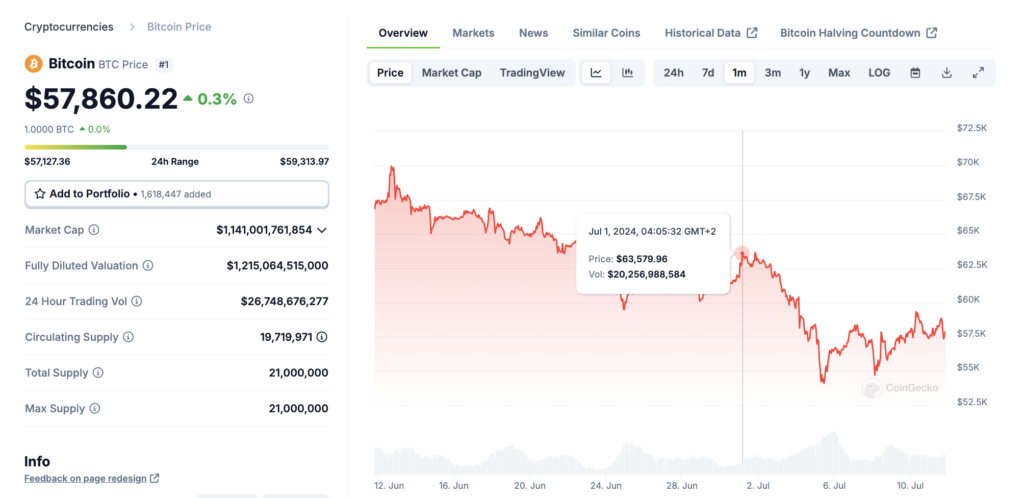

The Bitcoin market has been sent into a tailspin following a dramatic 25% plunge in its value. When we see massive volatility in this space, everyone scrambles, looking for someone to blame.

This time around, analysts are pointing fingers at the German government as the primary culprit, attributing the unprecedented price drop to the massive offloading of its seized Bitcoin holdings.

The sudden influx of thousands of Bitcoins hitting the market appears to have shaken out buyers and triggered a panic sell-off, but where did the German government get such a massive amount of Bitcoin?

How did movies2k accumulate a massive Bitcoin treasury?

Between 2008 and 2013, Movie2k was a platform for the unauthorised distribution of copyrighted movies, TV shows, and other media content. In 2013, the Motion Picture Association of America (MPAA) shut down the website due to concerns related to copyright infringement.

A further investigation by the German authorities identified two operators of the popular platform, a 40-year-old German national and a 37-year-old Polish national, which led to the seizure of 50,000 Bitcoin in January 2024.

The duo acquired a sizable Bitcoin position with the proceeds from subscriptions and advertising through its media platform, which was like NetFlix or IPTV but paid in Bitcoin.

“In an investigation by the Dresden General Prosecutor’s Office, the Saxony State Criminal Police Office and the tax investigation of the Leipzig II Tax Office as the Saxony Integrated Investigation Unit (INES), almost 50,000 Bitcoins were provisionally secured in mid-January 2024,”

Saxony Police – Press Release

The unexpected Bitcoin haul

When you acquire a bunch of Bitcoin from transactions deemed illegal, trying to liquidate those funds becomes a complex task. You can use privacy tools for small payments, but at a certain position size, Bitcoin OPSEC becomes really tough, and you can slip up and leave markers that lead back to you.

Ask the Bitfinex hackers about that; a few voucher purchases and exchange sales later, and they ended up behind bars.

The stress of dealing with this growing treasury can be tough to handle, and according to reports, one of the suspects reportedly transferred the BTC voluntarily to the Federal Criminal Police Office (BKA).

While it could be plausible someone could hand over that kind of life-changing money, it couldn’t have been without considerable pressure.

Seriously? That must have been one of the most painful transfers any holder could ever make, but the chain doesn’t lie, and in a shocking turn of events, the German government found itself in possession of a staggering 50,000 Bitcoin.

Governments have a history of dumping.

Governments have previously sold confiscated Bitcoin directly to buyers at auction, but very few single buyers or OTC desks could manage that kind of volume for a sale of this size.

Sure, the government in question could take its time and sell over an extended period to reduce the price impact, but when has a government ever exercised a low-time preference?

Since fiat maxis see Bitcoin’s future prices as volatile and unknown quality, they might feel waiting could risk getting a lower price for their stash.

However, opting to liquidate at mass leaves no alternative but to sell the Satoshis on the open market.

Why sell the Bitcoin?

Given the sheer size of the Bitcoin stash, the German government faced a dilemma:

What to do with it?

Holding onto such a volatile asset could expose the government to significant market risks and raise questions about the possible unrealised gains that could be used to fund programs.

When you have the privilege of creating currency, you probably don’t see the value in a scarce asset, and these seized assets are not seen as investments but rather as something to drum up liquidity from the private market.

If a government impounds a car or seizes a building from a company or citizens, it eventually needs to dispose of it and turn it back into liquid currency.

Several other factors likely influencing the decision to sell the Bitcoin include:

- Market volatility: Bitcoin’s price is unpredictable, making it a risky asset for governments.

- Revenue: Selling Bitcoin allows the government to tap into the increased purchasing power of the asset they had on their balance sheet

- Public perception: Keeping a large amount of Bitcoin could raise concerns about the government’s involvement in cryptocurrency.

Operation market dump goes into effect

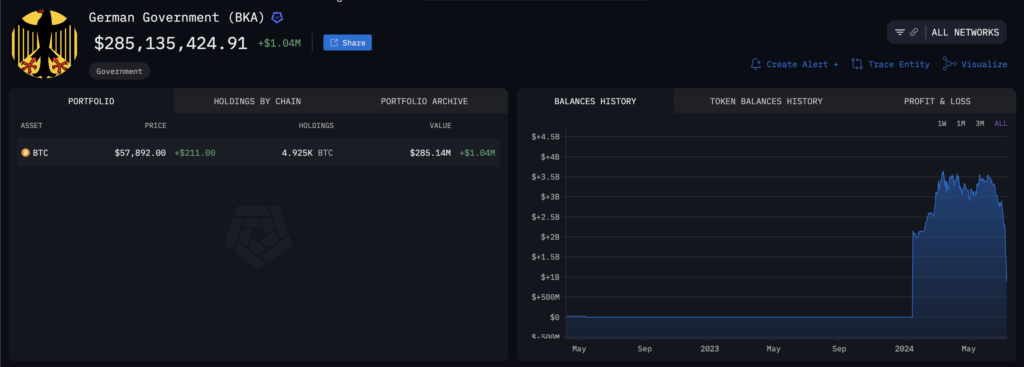

Since mid-June, the government has steadily started moving coins to exchanges and selling portions of the huge Bitcoin stash; according to reports, around 40,000 coins have been marked for sale.

The German government’s on-chain address has been closely monitored, and reports state that some of the coins have been transferred to major exchanges like Coinbase, Kraken, Bitstamp, and OTC trading desks.

Germany has offloaded over 25,000 Bitcoin worth $1.5 billion over the past month and still has 15,000 coins to liquidate over the next few weeks.

The liquidation and news have negatively affected Bitcoin’s price, which sank below $55,000 in July, dropping 20% from its previous trading range of $64-67,000.

The German government’s decision to offload its Bitcoin holdings has had a noticeable impact on the Bitcoin market, but this is temporary; with the government’s reserves dwindling, eventually, the market will absorb this unexpected surplus and find a new range to trade at.

German government criticised for not holding onto seized Bitcoin

Since the German government revealed that it was selling off this confiscated Bitcoin, it hasn’t only affected the price and triggered critiques. Government members have faced a significant backlash, and they believe the move might be rushed or short-sighted.

German MP Joana Cotar, who has criticised her government for failing to hold Bitcoin, has also revealed that she holds BTC as part of her portfolio.

Statt #Bitcoin als strategische Reservewährung zu halten, wie es in den USA bereits debattiert wird, verkauft unsere Regierung im großen Stil. Ich habe @MPKretschmer, @c_lindner & @Bundeskanzler @OlafScholz darüber informiert, warum dies nicht nur nicht sinnvoll, sondern… pic.twitter.com/v9FpzmfLbp

— Joana Cotar (@JoanaCotar) July 4, 2024

It’s not every day that you find yourself with 50,000 Bitcoins, and as every stacker will tell you that it has sold in the past, it’s not easy to regain that same Bitcoin figure as the price rises.

Some members of the German government have promoted the idea of holding Bitcoin as an economic reserve for the future, given that an increasing number of global transactions are now being made using various crypto.

Furthermore, critics believe that this could be the perfect chance for the country to develop its Bitcoin strategy on a global basis and leverage the haul further.

Considering the fact that many countries like China, Russia and other BRICS nations are moving away from US treasuries and into gold, it’s not uncommon to have a mix of assets as part of your government’s strategic reserves.

Other countries, such as El Salvador, have already gotten a head start in this. The government made Bitcoin a legal tender in 2021 and has accumulated over 5,000 Bitcoins as part of its Bitcoin treasury acquisition program.

The greatest own goal

The German government’s acquisition and subsequent sale of 50,000 Bitcoin is a fascinating case study in the intersection of law enforcement, Bitcoin, and finance. The decision to hit the sell button on its Bitcoin haul could be a colossal financial blunder, akin to scoring an own goal in a high-stakes match.

If Bitcoin’s price continues to increase over the coming years and the network’s total value reaches multiple trillions, it would mean the government sold its stash on the cheap and could be priced out, recouping the same amount of funds, should they decide to reverse course and embrace a Bitcoin standard.

Very few people who decide to cash in on their Bitcoin early don’t regret it, and like every maxi will tell you, everyone gets Bitcoin at the price they deserve.