The decentralised finance (DeFi) space has primarily remained in the hands of altcoin chains, promoters claim to have brought innovative financial instruments to the broader public within a KYC fee environment.

While the barrier to entry is low, these trading platforms have yet to demonstrate a compelling use case beyond swapping between stablecoins, unregistered securities, and meme coins.

Trading tokens is the primary product, but the gold rush is tapping into the fees earned from trading. The idea is basically taking what centralised exchanges do, moving it on-chain and distributing the fees to users who participate in a specific network, platform or smart contract.

The term yield farming encapsulates the premise of DeFi; traders who participate in this space aim to generate cash flow from their tokens in some form.

Fees can be generated through mechanisms like:

- Earning fees through lending contracts

- Earning fees via staking protocols

- Earning swap fees via Liquidity pools

Liquidity pools represent one of the ideas that have gained traction, as they can be applied to a wide range of trading pairs.

Every on-chain market requires an order book of traders buying and selling, as well as a pool of capital ready to handle instant swaps for less patient traders.

DeFi activity has historically occurred on Ethereum and other major smart contract blockchains. Rootstock (RSK), a Bitcoin EVM-compatible sidechain, has sought to bring DeFi capabilities closer to the Bitcoin ecosystem.

What Are DeFi Liquidity Pools?

DeFi liquidity pools are smart contracts that hold pairs of tokens and enable on-chain trading through automated market makers (AMMs). Instead of relying on traditional order books with buyers and sellers, liquidity pools use mathematical formulas to determine prices and execute trades automatically.

Think of a liquidity pool as a digital vault containing two different cryptocurrencies in predetermined ratios. When traders want to swap one token for another, they interact with these pools rather than finding individual counterparties.

The pool’s algorithm automatically calculates the exchange rate based on the ratio of tokens in the pool and the size of the trade.

As a liquidity provider, you can choose to provide capital on a double-sided (more common) and single-sided (less common) basis.

- Double-sided means you provide both the tokens that make up a liquidity pool at the same ratio, ensuring that no single token is overrepresented and makes up too much of the pool.

- Single-sided means you only provide one token of the pair, whichever you prefer. However, this is a less common option, so you may not find it available everywhere and for every token. These markets carry more risk and are usually used to attract capital to a lopsided market, via a massive teaser APR.

Understanding Rootstock (RSK)

RSK is a Bitcoin sidechain that brings Ethereum-compatible smart contract functionality with Bitcoin as the base asset. This means developers can deploy the same smart contracts they would use on Ethereum, but with the security backing of Bitcoin’s proof-of-work via RSK’s merged mined sidechain.

Rootstock uses a pow-peg system with Bitcoin, allowing users to convert Bitcoin (BTC) to Smart Bitcoin (RBTC) and back again. This creates a bridge between Bitcoin and RSK’s DeFi’s programmable money smart contracts.

How Liquidity Pools Work on Rootstock

Liquidity pools on Rootstock operate using the same fundamental principles as those on other EVM-compatible chains, but with some unique characteristics:

The AMM Mechanism

Most RSK liquidity pools use a constant product formula (x × y = k), where x and y represent the quantities of two different tokens, and k remains constant. When someone makes a trade, the product of the two token quantities must remain the same, which automatically adjusts prices based on supply and demand.

For example, if you have a liquidity pool with 100 RBTC and 200,000 DOC (Dollar on Chain, RSK’s stablecoin), and someone wants to buy 1 RBTC, they would need to add enough DOC to maintain the constant product relationship. This mechanism ensures that prices adjust organically based on trading activity.

Liquidity Provision Process

To become a liquidity provider (LP) on Rootstock, users must:

- Connect a compatible wallet (such as MetaMask configured for RSK)

- Deposit equal values of both tokens in a trading pair

- Receive LP tokens representing their share of the pool

- Earn fees from trades that occur in their pool

The LP tokens serve as receipts that can be redeemed later for the underlying assets plus any accumulated fees.

Smart Contract Execution

RSK’s EVM compatibility means that liquidity pool smart contracts function identically to those on Ethereum, with the added benefit of Bitcoin’s security model. The network processes transactions with faster block times than Bitcoin (approximately 30 seconds) while maintaining cryptographic security through merge-mining with Bitcoin.

Why Traders Use RSK Liquidity Pools

Several compelling reasons drive traders and liquidity providers to RSK’s DeFi ecosystem:

Lower Transaction Costs

Compared to the Ethereum mainnet, RSK typically offers significantly lower gas fees for smart contract interactions. This cost advantage makes smaller trades and frequent liquidity provision adjustments more economically viable.

Arbitrage Opportunities

Price discrepancies between RSK DEXs and other chains create arbitrage opportunities for sophisticated traders. The relatively smaller liquidity on RSK can sometimes lead to more significant price movements, creating profit potential for those who provide liquidity or trade strategically.

Yield Generation

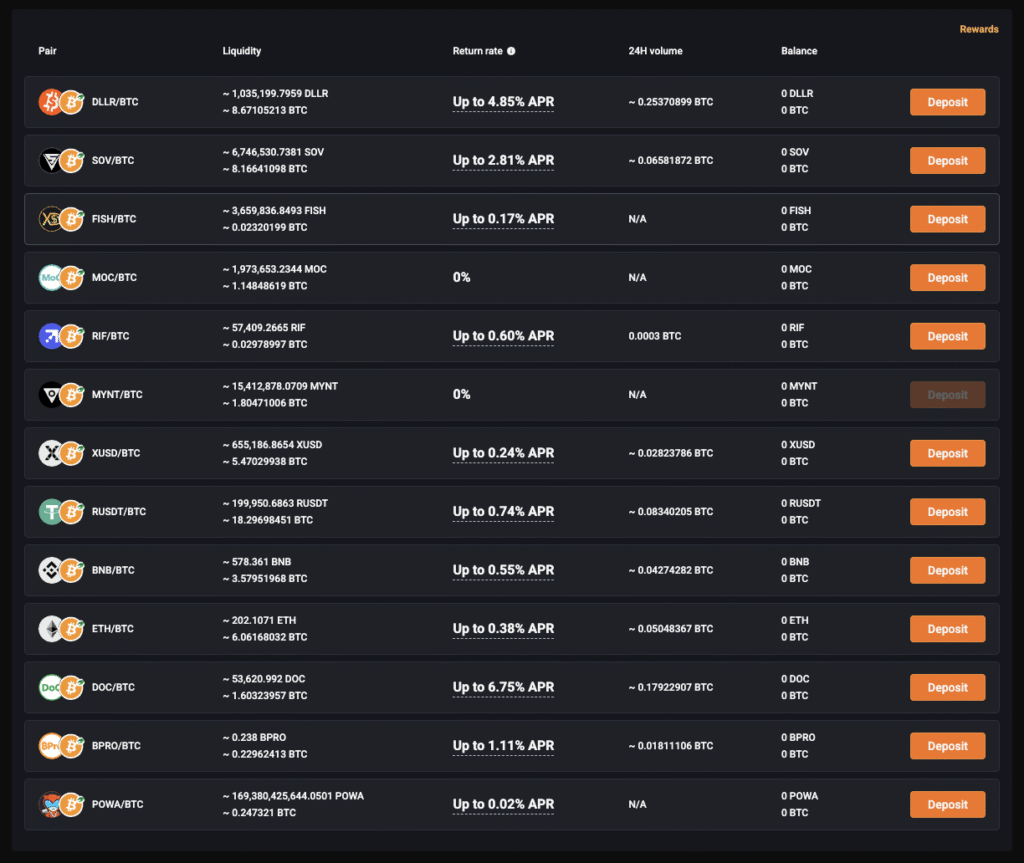

Liquidity providers earn trading fees from every transaction in their pool, typically ranging from 0.25% to 0.30% per trade. In addition, many RSK DeFi protocols offer additional yield farming rewards through governance tokens or other incentive programs; however, these tokens have not performed well against Bitcoin either.

Pools’ APY can change based on demand, but usually decay over time. Take the DLLR/BTC pool, which launched at a 140% APY, but in 2023, it now hovers around a 4% APY.

In the 24 hours since Sovryn Dollar ($DLLR) launched:

— Yago (@EdanYago) March 17, 2023

🔅The DLLR/BTC trading pool has reached $3m in liquidity and currently providing ~140% APY

🔅Protocol revenue has increased by about 3X

🔅Total Zero borrowing has surpassed $10m pic.twitter.com/O4OzFYRats

Limitations of RSK Liquidity Pools vs. Other EVM Chains

While RSK offers unique advantages, it also faces several limitations compared to more established EVM chains:

Limited Ecosystem and TVL

Rootstock’s DeFi ecosystem is significantly smaller than Ethereum, Polygon, or BSC. With a total value locked (TVL) of approximately $77 million (representing 50% of Bitcoin’s entire DeFi TVL), RSK has limited liquidity depth compared to major DeFi platforms. This can result in higher slippage for larger trades and fewer available trading pairs.

Fewer DeFi Protocols

The number of mature DeFi applications on RSK is limited compared to Ethereum’s extensive ecosystem. While platforms like Sovryn provide core DeFi functionality, users have fewer options for advanced strategies like complex yield farming, options trading, or exotic derivatives.

Developer and User Adoption

RSK has a smaller developer community and user base, which can lead to slower innovation cycles and fewer protocol integrations. Network effects are crucial in DeFi, and RSK is still building the critical mass needed to compete with established platforms.

Bridge Dependencies

While RSK’s Bitcoin peg is a strength, it also creates dependencies on bridge security and Bitcoin network confirmation times. Users must wait for multiple Bitcoin confirmations when moving funds in and out of the RSK ecosystem, which can be slower than native transactions on other chains.

The Risks: Impermanent Loss and Beyond

Participating in RSK liquidity pools involves several risks that traders must carefully consider:

Impermanent Loss: The Primary Risk

Impermanent loss or divergence loss is the most significant risk facing liquidity providers. This occurs when the relative prices of tokens in a pool change compared to when they were initially deposited.

The term “impermanent” reflects the fact that losses only become permanent when liquidity providers withdraw their funds.

How Impermanent Loss Works:

Consider a liquidity provider who deposits equal values of RBTC and DOC into a pool when RBTC trades at $50,000.

If RBTC’s price rises to $60,000 while DOC remains stable, the AMM algorithm automatically rebalances the pool by reducing the RBTC amount and increasing the DOC amount to maintain the constant product relationship.

When the liquidity provider withdraws their funds, they’ll receive fewer RBTC tokens than initially deposited but more DOC tokens. The dollar value might be higher due to trading fees, but they would have been better off simply holding the original tokens outside the pool. This difference represents the impermanent loss.

Quantifying Impermanent Loss:

- If one token doubles in price while the other remains stable, impermanent loss is approximately 5.7%

- If one token increases 4x while the other stays constant, impermanent loss reaches about 20%

- The more volatile the price ratio between tokens, the greater the potential impermanent loss

Smart Contract Risks

RSK liquidity pools rely on smart contract code, which can contain bugs or vulnerabilities. While RSK benefits from Ethereum’s smart contract frameworks, any code defects could lead to the loss of funds. Users should only interact with audited protocols and understand that smart contract risk is always present.

Liquidity Risk

RSK’s smaller liquidity pools can experience more dramatic price impacts from large trades. This can create situations where withdrawing liquidity during volatile periods results in unfavourable prices or high slippage.

Bridge and Peg Risks

Since RSK relies on a two-way peg with Bitcoin, there are risks associated with the bridge mechanism. While RSK uses a robust federation system, any issues with the peg could affect RBTC’s value relative to Bitcoin.

Risk Management Strategies

Successful liquidity provision on RSK requires thoughtful risk management:

- Pair Selection: Choose trading pairs with similar volatility profiles to minimise impermanent loss. Stablecoin pairs (like DOC/USDT) typically experience less impermanent loss but may offer lower yields.

- Time Horizon: Impermanent loss can reverse if token prices return to their original ratios. Longer holding periods give more opportunity for price mean reversion and fee accumulation to offset temporary losses.

- Fee Analysis: Calculate whether expected trading fees will compensate for potential impermanent loss. High-volume pairs may generate sufficient fees to make liquidity provision profitable despite price volatility.

- Diversification: Don’t concentrate all liquidity in a single pool. Spread risk across multiple pairs and consider keeping some assets outside of DeFi protocols entirely.

- Monitoring and Exit Strategies: Regularly monitor pool performance and have clear criteria for when to withdraw liquidity. Set stop-loss levels and rebalancing triggers based on your risk tolerance.

The Expansion of RSK Liquidity Pools

Rootstock’s roadmap includes several developments that could enhance its DeFi ecosystem. Plans for Bitcoin-native asset bridges, scaling improvements, and expanded smart contract capabilities through BitVM could attract more liquidity and users to the platform.

The integration of RSK with cross-chain protocols like Symbiosis is also expanding access to Bitcoin liquidity across the broader DeFi ecosystem, potentially increasing trading volume and opportunities for liquidity providers.

Cash Flow Versus CAGR

DeFi liquidity pools on Rootstock offer cash flow opportunities, but success requires understanding the significant risks involved, particularly impermanent loss, as well as the current limitations of RSK’s smaller ecosystem.

Traders should remember that they are also up against MEV bots and approach RSK liquidity provision with appropriate risk management strategies and realistic expectations about returns and liquidity.

Given the returns available and the possibility of imminent loss on your Bitcoin, these pools will not appeal to any hodler. As a Liquidity provider, you’re hoping that prices trade sideways as long as possible so you can earn fees, while prices don’t diverge and rebalance the pool in a way that reduces your RBTC amount.

Sure, this optimum environment can occur in a crab market. Still, you’ll also have to deal with a lower volume of traders compared to the trading fees generated from activity when there is a lot of volatility.

Finally, depending on the size of your position, you’re also losing potential returns by keeping a portion of your funds in a stablecoin. Let’s say you pool 1 RBTC and $110,000 (USDT/DOC/DLLR); half of your exposure is in a dollar-pegged asset.

You’ll have to compare the fees you generate versus the gains you would have netted by keeping that entire investment in Bitcoin, and this is a very high hurdle rate to beat.

The chances of underperforming the hodl in cold storage are pretty high, but that has never stopped a cash flow addict from trying their luck, so if you think you know better, by all means have a crack.

However, risking all that downside for a possible % 4% APY – all the on-chain fees swapping back to Bitcoin in the end makes no sense.