If you’ve heard about trading and the possibilities of creating wealth without work, then you’ve probably gone down the “make money online” or “get rich quick” rabbit hole. As someone who makes a living as an SEO, I can tell you these are some of the most toxic keywords you will find on the internet. Placing these keywords into any search engine or social media site will lead you to a path of losing money, hands down, guaranteed.

You’ll either end up at some shoddy broker platform or some snake oil course salesperson. They will all waste hours of time and money and leave you with nothing. Their sole intention is to migrate what little cash you did have from your pocket to their pocket.

When you search for these terms, you are prescreening yourself, saying “I’m a dumbass, please take my money”.

The one side of the search results will be the “organic” side; these companies pay guys like me to optimise their website, create compelling landing page content and build high authority links.

It’s not about the quality of the product; it’s all about the quality of the SEO they employ and their SEO budget. On the other side is the paid search ads; these guys are willing to pay search engines money each month because it drives a consistent amount of suckers to profit from so they can repeat it each month.

I know this won’t be a popular post because I am telling people what they don’t want to hear; when I see the search volume for “how to trade” and look at the content returned for search results, it’s shocking. Any search result list of 10 links is a game of buyers meeting sellers, most of those sellers pay large sums to be there.

When you evaluate the search results, you’ll notice very little if any warnings or negativity towards trading; it’s all about how easy it is and why did it take you so long to get here; you’re only a few clicks away from huge profits.

The secret sauce is behind this paywall.

Now, if you can’t think critically and evaluate the sources of information or you’re too lazy, you’re going to learn the hard way. If you’re not drawing from multiple sources and reviewing opposing views, you’ll get caught in echo chambers.

If you’re not learning from several books along with someone you know personally, who is an active trader, then you’re probably getting suckered into a sales funnel.

The vast majority of retail traders will end up with losses exceeding their gains, and when I say majority, I mean 80 – 95% of people. The odds are undoubtedly stacked against you, and that’s why returns are so asymmetrical for those who do get it right or those who can outplay most traders with the help of certain advantages.

According to “tradeciety.”

- 80% of all day traders quit within the first two years;

- Among all day traders, nearly 40% day trade for only one month;

- Within three years, only 13% continue to day trade. After five years, only 7% remain;

- The average individual investor underperforms a market index by 1.5% per year;

- Active traders underperform by 6.5% annually;

- Traders with up to a ten-year negative track record continue to trade.

I don’t trade

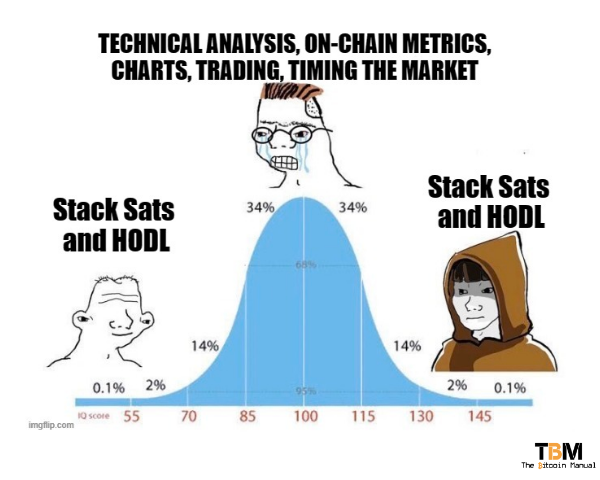

Before we carry on, I would like you to realise my biases; I do not trade cryptocurrency, nor do I trade bitcoin. I trade my time for fiat and then trade my fiat for bitcoin. My fiat mining operations are constantly optimised to get the most sats each month, and that is where I focus my time and energy.

I have traded before, I’ve bought coins that went to zero during the ICO phase, I’ve also made great trades that produced returns. I do realise that I was first all fortunate, and second, I was taking on an amount of risk I didn’t truly understand.

So while I’ve had a little taste of the “click trader” life, I can openly say the game is not something I feel is a constructive use of my time. It takes up far too much mental bandwidth, and the rewards to me aren’t going to beat what I can do selling my labour and locking it into bitcoin.

An industry of encouragement

We’re all suckers for a good lie; telling us what we want to hear makes us feel all warm and fuzzy inside, and that’s why marketers like myself have jobs. Consumers don’t need that much convincing; all they need is a believable story and a bit of repetition. Most consumers won’t dig deeper, and if they see something parroted a few times, that’s more than enough evidence to pull the trigger on a purchase.

Information asymmetry is paramount in trading; if I know something that can affect a market that others don’t know, I am more likely to place winning trades. These platforms and trading coaches aren’t trying to teach you, they are trying to sell you something.

What are they selling you?

They’re selling you more convenient tools that forward your trading data to funds to improve their AI and trading strategies. These platforms also offer you access to more risk and a host of sites offering educational material that provides a false sense of confidence and trading strategies that play into the hands of the big boys.

Dash this with a few testimonials to keep the false hope going, and you have a recipe for easy profits out of retail investors.

The incentive for useful idiots

These useful idiots come in all shapes and sizes, from micro or large content creators and financial influencers. To ordinary people who simply hold a few coins and are willing to state their reputations on something they understand very little about but hope to make money.

Humans tend to find safety in numbers, but this also makes us susceptible to the madness of crowds. Where enough people gather and repeat something ad nauseam, it can become fact in that circle of influence. These people or investors parrot off narratives like DAO’s, Web 3, flippening and all these pro-crypto stories.

Stories that originate from larger players that work in the shadows.

These swarms of people will frantically share these stories and promote these narratives with very little if any, critical thinking. As long as “trusted” publications can syndicate paid press releases, these shills will amplify it to their network for friends and family.

Then we get those influencers or “fin-fluncers”, these are people with larger audiences who will absolve themselves of guilt with a flimsy disclaimer by saying their content is “not financial advice” or state that I don’t make the trades; people are doing it themselves.

It’s like saying, I didn’t dig the hole you fell into. All I did was point you there and nudge you on, encouraging you that gravity won’t take its course this time you step over the edge.

These people are trying to make a living. I get it; they tend to fall into two camps, the outright malicious or the outright naive. The thing for me is naivety only works for so long. If you’re still shilling after a full bull and bear cycle, you’ve long past naivety and graduated into malicious shilling of unregistered securities and unregulated exchange trading.

As long as your bags keep filling with sponsorship fees, who cares? We all have a figure of money that makes everything palatable. I’m not here to knock peoples hustle. I believe they provide a valuable service; they show you what trickle-up economics is all about in real-time.

The industry of manufactured authority continues to boom because cryptocurrencies do not have the play but same rules as regulated securities yet. While these individuals will take the blame and the fall, it was the venture funds, hedge funds, exchanges fawning the fires through various marketing material and community management and referral programs.

All working together to groom a new batch of suckers, I mean liquidity providers, for their exit strategy.

It’s a full-time job.

Perhaps you picked up earlier I mentioned the term “click trader”, this refers to people who use brokerage sites and exchanges to perform their trades. They are the average joe and jane who create an account, load it up with money and start trading by hand; so to speak, they are doing all the clicking.

It seems cool, making money from a few clicks; I am sure you’ve seen these social media fintech influencers showing you how they trade from their phones or laptops and can make money.

The truth is, the real traders laugh at these morons; real traders are not sitting at their screens setting stop losses and limit orders, no. These are teams with years of experience from traditional markets. These teams consist of

- AI and machine learning coders,

- Quantitative analysts,

- market makers,

- and companies with preferential access to capital.

In addition, many of these funds also hold pre-mines on coins you’re trading and can flush the market with liquidity at any time to move prices in ways they feel would be most beneficial.

Let me illustrate with a bit of a sports analogy.

It’s as if you stepped onto the rugby field (American Football for my US readers), and you’ve never picked up weights or did any cardio in your life. You have no in-game experience nor natural ball-handling or running skills, and no protective gear.

Then imagine EVERYONE else you’re playing has the best protective gear, the best physical conditioning money can buy, and they are juiced up with performance-enhancing drugs to the max.

So they pass you the ball, and you’re expected to doge all these guys to make it to the try line (touch down). Chances are you’re more likely to have your back broken before you make any ground, but you’re still going to give it the old college try.

There is nothing wrong with trading; I only ask you to realise the odds and who you’re up against.

The curse of winning

As I said, I know the feeling of making a good trade, I know how intoxicating the feeling of winning can be and how strong the pull of the roulette table is when you feel it’s time to walk away. Anyone who asks me about trading, I’ll tell them straight up, do it and blow up your account; it’s the best thing you can do for yourself.

Once reality sets in, we can talk without that monkey on our back. What if I did this or that with my account? Nope, it’s done. Once the market rips your face off, you have the choice to accept it and learn humility from experience.

The ones I do find harder to convince is the ones that were lucky enough to make a great trade. They went out and caught the massive trophy fish on their first time out on the water and now think it should always be that way.

They will continue thinking they can replicate it, even when they blow up their accounts several times.

Don’t believe me? Then why not do some field research.

Go to your local casino and look at some of the people there, have a chat with them; almost all of them have a story where they won big and are sitting there trying to replicate that moment.

Leading lambs to the slaughter

The game is set to sell you dreams and then crush those dreams but if you want to gamble and take on outsized risk for your portfolio, by all means, have at it.

I can understand the desire to YOLO trade if you feel your life isn’t going anywhere. You might as well blow these last few thousand in savings to see if you can hit the million. I get how attractive that sounds, especially in a world where people continue to have less hope and see things nihilistically.

If, however, you have faith in yourself that you are willing to work and live by the sweat of your own brow, you may want to consider the savings route instead. Yes, it is still possible to save money even in a world, you simply need to find a tool that protects your savings, and for me, that has been bitcoin.

The truth is for most of us, there is no winning lottery ticket, and there is no wealth without work. A reality that is perfectly fine with me put in the work, show your proof, help soceity create new products and services, make sure your clients get an awesome experience and consider moving more of your business out of fiat into a bitcoin standard where possible.

There is no set amount needed to get started; it’s all about how much you’re willing to save for the future.