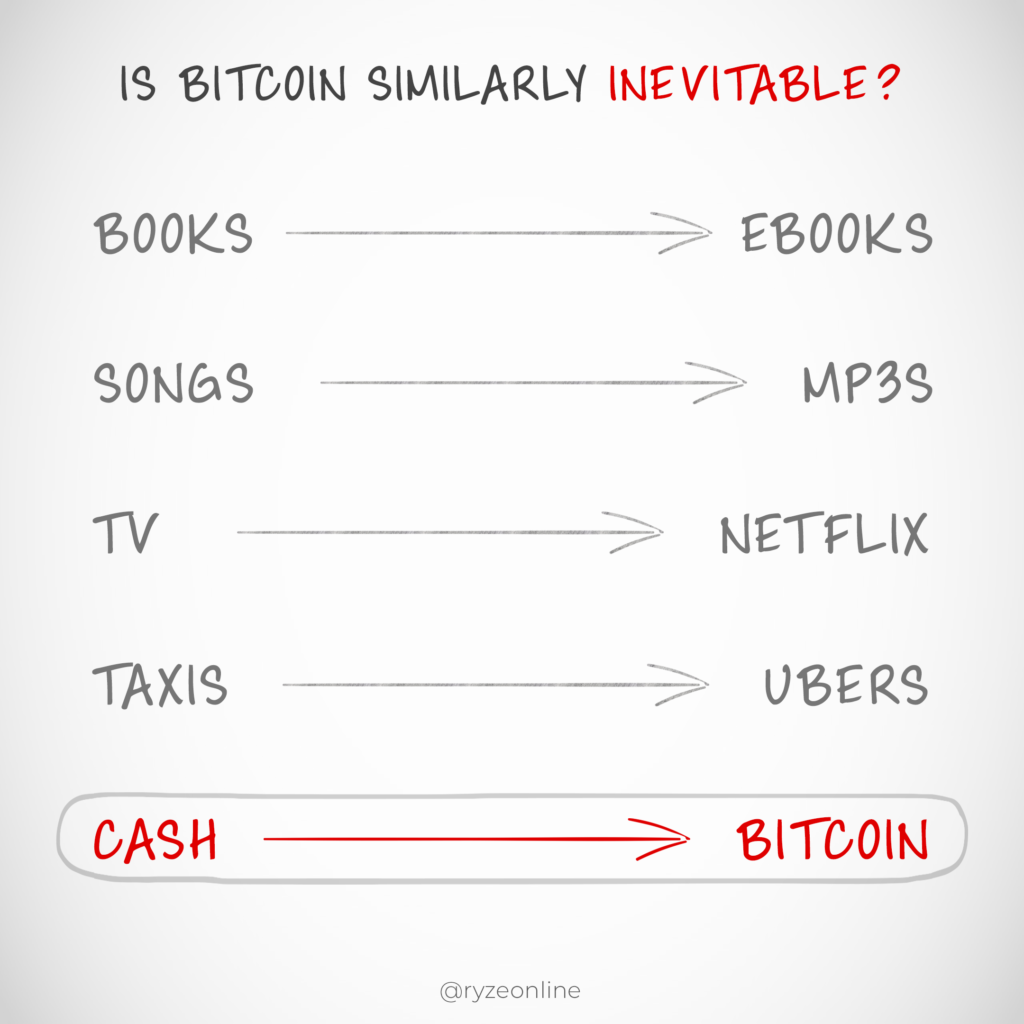

Bitcoin is replacing USD the same way Netflix replaced TV and Uber replaced taxis.

Bitcoin beating USD is actually pretty simple, once you understand it.

Bitcoin and the US Dollar are both valued by people.

The question is will each currency’s value remain the same? Which will increase in value most? Which will decrease in value most? To answer these questions, we’ll first look at the true value of money.

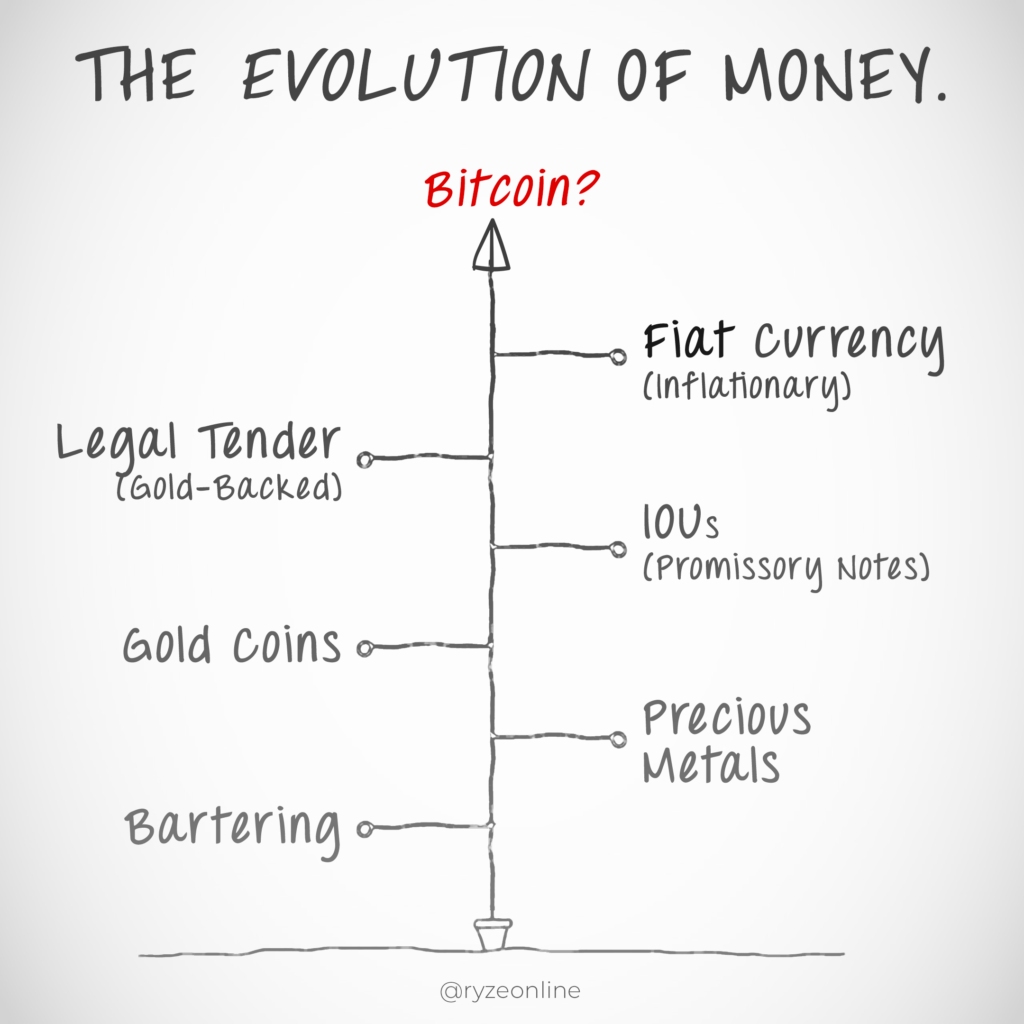

Value has existed since cave-men bartered.

Before money existed, each ‘cave person’ had value. For example, Grog was a strong rock-breaker who could make caves better. Nog was an adept hunter who could get food quickly. Zog was great at making fires. And each of these Neanderthals had time and freedom to pursue whatever they wished, to survive, and to thrive. And to save their time and have the freedom to pursue their strengths & passions…

…they bartered goods and services with each other.

This bartering system was their way of exchanging value, backed by the value of each person providing the goods and services in the bartering system. Because each person was offering something valuable to each recipient, the exchanges had value. Makes sense, right?

The problem was, this ‘bartering system’ of value-exchange was awkward.

So eventually people evolved to use seashells as ‘money.’ (~1200 BC)

As time went on, it became awkward to keep track of who was bartering what to whom. Plus, some of the goods were cumbersome to transport. And eventually, people realized it would be helpful to have a ‘symbol’ of value that could be exchanged, rather than lugging around barrels and giant oxen for trade.

So society began using seashells. Seashells were shiny, rare, and seemed to make a great ‘symbol of value’ for people.

The ‘seashell system’ became corrupted, though. People closer to the shore ended up much wealthier than people inland because they had easy, abundant access to all the seashells (‘symbols of value.’)

So seashells were replaced with silver & gold. (~700 BC)

Precious metals had traits similar to seashells. Namely, they were shiny and desirable, so they seemed to be great ‘symbols of value.’ People found value in things that were physical and tangible. Precious metals certainly fit the bill and were highly sought after for various uses. These metals were even better ‘symbols of value’ than seashells because they were more accessible and durable.

But they were also heavy, and not very portable. Plus it was hard to measure them, since ore from the earth had many different purities. So…

Gold nuggets and bars were replaced with gold coins. (~600 BC)

The first coins industrially minted were in Lydia (modern-day Turkey), in 600 B.C. This coin-minting solved the portability problem, and it seemed that gold coins had given us something great. We finally had a solid system to store and symbolize value. Hooray! We’d come so far since our bartering days.

Unfortunately, this ‘gold coin system’ became corrupted too.

This time the money system got corrupted by rulers, businesses, and citizens shaving metal off the edges of many gold coins, so they could melt the shavings down and create new coins for themselves in an early form of counterfeiting.

They also substituted cheaper metal coins but plated them in gold. These fake coins would pass for genuine coins. They knew most people can be tricked easily by something that has ‘face value.’ Most citizens are quick to judge a book by its cover, so if a coin looked like precious gold, that was good enough for people to spend it, and they’d look no deeper.

The rulers minting the fake gold coins got richer while the serfs and citizens blissfully spent worthless coins amongst each other. Eventually, their coins became worthless. Eventually, pure, genuine gold coins were hoarded rather than spent. This was an early example of inflation.

But, despite this corruption creeping into the system…

Population & biz boomed, and so, coins were replaced with IOUs. (~118 BC)

Why? Because with a huge population performing many transactions all the time in a bustling economy, even the great ‘symbol of value’ we had (heavy metal coins) was too cumbersome to deal with.

So people figured there had to be a better way than all this ‘heavy metal,’ and they created IOUs or promissory notes. These were signed pieces of paper that promised the bearer that they could go and collect actual, valuable gold coins from the note-sender.

These notes seemed to be quite good ‘symbols of value’ because they remained backed by valuable assets (precious metals) just like it was in the bartering days (goods & services)… and they were much easier to deal with and transport and exchange.

Unfortunately these notes were also easy to counterfeit.

To stop counterfeiters, IOUs became govt. bills, or legal tender. (~1775)

The Continental Congress (British Colonies & The United States) issued paper money, officially certifying each promissory note. These pieces of paper became banknotes, or ‘bills.’ Each bill had something like ‘this certificate entitles the bearer to 20 pieces of gold’ marked on it, and was stamped with official government markers.

At this point, the pieces of paper were still “I-Owe-Yous” (‘IOUs’) for real, tangible value. Each bill still represented precious metals, just as previous systems had seashells or bartered goods & services behind them.

The point is that initially, citizens had the option of taking paper money to a ‘reserve.’ There, citizens could cash their notes in for the assets held in that reserve. So, reserves began as store-houses of assets exactly matching the value of the paper money bills in circulation. This was a reasonably fair system… in the beginning.

It created a new problem though. The nations were full of pieces of paper circulating that were easy to lose, hard to keep track of, easy to rob, and so on. A new invention was needed.

Banks were invented to protect people’s money. (~1791)

And banks provided a reasonable service, at least at first. They were secure places where people could store their ‘symbols of value.’ They then had peace of mind that they could take their bills out anytime and cash them in at a reserve if they wanted to.

At first, banks were places to secure asset-backed legal-tender. They were places to store true, honest value. They took a fair, reasonable fee for this service, and that was that.

But, unsurprisingly, they became corrupted.

Over the years, banks and governments started f**king with the reserves. So instead of the reserves having assets of the exact value matching all the bills in circulation, they had smaller and smaller amounts in reserve.

The banks and governments agreed to simply ‘print more bills’, even though there was no gold or precious metals in the reserves back then.

“It’s economic power that determines political power.”

Jose Saramago

They called this ‘fractional reserve.’

Fractional reserve reduced the legal requirements for each reserve to match the bills in circulation. You can slap whatever labels you want on it, the reality is that they basically stole gold from the reserves for themselves. Or from a different view, they printed IOUs for themselves which made other citizen’s IOUs worthless and backed by nothing, since there weren’t enough valuable assets in reserve to cash them out.

Meaning that if all bill-holders wanted to cash out and get their matching gold… many would find they couldn’t do so, because their gold, stored in the reserves… was gone. There was no longer enough gold in the reserves to match the IOUs.

And society let this happen right under their nose.

Why? Because the banks and government spoke with authority, like any good con artist. They didn’t label it ‘stealing’ or ‘fraud’ (which it was,) instead they called it ‘fractional reserve’ banking, where only a small percentage of assets are held in reserves.

“Don’t worry citizens, the system is fine, nothing bad is happening, we’re just holding a ‘fractional reserve’ for your funds.”

And every single time in history when a government does this, it turns what was originally a real, true, value-backed money into a rapidly devolving ‘currency.’

The reason we covered all this is so you understand that…

What was once value-backed money, had now become ‘fiat’ currency. (~1971)

And fiat currency is ‘bad.’ It always fails. It’s a financial system that benefits the corrupt few and punishes the masses ignorant of most financial education. Fiat currency is basically ‘printed money’ that ain’t backed by proper value to match it.

“By this means the government may secretly and observed, confiscate the wealth of the people, and not one man in a million will detect the theft.”

John Maynard Keynes

Monopoly money, for example, is printed money having zero valuable assets backing it. I could print some tomorrow, and I don’t need goods & services, seashells, or precious metals backing it. It’s not real money. It’s just a ‘make-believe’ currency.

The game “Monopoly” sold for $2 in 1935. In the box, you get monopoly money.

— Dan Held (@danheld) July 30, 2021

That original stack of monopoly money from 1935 is worth $50 as a collectors item.

Monopoly money literally holds more value than your fiat currency. pic.twitter.com/CpAL6Fxoek

In civilization’s storied past, all attempts to use a ‘fiat’ currency as a financial system failed. (China began using fiat in the 10th Century, while the West picked it up in the 19th Century, leaving many examples of failed fiat systems along the way.) Why? Because unlike a currency backed by valuable commodities (e.g. shells, bartering, and precious metals,) fiat is essentially the same as using monopoly money.

So, fiat systems will continue to fail, because ‘symbols of value’ only work… get this… if there’s an actual value to symbolize.

“I owe you (I.O.U.) ten gold bars” only works if gold is a valuable thing that exists.

“I owe you (I.O.U.) fifty nibbledy-pibbles” doesn’t work because nibbledy-pibbles are utterly made-up and value-less.

A promissory note or bill representing them is meaningless. Nibbledy-pibbles can’t feed or clothe a human, or be melted down into jewelry, or help anyone thrive, just like Monopoly money can’t.

How does this relate to Bitcoin? We’re almost there.

Terrible monetary policies and systems, combined with reckless currency-printing to ‘bail-out’ those terrible policies has the same result every time.

A declining currency.

It shouldn’t be rocket science to see that fiat systems are a giant house of cards, built on lies. Sooner or later, any fiat currency’s value drops. Its purchasing power drops and a ‘dollar’ just doesn’t go as far.

Then more bail-outs and stimulus checks and inflation happen, and it drops further. Eventually, it collapses completely. If not in your lifetime, it will happen in your children’s lifetime.

This is guaranteed the way night follows day or the way planting enough crops eventually bears fruit.

“Paper money eventually returns to its intrinsic value: zero.”

Voltaire

A quick internet search on ‘hyperinflation’ will give you many examples of fiat money collapsing. Check out China during the 12th century, or search France’s multiple collapses, or study post-WW1 Germany’s economy. And there are plenty of other examples if you look. We’ve even seen this recently in Venezuela, where their fiat currency was so overprinted that it became worthless.

Many people don’t understand how money that has served them for a lifetime, can suddenly become worthless.

Unfortunately this happens more often than you may imagine. It goes something like this:

“Five or six years ago, 500 bolivars would’ve bought you a meal for two with wine at the best restaurant in Caracas. As late as early last year, they would’ve bought you at least a cup of coffee. At the end of 2016, they still bought you a cup of café con leche, at least. Today, they buy you essentially nothing … well, except for 132 gallons of the world’s most extravagantly subsidized gasoline.”

The Washington Post, 2018

There’s even an image floating around of Venezuelan currency, ‘Bolívar Fuertes’, literally lining the gutters.

The same thing happened with the Zimbabwean Dollar.

“Since 2009, Zimbabwe has used other currencies in lieu of its own, which it abandoned after hyperinflation of more than 5,000 percent made it essentially worthless.”

CNN, 2016

A similar thing can, and will, happen to the US Dollar eventually, because they’re printing unbacked fiat and inflating their currency just as Venezuela, Zimbabwe, and even Athens once did, and the U.S. will reap the exact same reward for this irresponsible behavior.

Fiat always fails. Always.

For about 50 years, the global economy —not just the US— has operated on a fiat version of the old ‘Bretton Woods’ system. The system, founded in 1944, collapsed in 1971. But through confidence-scams, financial sleight-of-hand, and outright lies, corrupt governments and banks keep all their citizens in the dark, encouraging them to prop up the broken money system while the rich get richer. Politicians and bankers benefit heavily from defending an outdated, collapsed, broken system.

You might believe all this financial foppery I’ve outlined is just history. Or that your nation’s fiat currency is ‘too big to fail.’ Or that it has ‘checks and balances’ in place to stop hyperinflation.

You would be wrong though.

Because it doesn’t matter if you’re a rich, powerful man, or a poor, unknown hermit… if you light a fire in your house and walk away as it burns, you end up with ash. Period.

Because any ‘fiat’ system (ie: printed money, unbacked by matching value), in every historical case, gets corrupted and loses its ‘value’, because it was unbacked by any valuable asset in the first place. The US dollar is no exception.

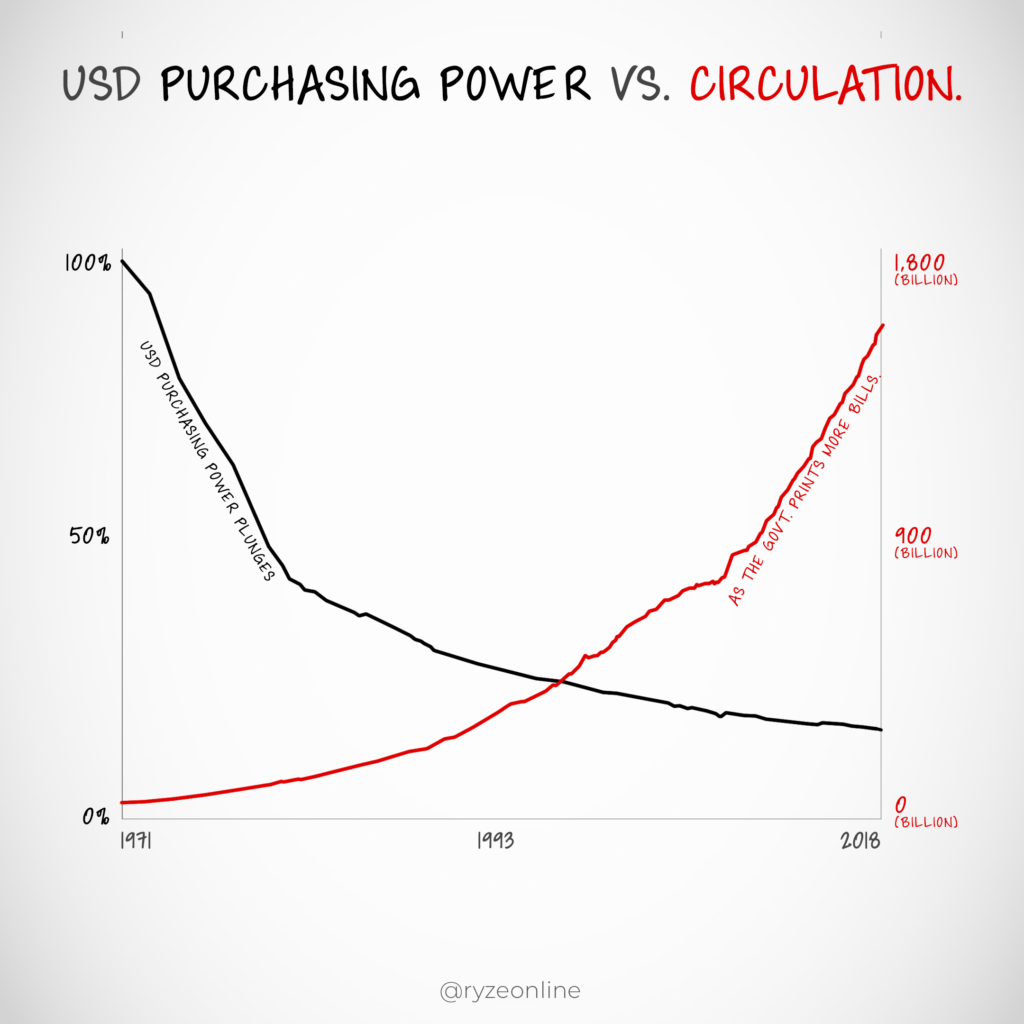

In fact, the US dollar’s purchasing power has plummeted 90% over the years.

Ninety-percent! That is pretty crazy for a once-powerful currency. It’s quickly approaching zero.

Even if you only focus on your hometown, the fact is we’re in a global economy, and when the ‘outside world’ begins to recognize a fiat currency has been overprinted and overinflated, that fiat loses value, just as it has always been.

Real value is always real value and monopoly money is always monopoly money.

Sure, when living in a developed nation, where the fiat system seems to be working decently, it’s tricky for most people to see how corrupt and manipulated the economy actually is.

But it’s kind of like a beautiful apple with a rotten core or a gorgeous person with a terrible personality. Give things time, and their true nature will show. With big governments pulling the wool over people’s eyes for decades, it may take longer than usual, but the truth will come out.

Most people with mortgages are one or two economic decisions away from being bankrupt. They’re at the mercy of the government’s economic whims even as they sit at home, playing League Of Legends in blissful ignorance.

Along the way, there were attempts to save fiat.

In fact, there was an attempt to save the US Dollar and keep it as ‘proper’ money backed by value in the early 1900s. It went like this: The ‘Federal Reserve’ (a private corporation, in league with the government) appeared, and they kept financial control in the hands of the government. The Reserve actually had plenty of gold stored in it, which was meant to ‘back’ the US Dollar. But during the financial crisis of 1933, many citizens turned in their banknotes and cashed out their gold from the Federal Reserve. At the same time, more gold was flowing out to foreign nations, because they feared the devaluation of the US Dollar.

This resulted in the Federal Reserve having very little gold in it. It also resulted in too many printed banknotes in circulation. So In March 1933, when the Federal Reserve could no longer honor its commitment to convert bills to gold, President Roosevelt suspended the ‘gold standard.’ Citizens were urged to turn in their gold and receive ‘gold certificates’ in exchange.

The dollars printed during that time actually said ‘gold (or silver) certificate’ on them, and they were backed by a person’s own gold, held in the reserve. Roosevelt’s policies are said to have hastened the United States’ economic recovery and ‘reflated’ their currency.

Those days are long gone though.

If you look at today’s printed U.S. Dollars, they’ll say ‘Federal Reserve Note’ on them, not even a hint of the money relating to a valuable asset.

Anyway, the govt. and banks knew that fiat always collapses. And they knew that if that happened to US Dollars, they would lose all their power and control.

So the United States made a deal with most of the world to make the US dollar a ‘global reserve’ currency.

This basically means that the US became the ‘bank’ for every other country. The US held all the gold, and the other countries held US dollars, making all participating nation’s currency into fiat currencies, no longer backed by anything.

They did this through the ‘Bretton Woods Agreement’ of 1944, and as long as other nations trusted in the ‘gold-backed US Dollar,’ things would be fine.

But corruption struck again.

As mentioned earlier, in 1971, President Nixon ended the ‘gold standard,’ meaning the dollar became a fiat currency, backed by nothing. This allowed the US to keep printing lots of money while having everyone believe that it remained valuable. How?

Because they already had a deal as a ‘global reserve’, and most of the printed money was shipped overseas in return for foreign goods, anyway. This lets the US receive cars and tech manufactured elsewhere, as they shipped out their overinflated dollars abroad. Voila, their inflated dollars don’t mess up the US economy directly… at least, for a few decades.

This is called ‘exporting inflation.’ As long as nations continue to trust the US dollar (despite it being unbacked) the facade can go on. As this took place, Nixon promised the dollar would ‘retain its full value,’ but his promises were broken.

The US dollar has lost over 90% of the purchasing power it originally had in 1971. From ancient times up till now, we’ve seen banks fail and governments print money despite inflation, just to bail out those banks again and again.

“The bank was saved but the money was ruined.”

William Gouge

Governments print money to prop up their bad money-system.

What Gouge is talking about in the quote above happens fairly regularly. In 2008, people woke up and realized the banks, governments, and real-estate industry had mismanaged everything.

Their solution? Print more money (unbacked by precious metals or any valuable assets,) and bail out the banks. Yep. They figured they’d just “press the magic money-printing button, and all’s well, right?” Wrong. They saved the banks, but the US Dollar is worth less than it has ever been.

The truth is, these are all band-aid solutions. Money hasn’t really evolved in ages. “Oh, but we have credit cards now, and banking by phone, and online banking!” you might say. But these are just surface tweaks that make using hollow, unbacked fiat currency more convenient.

Our actual money system is still the same flawed one as before. And evolution has to happen eventually. In fact, it’s been a long time coming, a financial upset happens about every 40 years. And the powder-keg of covid stimulus, plus inflation, plus growing awareness of Bitcoin is bringing it about fast. The world is hungry and ready for something better.

So how come I can still buy stuff with USD?

Your US Dollars still let you buy stuff because of a few (unsustainable) reasons.

- Because of the U.S. military’s immense power and threats. Other nations are hesitant to spit on U.S. currency because they might face military backlash. But this only lasts so long before the world gets fed up with a military bully and unites against them.

- Because of the U.S. government’s & bank’s trickery. They keep exporting inflation dollars out to other nations so that their own country isn’t flooded with low-value currency. Plus they set it up so the ‘U.S. Dollar’ is the agreed-upon global reserve currency instead of gold, making them the world’s ‘bank’, as I mentioned above. This also won’t last because eventually foreign nations will get sick of all the United State’s worthless inflation dollars, and they’ll start sending them back into the U.S. economy.

- Because no other system was around. U.S. citizens would rather prop up their terrible fiat system than admit the truth that they’ve all been duped. They’d rather defend their ‘great nation’ rather than embrace the confusion, chaos, and uncertainty of not having a money system at all. Citizen’s complacency and comfort-seeking spurs them to grasp at straws of a corrupt fiat system. This is unsustainable because blind denial of reality is never enough to sustain a lie.

“We now live in a nation where doctors destroy health, lawyers destroy justice, universities destroy knowledge, governments destroy freedom, the press destroys information, religion destroys morals, and our banks destroy the economy.”

Chris Hedges

The old ways shall fall, the new shall be born, as always.

Welcome to the debut of digital money.

And I don’t mean just Bitcoin. I’m talking about any digital money.

Because people had been trying to create a digital money system since the internet launched, way before Bitcoin came along. But every time they did, digital money had two major problems.

One, the money was centrally controlled. That meant the digital money had one ‘point of failure,’ and one ‘point of corruption’, very similar to what banks/govt./federal reserve is to fiat. So digital money would quickly experience the same type of corruption that broke all previous money systems throughout history.

Two, it was susceptible to ‘double spending’ (basically a ‘digital counterfeiting,’) since digital data is usually so easy to ‘copy’ and ‘paste.’

These were big problems until Bitcoin launched.

Satoshi Nakamoto designed Bitcoin from scratch to be better than US Dollars. He/they designed it to solve some of the biggest problems fiat has. Whether they succeeded or not may be too early to tell, but it’s a huge advancement towards solutions. For example…

Bitcoin is less ‘corruptible’ than USD.

This is because Bitcoin is ‘decentralized.’ It doesn’t have a single point of corruption or failure because it operates on thousands of different computers globally, instead of on one corporation’s servers.

Bitcoin is harder to counterfeit than USD.

Bitcoin’s blockchain technology makes double-spending (‘crypto-counterfeiting’) extremely difficult. Not to mention its blockchain technology ensures public transparency, so all shady dealings can be observed, as anyone can look up any individual transaction history on the blockchain.

So, Bitcoin solved the two major problems that foiled previous digital currencies. It also has a total supply of 21 million Bitcoin to be released by the year 2140. No additional Bitcoin shall (or can) be printed. This means there are no hyperinflation issues like there is with fiat since nobody can just ‘print’ new Bitcoin after 2140.

If unbacked currency is so bad, what’s Bitcoin backed by?

And doesn’t Bitcoin have the same problem as fiat? As far as I know, Bitcoin is not backed by gold, or seashells, or even bartered goods and services like the valuable currencies of old, is it?

Well, yes and no.

Money’s purpose is a ‘symbol of value’, and it works best when each unit of money is ‘backed’ by something tangibly and measurably valuable. And unlike the bartering of goods and services, people tend to argue whether gold (or seashells) is truly valuable or not. Similarly, people argue about whether Bitcoin’s backing is truly valuable or not as well.

That said, Bitcoin is backed by ‘proof of work.’

It’s a bit technical, but basically ‘proof of work’ means that every single bitcoin in circulation indeed has ‘valuable work’ done to create it. Each bitcoin costs someone electricity, computing power, and space to create. These are all valuable things, the same way gold, seashells, or bartered goods are valuable.

Bitcoin’s built-in ‘proof of work’ is why it’s not possible to just snap our fingers and ‘print new bitcoin’ the way the US government currently prints fiat. Creating a new bitcoin takes real people, with real electricity, doing real computer ‘work.’ Bitcoin’s network is also quite valuable, because this network allows digital, peer-to-peer transactions, a value fiat doesn’t provide.

Still, Bitcoin certainly isn’t backed by something as tangible, reliable, and agreed upon as precious metals either. So it lies in this nebulous space where it’s not unbacked like fiat, (totally made-up and infinitely printable,) and it’s not exactly the ‘gold standard’ of value either.

Regardless, Bitcoin is seen as a viable ‘symbol of value’ (often called a ‘store of value’) by growing numbers of people, and we’ve seen that the entire globe can believe in the US’s fiat ‘monopoly money’, so it’s not a stretch for people to believe in Bitcoin just as fervently.

Bitcoin is already poised to store more value than the monopoly money the US Dollar has become.

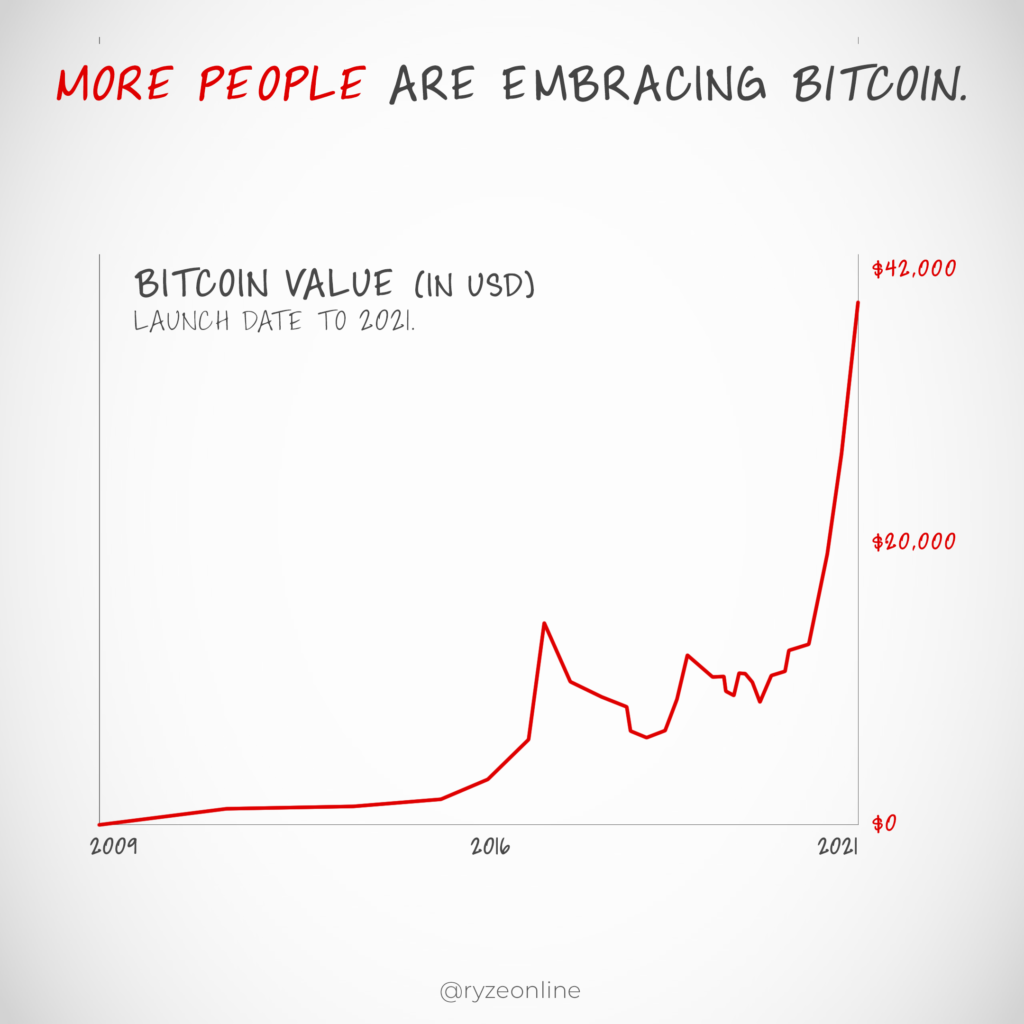

And Bitcoin’s value continues to rise.

You can see this in the chart above, the price of a single Bitcoin at time of writing being:

$42,224.80 USD

Now this isn’t Bitcoin’s final value or true value. All the buzz, popularity, and speculation going on in the market can cause Bitcoin’s price to fluctuate wildly.

And another thing to note is that Bitcoin’s proof of work functionality currently takes a good amount of fiat to get going because computers, space, and electricity are generally all purchased with fiat (at time of writing.)

These kinks haven’t been fully worked out, but society is passionate about doing so. And deep down at its core, Bitcoin has huge upsides over the dollar.

And it’s not just Bitcoin that has these upsides, many cryptocurrencies are getting into the game. Bitcoin paved the way for many cryptocurrencies to enter the market as viable money systems, but Bitcoin currently leads the field, with its Lightning Network allowing everyone with internet access to do business with others all over the world.

It lets them instantly send or receive payments without the need (or the fees) of third-party banks or other payment providers that only exist to drain fees from those transactions. Similar to bartering days, Bitcoin brings our system back to person-to-person trading, or peer-to-peer money transfers.

And one more thing…

Bitcoin also has the widest global appeal.

Do you know what’s not appealing? Pieces of paper printed by corrupt politicians in rich nations, backed by no real value whatsoever. And you know what is appealing? Instant digital wealth transfers from one honest citizen to another, with no middlemen, available to every human who can access the internet.

Bitcoin is available to all, including many who’ve been unable to participate in financial markets before.

“The government will one day be corrupt and filled with liars and the people will flock to the one who tells the truth.”

Thomas Jefferson

We live in a world of ~7 billion people, but only about one-and-a-half billion get access to financial tools and markets. Many are unbanked. Or can’t invest. Many have little-to-no purchasing power. Others have minimal financial freedom. In large part due to our woefully outdated money systems.

And just as we abandoned bloodletting as a foolish way to cure diseases, we’ll soon look back on how silly it was that a person’s nationality or geographic location decided whether or not they could use financial tools, investment opportunities, and money transfers.

Whether you live in Nigeria or the US of A, Bitcoin allows every human to ‘flex their financial muscles.’ It lets them improve their financial practice/education, and become more economically involved with the world, instead of being marginalized as ‘not economically valuable’ or ‘not economically impactful.’ And even if it doesn’t do so perfectly, Bitcoin is a huge step in the right direction here.

Bitcoin can also free those being conned by greedy banks, governments, and middlemen.

As we’ve seen repeatedly through history, oligarchs conning citizens is common, and affecting many people this very minute. And it’s time for change.

Nearly all other fields have embraced technology and a digital era, books have gone digital. Media has gone digital. Taxis have gone digital. Now it’s the finance industry’s turn, whether they like it or not.

Basically, fiat has a lot of problems, while Bitcoin has a lot of solutions.

It’s kind of a ‘no-brainer.’ People once said the world wide web was a ‘fad,’ and that all these ‘websites’ would eventually fade away. Instead, the internet and the web became a pillar of our global society.

Many people said a similar thing about cell phones. Instead, there are more mobile-device users than ever. People who say Bitcoin is a fad or a bubble may be in for a surprise.

But I get it.

Because most of us have grown up in a confusing, corrupt system that we assume to be ‘normal’ and ‘unchangeable.’ Because we’re immersed in the system, it can be tough to see the forest for the trees. If a person is born inside a fiat economy, then that is all they know. If they’re never given a financial education or outside view, it’s challenging to know what’s going on.

“No generation has a right to contract debts greater than can be paid of in the course of its own existence.”

George Washington

Our current fiat system is a game where whoever cheats best wins. And it’s usually the politicians, banks, and corporations who cheat best. It’s a rigged game by the people who founded it. It has barely any transparency and accountability (as seen by the 2008 crisis.)

Digital currencies are a new game though.

They use blockchain technology to minimize corruption, prevent counterfeiting, offer total transparency in all transactions, and bring shady dealings out of the shadows.

Auditing Bitcoin is easy, while auditing fiat is practically impossible. Bitcoin is designed from the ground up to be more fair and accessible to all, not just the rich.

Traditional finance allows a handful of major players to cheat, effortlessly printing money and lining their pockets, while lowering the ‘purchasing power’ of every other citizen. Given the options between fiat and Bitcoin, the choice is easy.

Just like Uber solved taxis, Netflix solved TV, mp3s solved CDs, Amazon solved retail, etc. Bitcoin solves finance. And with Bitcoin, as with all those great inventions, even the most stubborn people eventually get on board because, well, it’s just better.

Bitcoin is just better, in nearly every way.

Yes the US Dollar has longevity and familiarity, but those two things didn’t stop Uber, Amazon, or Netflix. Better is better. Better overcomes ‘the way we’ve always done things,’ and people eventually embrace the new way.

Yes the US Dollar has rich men and military power heavily invested in it, but rule by an iron fist or rule by economic manipulation can only last so long.

Just like society got tired of cumbersome gold bars, then tired of pocket-heavy gold coins, they’re now tired of chopping down trees to make paper money. More and more children are being born with no idea what vinyl is, they know only ‘streaming.’ The next generation may not even know what paper money is, they’ll only know crypto. The U.S. is going to have to create its own digital currency, and the traditional paper-money U.S. Dollar is as good as dead.

We’re all embracing a digital era, and that means digital money.

“But what about regulation?” you ask.

Sure, crypto is the wild west right now but…

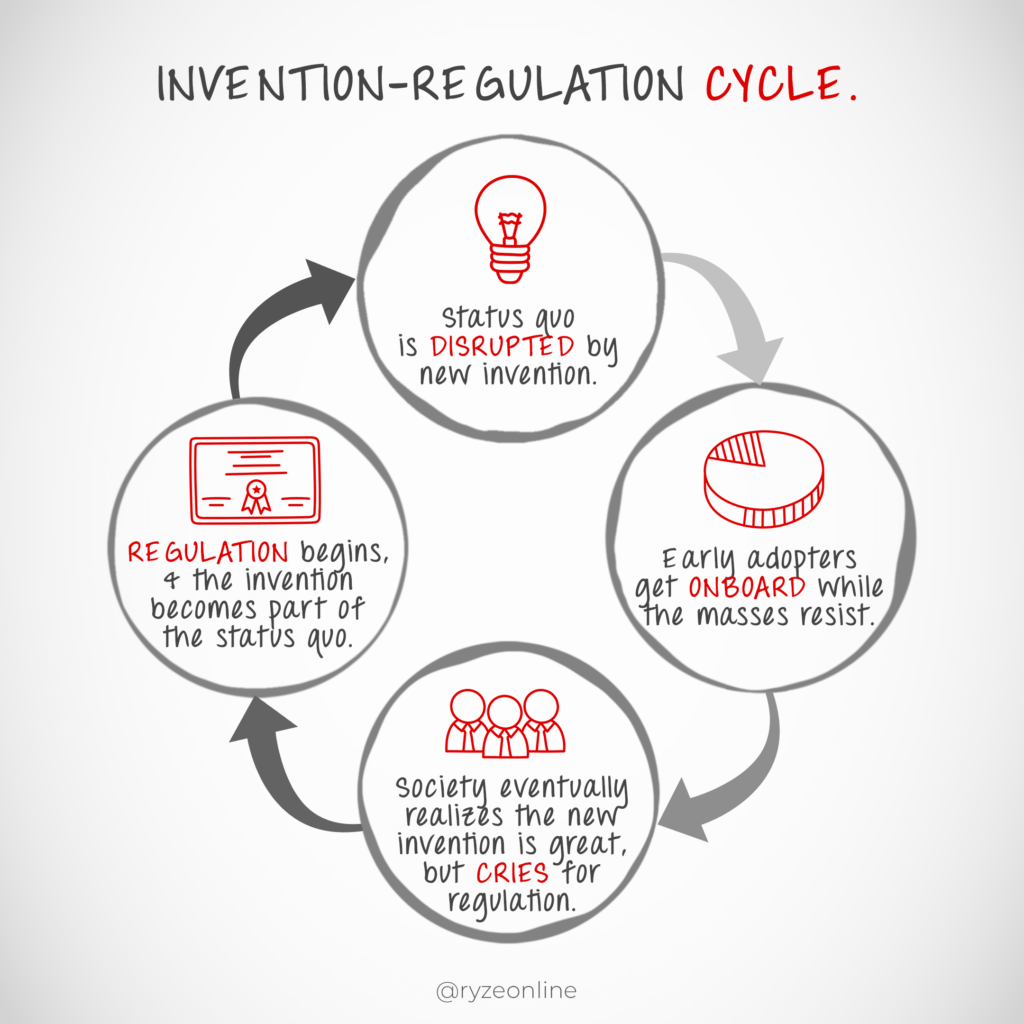

It will go the way these things always do. First, a new invention arises. It revolutionizes life and people scramble on board. Then society realizes this new technology is great, but it could use some regulation. And so, regulation efforts begin. Shortly after, the new technology is now a staple of society, reasonably regulated, and used by all.

The train has left the station, the wheels are in motion, this is happening, and the traditional, fiat, US Dollar is going to be left in the dust.

If the US government, banks, and federal reserve want to keep up, they’re going to have to create their own blockchain and digital US Dollar or something.

But once they do that, they’re competing on an even playing field with all the other blockchain currencies, of which Bitcoin is the reigning king. (Or maybe their fiat money is still valuable enough to someone for them to corner the market on Bitcoin?) Heheh.

Now, I realize I might sound like a Bitcoin maximalist.

I may have come across as a Bitcoin fanatic here. Let me assure you that’s not the case. At the time of writing, I own less than 0.0002 of a bitcoin, and I do hold other cryptocurrencies. I’ve been in the crypto scene for just over three months, and have only recently begun researching the economy. I am a beginner. I’m a newbie. I may have been inaccurate on the odd detail here or there. But I still have insights to offer on finance, the economy, and the direction humanity is taking, and I poured a lot of love into writing this, intending to help readers understand Bitcoin’s buzz a bit better.

And to take it a step further, I can see some small holes and issues with Bitcoin. For example, technically Bitcoin can only fix part of our financial problems, mainly inflation. Bitcoin won’t stop all wars or end world hunger. And it definitely won’t magically make greedy people honest. Greedy people will still exist, and they will find other ways to abuse the system.

But if you had to choose between a hyper-abusable system like fiat, or a minimally abusable system like crypto…

What would you choose?

“I think the fact that within the Bitcoin universe an algorithm replaces the function of government…is actually pretty cool.”

Al Gore

But Bitcoin has the ‘first-mover’ advantage, and once a trailblazer takes the lead it becomes very tricky to surpass them. It’s certainly possible that some other cryptocurrency will take the lead, but it’s incredibly doubtful any fiat-based money system will prevail. It’s about as likely as the music industry returning to a ‘Discman’ over an mp3-player.

Since Bitcoin’s debut, we’ve seen thousands of cryptocurrency projects launch. Most have failed to innovate or gain mass adoption while Bitcoin leads the way, still going strong.

If you get how Netflix replaced Blockbuster, you get how Bitcoin will replace USD.

Netflix has become the default entertainment medium, and Blockbuster is a forgotten footnote. Bitcoin can and will do the same thing to any fiat currency. You might say ‘what about Ethereum?’ And sure, it’s possible some other digital currency will pull ahead of Bitcoin. People suggest Hashgraph, Nano, whatever else, as superior. They do seem more corruptible and less decentralized than Bitcoin, but I’m willing to concede another winner is possible. A true ‘crypto winner’ is about as easy to predict as predicting a winner during the ‘dotcom boom.’ For years it looked as if Yahoo would be the winner of Internet search, but along came Google.

Still, Bitcoin’s pioneering momentum is big. Hulu, Peacock, and other streaming services exist, but even with recent hits, Netflix is still king. Even if new streaming services have more features and are technically ‘better’ than Netflix, dethroning Netflix is difficult and quite unlikely. The same applies to Bitcoin.

In conclusion, everything I’ve said above is why it’s likely that…

Bitcoin will beat the US Dollar.

The only question is, will you get in on the ground floor, or be dragged into the crypto revolution, kicking and screaming, once you realize your fiat is practically worthless, backed only by a corrupt government’s con-artistry?

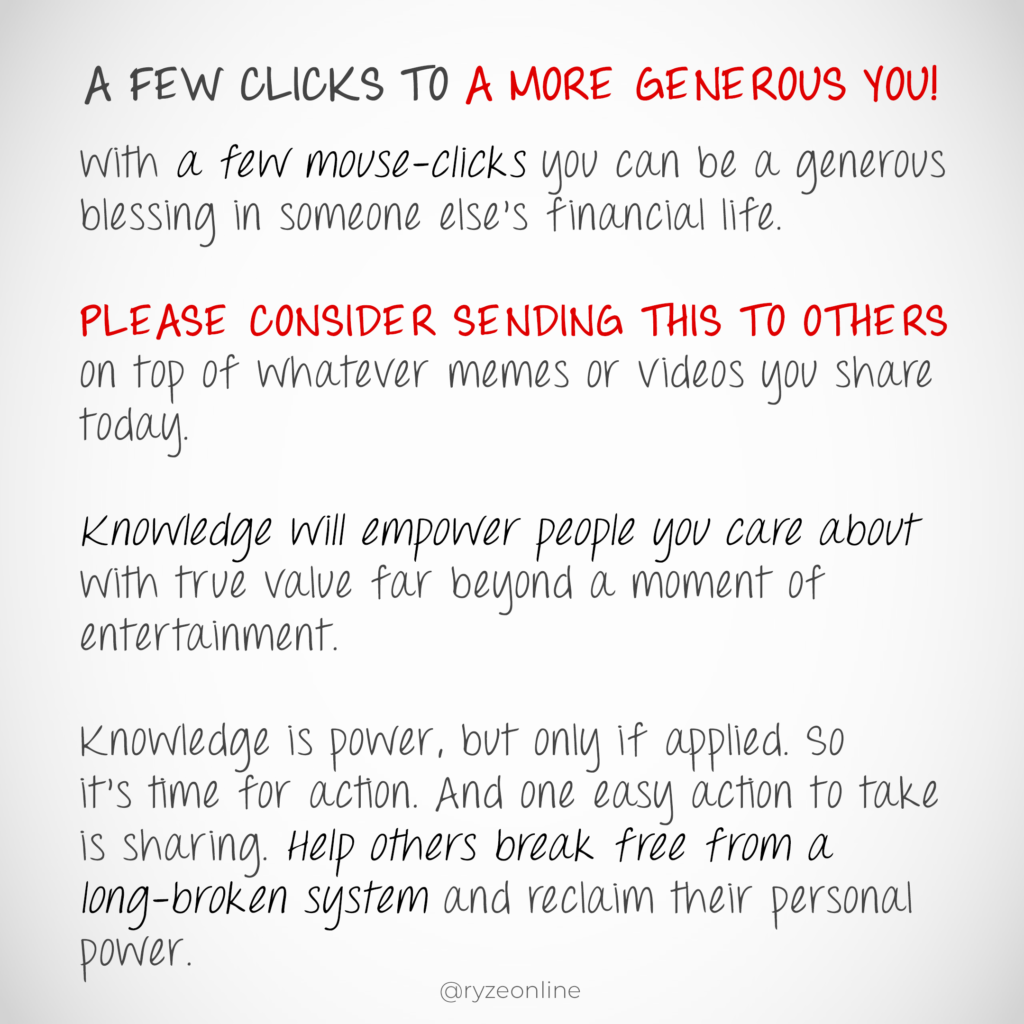

There’s a lot of misinformation and misunderstanding out there, and I believe this article can shed a lot of valuable light on things. I believe it can empower and educate people who’ve been kept in the dark. I believe that with a few mouse clicks you can be a huge, generous blessing in someone else’s financial life by sending this to them, so please consider using some of your valuable time and energy to share this with others.

It’s tempting to send people one more Instagram meme or Tiktok video, but the knowledge will empower them with true value beyond a moment of entertainment. Knowledge is power, but only if applied. It’s time for applied action. And one easy action to take is to share. Help the people you care about break free from a long-broken system and reclaim their personal power.

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.”

Satoshi Nakamoto, pseudonymous founder of Bitcoin

Whatever the case, I appreciate you reading, commenting, sharing, or even skimming, and I wish you a joyful, smooth, fulfilling financial journey in your future.

~J-Ryze

Sources:

- https://www.eurekaselect.com/139130/chapter/shells-as-currenc

- https://onlygold.com/facts-statistics/history-of-gold/

- https://www.messynessychic.com/2019/03/18/when-seashells-were-money/

- https://en.wikipedia.org/wiki/Banknote#Permanent_issue_of_banknotes

- https://www.philadelphiafed.org/education/the-first-bank-of-the-united-states-a-chapter-in-the-history-of-central-banking

- https://en.wikipedia.org/wiki/History_of_the_United_States_dollar

- https://corporatefinanceinstitute.com/resources/knowledge/economics/fiat-money-currency/

- https://www.theatlantic.com/business/archive/2012/02/a-short-history-of-american-money-from-fur-to-fiat/252620/

- https://blogs.cfainstitute.org/investor/2013/03/13/president-nixon-the-man-who-sold-the-world-fiat-money/

- https://www.federalreservehistory.org/essays/roosevelts-gold-program

- https://www.reddit.com/r/NewsCryptoOfficial/comments/ouiivb/howtocrypto_history_of_money/

- https://bmg-group.com/usd-purchasing-power-currency-in-circulation/

- https://tpglobalfx.com/fundamental-news/bitcoin-hits-historical-high-jumps-above-us-41000-mark-jan-08-2021/

- https://economictimes.indiatimes.com/markets/stocks/news/boom-and-bust-how-bitcoin-prices-have-swung-wildly-since-2010/bitcoin-vs-gold/slideshow/82790257.cms

- https://www.youtube.com/playlist?list=PLE88E9ICdiphYjJkeeLL2O09eJoC8r7Dc

- Also, most images are from my favorite stock site, Envato.com , a couple from DreamsTime.com , and one from NetClipArt.com!

11 Responses

Honored to be the first guest poster on The Bitcoin Manual, thanks Nicky and Che, much appreciated!

Great work on telling the history behind money and how Bitcoin came to be – it will be exciting to see how the tussle between Bitcoin and USD ends up!

Really awesome effort on this one J! Thanks for being our first guest poster – many more to come 🙂

Thanks man, I poured a lot of love into it, and I agree, it will be exciting to see how it all plays out. Looking forward to more from TBM!

So well written. I learned A LOT. All that history of fiat was never taught to me but I’m not surprised after reading your article.

I loved it. I also shared it all over my socials and with friends and family.

Great job,

Much love

Cyn

The history of fiat isn’t really taught to anyone unfortunately! Imagine if it was – I wonder how people’s thoughts on dollars or pounds or euros or rands or other currencies they use would change.

Well, hopefully I’m teaching it a bit here at least, lol. And yes, I imagine their thoughts and views would change massively.

“Fears are educated into us, and can, if we wish, be educated out.” — Karl Augustus Menninger

You picked the best guest to start with a bang lol! great site. I’ve been learning quite a bit. I love it.

Much love,

Cyn

Thanks for checking the site out! Barely a month old at the moment, a long way to go but very happy you’re finding it useful and learning from it! Every day is a school day here!

Thanks to both of you for these kind comments, and yes, psyched to see TBM grow! 🙂