Retail has long been the primary custodian of Bitcoin as the idea of the store of value took hold among early investors. Eventually, that idea reached the ears of those heading up corporations.

2020 and 2021 have been the year of corporations getting into Bitcoin, well rather in the public eye and by corporations, I mean non-crypto companies. The most high profile of those announcements has naturally been Tesla’s purchase of $1.5 Billion in BTC.

The news really rallied the market, and Papa Musk sure does know how to get his adoring fans excited and his haters annoyed.

Elon is always making headlines, but one of the unknown quantities that have become a household name in the Bitcoin space has to be Micheal Saylor. The CEO of Microstrategy (MSTR) had become the official GigaChad of corporate Bitcoin Bitcoin holders when he converted his retained earnings of $500 million into BTC.

Since the reaction from the market and general public, it’s only seen MSTR continue on its Bitcoin accumulation path. They then by issuing convertible debt and buying Bitcoin, and turning itself into a hybrid BTC ETF.

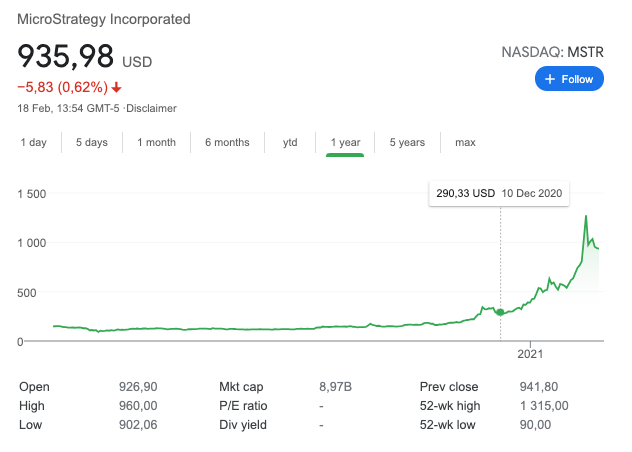

If we take a look at MSTR’s share price since the Bitcoin news, you can see that it’s pretty much 6x’d since its usual price range, and I don’t need to tell you when they announced their BTC position.

Bitcoin is the new share buyback

In the last few years, we’ve seen company market cap valuations explode through the help of share buy backs. This is the process of companies taking their retained earnings or even debt they’ve financed for the year and using that to repurchase shares from the open market.

Naturally, that pushes up the company’s value, attracts more investment, and the feedback loop continues. It allowed companies to do less to earn more. Instead of focusing on improving their product, instead of acquiring more customers, they could juice returns via these accounting tricks.

After a while, all accounting tricks tend to lose their shine, and we see diminishing returns or rather more capital needed to generate the same or better year on year returns.

Now that share buybacks have become commonplace; companies are looking at new ways to juice returns.

I am not saying MSTR is doing this exactly; I am saying if we look at what it’s done to their share price, you can imagine other companies would want to emulate their playbook.

MSTR was in a position where they had retained earnings losing purchasing power, and turned it into BTC. Additionally, they’ve used that to attract new investors, but every decision comes at a cost.

Bitcoin doesn’t mean companies are sound

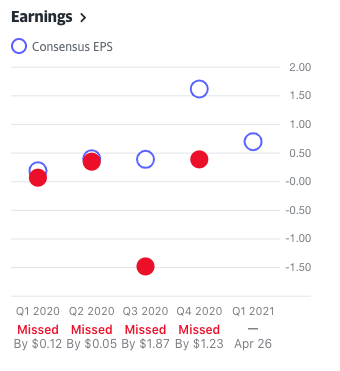

If we take a look at Yahoo Finance’s data on MSTR we can see for the last 4 quarters; they’ve missed their projected earnings.

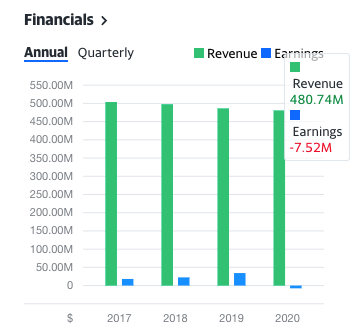

We can also see they posted a loss of $7.52 million in its last financial year, which isn’t that concerning considering how well capitalised they are and that they were generating healthy returns in previous years, so they should have enough runway to weather several storms.

Why I bring this up is NOT to bash MSTR but to illustrate that putting BTC on your balance sheet doesn’t translate to better business practices,

- improved earnings through productive means

- or that you have a competitive advantage,

- know how to deploy capital properly

- or you’re not at risk of market tailwinds

All the dangers businesses face in general, are the same dangers you will face regardless of holding your retained earnings in Bitcoin.

To remain in business, you still need to go out there, improve the product, acquire customers, build cash flow and remain competitive in your niche.

Bitcoin balance sheets a potential bubble

I know this is an oversimplification because companies can finance themselves in various ways, but I’d like to play out this thought experiment.

As we cheer on the likes of Saylor and Musk, and the share prices continue to rise, more companies are going to try to replicate this strategy. Some of them will be zombie companies thinking they can use this model to buy themselves a few more months or years of runway.

If we have more zombie companies sitting with BTC on their balance sheet and they never become profitable, eventually, they’ll need to liquidate their balance sheet.

Think of it like this if tomorrow I quit my job and decided to live on my BTC without ever working again, I’ll blow through my BTC eventually.

While my selling each month to finance my life won’t move the markets, think of companies that hold a lot of BTC that need to dump into the markets to cover expenses or generate runway.

Corporate accumulation could turn into corporate dumping

Dumping on this scale could drive massive market downturns, drive additional fear from weak hands in retail, and in bear markets, it could drive the price down as companies need cash to pay taxes, bills, loans, wages and other expenses.

While I am chuffed to see companies get into Bitcoin and realise the value it can provide, I do see the possible systemic risk if the tool is misused. Something corporations are pretty fond of doing when it comes to financial trickery.