Saving in your local currency has not been an excellent trade for most of us post-COVID; the record-high inflation we’ve experienced globally has eroded savings, and wages have not adjusted to compensate. Some consumers continue to dip into savings or reduce the amount they save each month, while others ask what savings are as they live off credit and service record high-interest payments.

Suppose you’re not too bothered by inflation and are still on social media. In that case, you’ve probably seen several of these grocery stores or fast food outlet parking lot rants, from TikTokers in their car, yelling about how X or Y item costs now and can take their word for it that consuming isn’t as manageable as it once was.

"Why is everything so expensive?"

— Wall Street Silver (@WallStreetSilv) February 24, 2024

"Why am I making more money waitressing than I would make using my college degree?"

"I barely have a life"

"I work Wednesday through Sunday just to pay my bills"

"How are y'all affording housing?"

"It feels like we're working for nothing"… pic.twitter.com/qb4uI2dgB9

While saving and balancing your budget has become a precarious past time even in the most developed of countries, with the relatively most stable currencies, I would encourage you to spare a thought for those of us, YOLO’ing it out in banana republics and kakistocracies where everything is made up and what the local currency is valued at doesn’t matter.

Setting fire to the Naira

A great example would be Nigeria, and no, not your local Little Lagos, where a bunch of Nigerians have moved to in your country. Sorry, I had to do it; you know it is true, and since Nigeria beat Bafana Bafana in the Afcon, I am not above being petty.

No, I am talking about real West African Nigeria.

If you’re living on Naira, you have not had a good time post-global reopening. The trade has not been in your favour, and it’s been more of a Hunger Games saga than anything else.

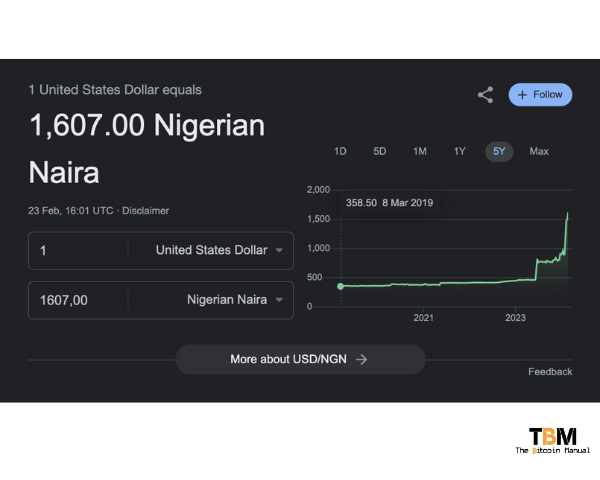

Back in 2019, the Naira (NGN) traded at roughly 360 to 1 US dollar, but 2023 saw it devalued to around 800, which was a significant blow to anyone holding Naira, seeing your wealth eroded by 50% overnight.

But it hasn’t stopped there, 2024 has not been kind either, and Nigeria has had its second currency devaluation in less than a year, and new forex rules suggest the central bank is gearing up to let the Naira float freely, so be ready for more volatility and pain head.

The official naira exchange rate plunged to as low as 1,531 per dollar from 900, well below black market levels, after the market regulator changed its closing rate calculation methodology in a de facto devaluation. The Naira fell to as low as 1,540 intra-day, dropping lower than the 1,449.27 naira quoted on the unofficial parallel market.

As the latest figures show, the Naira currently tops at 1600 NGN to 1 USD. It looks to stabilize around this range as the country deals with the shock of another devaluation and prices for goods, services, wages, and assets readjust to these new levels.

Understanding the Devaluations

I won’t bore you with the nitty-gritty of why the Naira is in the state it’s in, the short answer is money printing, but if you want a highlight reel, the primary factors contributing to the Naira’s depreciation are:

- Falling Oil Prices: Nigeria relies heavily on oil exports, and the 2019 oil price crash significantly reduced government revenue and foreign exchange reserves.

- Dollar Shortage: Limited dollar inflows due to reduced oil exports and foreign investment have created a demand-supply imbalance, driving up the dollar’s value.

- Macroeconomic Challenges: Inflation, high government debt, and fiscal imbalances have further weakened investor confidence in the Naira.

The Naira will continue to weaken

While the Central Bank of Nigeria (CBN) has implemented various measures to stabilize the currency, challenges remain:

- Global Factors: Rising global interest rates and a strengthening US dollar put downward pressure on currencies like the Naira.

- Limited Progress on Diversification: The Nigerian economy remains heavily reliant on oil, making it vulnerable to external shocks.

- Fiscal Pressures: Persistent high government spending and debt levels raise concerns about the Naira’s long-term stability.

Protecting Savings in a Volatile Environment

Nigerians don’t have the luxury of hedging inflation in growth stocks, sitting in index funds or having a dollarized stock and bond portfolio. Well, some do, but they are a tiny minority. The rest have to adopt various strategies to safeguard their savings, and the two most popular methods are:

Dollarisation

Converting savings into dollars, although limited by access and regulations, so where do you go? The new EURODOLLAR market, of course, is USDT, which has become wildly popular in Nigeria.

For obvious reasons, you don’t need a bank account; you don’t need an ID; all you need is a seed phrase and a Metamask 😷🤢 or TRON wallet 🤢, and you can secure dollars in the blink of an eye.

If you’re a fan of Brent Johnson’s Dollar milkshake theory, Nigeria is playing out as he prescribes in much of his work.

Bitcoinisation

Again, like USDT, Bitcoin only requires a software wallet. You can install it on your laptop and smartphone, and you’re golden as long as you have an internet connection. There are no caps on how much Bitcoin you can hold or access at any one time, like in the case of the Naira.

Bitcoin is easy to exchange across borders with a native market in every country, making it ideal for remittance and even import and export, where an amount of Naira or USD/USDT isn’t readily available to execute said trade.

While unregulated and banned by the government in the past, some Nigerians use Bitcoin for cross-border transactions and value storage. While those who have opted to move into USD or USDT have protected some of their purchasing power against the devaluations, those who opted for Bitcoin have not only received protection but enjoyed some well-deserved returns by holding Satoshis.

What are the unofficial markets pricing the Naira?

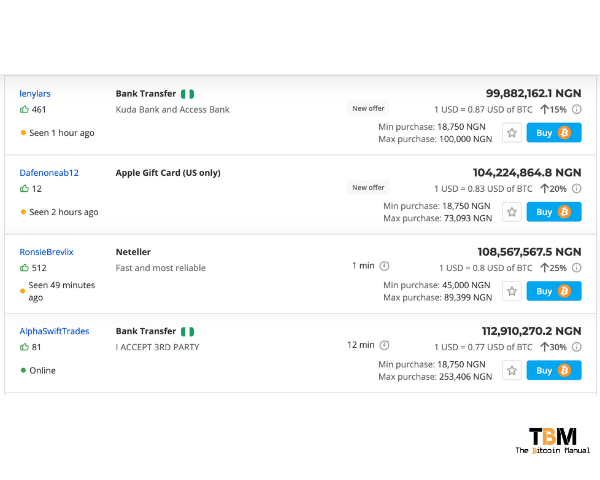

Official rates have Bitcoin trading at around 81 million NGN per coin. Official rates are one measurement; another is the risk Hawala men and P2P traders are pricing when trading between assets.

Let’s look at what traders are listing on P2P markets.

There are already offers for 100 million NGN per coin, and what’s remarkable here is that this payment method is a local bank transfer, which tends to carry the lowest premium apart from Stablecoins.

If the currency continues on its current trajectory and while Bitcoin continues to appreciate against currencies globally, it will only be a matter of time before we reach Naira/satoshi parity in an official capacity, likely within 2024.

So you don’t need to wait too long for what seems like an eventuality, and as a Nigerian, you have very little time to switch over if you’re still sitting in Naira.

The Naira won’t be the first country to reach this milestone, with the Indonesian Rupiah and Colombian Peso already blowing past this stage and firmly in confetti territory compared to the never-trusted and always-verified Satoshi.

Once the Naira officially joins the club, the South Korean Won is the next currency to reach Satoshi unit parity and presumably be flipped.

A new paradigm for unit bias

One of Bitcoin’s biggest criticisms is that it is volatile; how is it meant to be a medium of exchange when its purchasing power keeps changing?

How would businesses set pricing if they have to keep checking exchange rates? The truth is you don’t; if you live in a country with a relatively stable currency, you can still price your goods and services in the local currency and settle in Bitcoin; in fact, many times, the wallet software will do it for you.

But in the case of Nigeria, we have a unique situation.

If you’ve already reached the point where 1 Satoshi is worth 1 unit of your local currency, in this case, the Naira, and it’s less volatile annually, does it not make more sense to price everything in Bitcoin instead?

Am I talking crazy here?

Trading the free-falling elevator for the proof of work stairs

As a Nigerian holding Naira, have you had two doublings, or is it halvings, well doublings in units and halvings in purchasing power? Pick which one suits you better.

They fooled you once, and the early adopters took it upon themselves to find an alternative; they fooled you twice, and another cohort followed that first batch as they could see others’ positive switchover results.

Each devaluation is not only one of the monetary units but also confidence in the currency and its ability to be used as a store of value and medium of exchange going into the future.

People can only stomach so much fiat pain, and as these leaps get larger, the orange pill only tastes sweeter.