Taking complete ownership of your funds is one of Bitcoin’s killer apps, given the fact that all you need is 12 to 24 words, and you have an entire banking infrastructure set up for you. Self-custody of Bitcoin is crucial for users as it gives them complete control over their private keys, ownership over their funds, privacy over their transactions, censorship resistance, and empowerment to take responsibility for their own financial well-being.

The problem with self-custody today is that it requires some technical confidence to safeguard your funds and spend them correctly; the learning curve is still rather steep when compared to traditional finance, where a third party, like a bank, handles all your queries.

When you manage Bitcoin in self-custody, you become the bank and take on all the responsibilities that come with it. Responsibilities that many people are not ready for, which is evident through the number of people using exchanges or custodial wallets as their method of holding Bitcoin.

FediMint aims to bridge the gap between the two custody methods by providing a tool that trusted members of a family, community or business can run and instantly provide financial services to those who choose to use the mints service. Instead of relying on a single entity to manage your funds, you rely on the technical competence of people you know and trust.

FediMint achieves this through its federated model, which allows users to join a federation as a guardian and bring funds, credibility and technical expertise to manage the mint. Think of it as a type of bank, but instead of trusting a CEO you’ve never met or customer service reps that read off a script, you trust and deal with people you know personally and have a real relationship with and a track record.

Who can join a federation?

The Fedimint protocol is an optional open-source protocol that ships three default modules, Bitcoin, Lightning, and Chaumian Ecash, for out-of-the-box. Still, there are additional modules you can take advantage of. As the library expands with more community members contributing code, there will be new features for you to plug in and run on your federation.

The protocol makes several trade-offs when compared to features you get with base chain custody, but these concessions are made in order to provide benefits including Financial Privacy, Community Custody and Transnational Scaling.

These trade-offs are largely based on the trust assumptions in the system, which are explored below and detailed over the coming pages.

These trust assumptions are:

- Custody: The user must trust the Federation Guardians with custody of their funds, which introduces custodial risk.

- LN Pay: The user must trust “1 of n” Lightning Gateways to pay lightning invoices outside of the mint.

- LN Receive: The user must trust “1 of n” Lightning Gateways to receive lightning payments into the mint.

- Tx Execution: The user must trust a quorum of Federation Guardians to process transactions (deposit, redemption, swap, contract enforcement).

Now that you understand what you’re giving up with FediMint let’s see what you gain as a user.

- Blind Balance: The guardians cannot see a user’s balance.

- Blind Transactions: The guardians cannot tell which parties are part of a transaction.

- Unattended LN deposits: A user of a FediMint can receive payment on the lightning network without needing to be online.

- Simplified use: Using the Bitcoin and Lightning network is made simpler due to the operation of the Bitcoin and Lightning nodes being outsourced to the federation of LN gateways.

- Accessibility: Fedimint Federations provide a user-friendly experience similar to centralized custodial wallets.

- Community governance: Fedimint Federations can be governed by the community of users, ensuring transparency and accountability.

- Enhanced security: The distributed nature of Fedimint Federations reduces the risk of custodial theft or mismanagement.

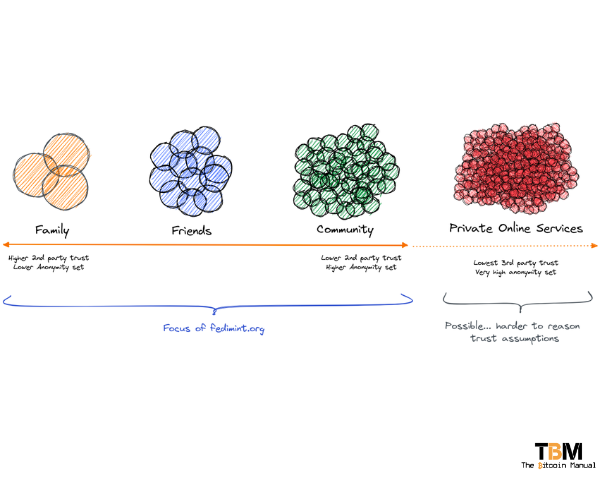

To run a FediMint, you must have the technical know-how of Bitcoin, the Lightning Network, and self-hosting and be willing to manage a Mint and people’s funds. Once a Federation is set up, the guardians that manage the mint can come from anywhere; it can be a combination of friends, family members, work colleagues or institutions you trust.

- Family: More likely used for longer-term holding due to higher trust. It could be used to refill alternate federation wallets with larger anonymity sets to facilitate spending.

- Friends: Similar to family in design, but with a wider anonymity set, this may be a backup scope for people who do not have direct family members who can assist with custody.

- Community: Larger community federations that would be used to facilitate spending across a regional area, analogous to community banking infrastructure. They are likely to be small value wallets that are more regularly depleted and regularly topped up from alternative wallets.

- Private online: This is likely where tools, service providers, games, and even stores explore options for temporarily holding funds to complete smart contract execution or deliver more complex services.

How to set up a federation?

If you want to get involved in a Fedmint Federation, you can choose to join an existing one, or you can set up and run your own federations for different reasons. You could be part of a federation for a non-profit, for a business, or for a community; it all depends on how involved you want to be and if you feel like you’d rather distribute your risk across different mints instead of one.

Fedimint is designed to be Byzantine Fault Tolerant, so it is resilient to m malicious nodes in a federation of 3m + 1 nodes. As a result, if you run a federation of 4 guardians, you are resilient to 1 malicious guardian; if you run a federation of 7 guardians, you are resilient to 2 guardians, etc.

Fedimint’s 0.1 release can also be run with smaller configurations (1/1, 2/2, 2/3) for testing and development, but these setups are not advisable for production.

Once your Federation is set up, you will be able to accept Bitcoin on-chain payments to the multi-signature address and issue eCash tokens to the users making deposits into your mint.

Fedimint can support Lightning network payments; however, the mint does not directly interact with the second layer but requires an additional service. To enable lightning payments, your Fedimint will need a Lightning Gateway:

This gateway is a 3rd party or member of the Federation that accepts eCash in exchange for sending/receiving lightning payments. The Lightning Gateway is not a guardian and acts as an untrusted economic actor serving the Federation.

Running Fedimint on Mutinynet

The easiest way to run Fedimint on the Mutinynet testnet is with Clovyr, a decentralised application platform. Click the Launch buttons below to spin up a Fedimint guardian or Lightning Gateway in a couple of minutes, with Clovyr handling the hosting, DNS, and configuration for you.

To run Fedimint on your own hardware or another cloud provider, or to run Fedimint on a different network like mainnet, see the Fedimint Setup Guide.

Made a @fedimint federation on mutinynet with @garyKrause_. Sent and received sats to a mutiny wallet. It was awesome.

— Rijndael (@rot13maxi) July 21, 2023

What are the risks of a federation?

How Fedimint Federations work

Once the Federation is set up, any user using a compatible eCash wallet can add the Federation mint to their wallet and begin interacting with it, like storing funds and sending and receiving payments to mint users, other mints or non-ecash Bitcoin wallet users.

The Federation is responsible for:

- User Deposits: Users deposit Bitcoin into the Fedimint Federation’s custody.

- E-cash Issuance: The guardians issue e-cash notes to users, representing their claims on the deposited Bitcoin.

- Payments: Users can use their e-cash notes to make payments to anyone on the Bitcoin network.

- Redemption: Users can redeem their e-cash notes back into Bitcoin anytime.

The trade-offs in the trust model bring along five key risks, namely:

Custodial risk

There is always a risk with letting other people hold your Bitcoin keys, and no matter how well-run a Mint is, there is always the risk of catastrophic failure through one of several concerns, like guardians colluding to steal funds, guardians refusing to honour redemptions, the mint is hacked, and funds are lost, or the government mandates the mint to shut down.

Debasement risk

eCash notes represent a claim on Bitcoin held by the federation guardians. In the case of debasement, the mint could generate more claims for Bitcoin than there are Bitcoin in the custody of the guardians.

This risk to a user is that the mint might create eCash notes that are different from Bitcoin in the federation vault assets, increasing liabilities that cannot be paid due to the rehypothecation of funds.

Regulatory risk

The Fedimint protocol has been designed to fit a particular regulatory niche through its scalable distributed custody model; in a Federation, users custody assets for friends, family and community interests, where there is no profit motive.

While there can be regulated entities or large companies offering mint services, they are possible choke points since they face the threat of changing regulations, and the mint can be forced to shut down or divulge user information.

In this case, the mints would need to be far smaller and localised, with members able to manage smaller, more nimble mints that are tough to find or regulate.

LN Gateway censorship risk

Lightning Gateways provides a service to the Federation; without this service, the ability to transact is heavily impaired, which will impact the user experience of the Fedimint user. Due to technical issues or malice, a Lightning Gateway could refuse to redeem eCash notes for Lightning payments and leave the mint without access to the Lightning network.

The only thing stopping an LN Gateway is reputational risk and future income risk, and the hope that those incentives are strong enough to act in the interest of the mint.

Transaction censorship risk

The user must trust a majority quorum of federation members to custody funds, redeem funds, and enforce contracts within the mint, which exposes them to operational risk. Users need to accept that once funds are committed to a Federation, there is a risk that they will be unable to spend or redeem coins due to the technical management of the mint or the guardians’ rug-pulling the service.

Fedimint’s Trust Model Risks

— Martin K. (@builtbymartink) July 7, 2023

1. Custodial Risk – Federation can steal/lose funds.

2. Debasement Risk – Federation issues more eCash than bitcoin owned.

3. Regulatory Risk – Federation forced to shut down.

4. LN Gateway Censorship Risk – Gateway refuses service to mint users.… pic.twitter.com/scKul2hY9y

Do your own research.

If you want to learn more about Federations, use this article as a jumping-off point and don’t trust what we say as the final say. Take the time to research, check out their official resources below or review other articles and videos tackling the topic.