping in that can be squashed should V2 take off and other pools adopt it.

But first, we need to see how V2 performs in the wild; with the world watching and billions needing to be secured, this will be an interesting test bed for another piece of open-source software that has been long in the works.

With Stratum V2 and our new solo mining pool, we aim to make home mining more attractive, which should in effect help decentralise the Bitcoin mining ecosystem and improve the health of the Bitcoin network overall

Alejandro de la Torre, DEMAND’s co-founder and CEO

Stratum v2: A Step Towards Decentralisation

Stratum v2 is a new mining protocol that aims to address the centralisation concerns associated with Bitcoin’s current mining pool structure. It introduces several improvements that can promote decentralisation and enhance network security, such as:

Reduced Communication Overhead

Stratum v2 reduces the communication overhead between mining pools and miners, allowing for more efficient and scalable mining operations. This efficiency improvement can encourage more miners to participate in the network, reducing the reliance on large mining pools.

Decentralised Block Template Distribution

Stratum v2 introduces a decentralised block template distribution mechanism, which eliminates the need for miners to rely on a single pool for block templates. This decentralisation reduces the risk of censorship and manipulation by preventing any single entity from controlling block creation.

Improved Security

Stratum v2 incorporates various security enhancements, such as support for stronger authentication methods and improved error handling. These enhancements can help protect the network from potential attacks and maintain its integrity.

The Bitcoin network has to evolve

Bitcoin’s decentralised nature is one of its core strengths; it brings confidence to the network and, with that, liquidity and resources. The launch of Stratum v2 represents a significant step towards preserving and enhancing this decentralisation and squashing critiques of the current mining landscape.

By reducing the centralising influence of mining pools and promoting more efficient and secure mining operations, Stratum v2 can help safeguard Bitcoin’s long-term viability and ensure its continued success as a truly decentralised network.

Do your own research.

If you want to learn more about Stratum V2 on Bitcoin, use this article as a jumping-off point and don’t trust what we say as the final say. Take the time to research and check out the resources below.

Are you investing in the Bitcoin ecosystem?

Do you invest in bitcoin mining? Are you considering bitcoin mining? Have you been mining for some time? What breakdowns have you had, and how did you deal with them?

Let us know in the comments below.