So, you’ve heard the term “Bitcoin strategic reserve” thrown around a lot lately. Maybe you’ve seen it in headlines, heard it in passing during a podcast, or perhaps you were confusedly scrolling through Twitter when suddenly, bam!—Trump’s speech at Bitcoin Nashville made you wonder if you missed an episode of a new tech drama.

Fear not! We’re here to break it all down for you in case all you heard was a bunch of nonsensical yapping and a whole lot of cheering, and you don’t get the hype.

Don’t worry, neither do I, but let’s pretend we care.

What the Heck Is a Bitcoin Strategic Reserve?

A strategic bitcoin reserve is essentially a stockpile of bitcoin held by a government or institution as a strategic asset. Similar to how countries hold gold reserves to diversify their assets and protect against economic fluctuations, a bitcoin reserve aims to achieve similar objectives in the digital age.

Imagine you’re a pirate—yes, a pirate, with a big ol’ treasure chest. But instead of gold coins and shiny jewels, your treasure chest is filled with Bitcoin. That’s essentially what a Bitcoin strategic reserve is, but with less swashbuckling and more spreadsheets.

In the world of finance and Bitcoin, a strategic reserve is a stash of assets kept in reserve to ensure stability and security. For Bitcoin, this means holding a significant amount of Bitcoin to hedge against market volatility, to safeguard against potential economic crises, or to simply make a statement that our country is better than yours based on the amount of Bitcoin we hold.

What do governments normally hold in reserve?

When governments aren’t stealing from their citizens through tax and inflation to fund all sorts of programs and line their own pockets, there are funds left over to keep things afloat and help with the country’s day-to-day operations.

Governments typically hold a mix of assets as reserves to manage their balance of payments, stabilise their currency, and maintain financial liquidity.

These assets are often referred to as foreign exchange reserves.

Common reserve assets include:

- Gold: Historically, gold has been a primary reserve asset due to its perceived stability and scarcity.

- Foreign currencies: Primarily US dollars, euros, and British pounds, these are held for international trade and financial transactions.

- Securities: Government bonds issued by other countries, especially those of developed economies, are often included.

- Special Drawing Rights (SDRs): Issued by the International Monetary Fund (IMF), SDRs are a reserve asset created to supplement existing foreign exchange reserves.

Why create a Bitcoin Strategic Reserve?

It used to be all gravy, with countries holding each other’s bonds and forex and making nice with one another, but when the US and EU decided to seize Russia’s foreign assets, liquidate them, and hand them over to fund Ukraine, the game changed.

It showcased the risk of a country holding an asset with counter-party risk. Sure, bonds are a deep and liquid market, but if the issuer can rug-pull you if you don’t toe the line, it becomes a hard sell to think of it as a reserve you own.

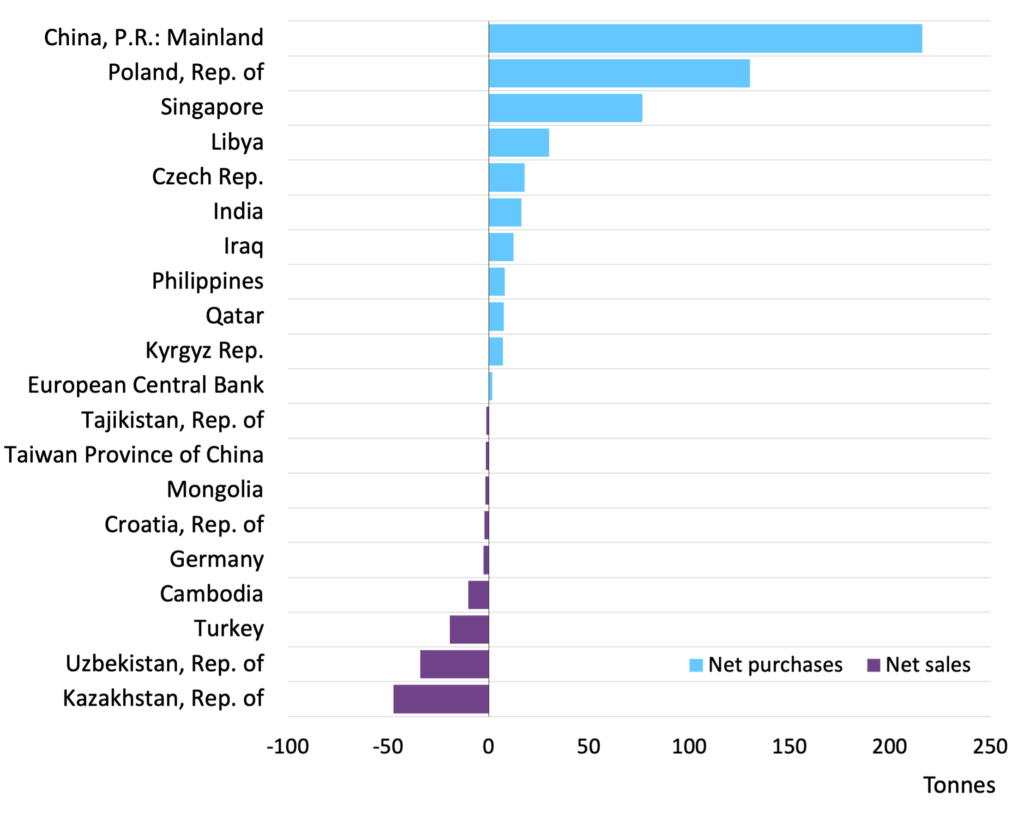

In light of these events, countries like Russia and China have been stockpiling gold, creating physical honeypots in their country that require a lot of money and labour to manage and defend, especially when compared to securing a set of private keys.

Strategic Play

Much like a chess grandmaster planning several moves ahead, entities with Bitcoin reserves are positioning themselves for future financial moves, whether it’s for investment, stability, or even making a political statement.

If you accept your currency is going the way of the dodo, it might be wise to use that borrowed time to secure your position on the new monetary standard.

Being The First Through The Door

With Bitcoin’s notorious volatility, having a reserve can be a way to hedge against sudden market drops or fluctuations, so it’s keeping a lot of the big boys on the sidelines.

If you’re moving massive volume, you move the market, so governments can’t exactly move in and out of the asset like your average pleb. While that volatility keeps these big players out now, if one global superpower makes a move, the rest have to dance to the beat.

Who knows? If Bitcoin does start to become a geopolitically relevant store of value, holding a Bitcoin reserve can stabilise a company’s or country’s financial standing.

Why the Fuss After Trump’s Bitcoin Nashville Speech?

Alright, so why is everyone suddenly losing their minds over this? Well, Trump’s speech at Bitcoin Nashville was like the crypto equivalent of a surprise cameo in a superhero movie. Here’s the scoop:

High-Profile Endorsement

When someone as high-profile as Donald Trump gets involved in a conversation about Bitcoin, you bet it’s going to stir the pot. Trump’s speech—whether you love him or not—was a huge endorsement of Bitcoin and brought the concept of Bitcoin strategic reserves into the limelight.

Political & Economic Implications:

Trump’s remarks had a ripple effect. By advocating for Bitcoin and its strategic reserves, he hinted at a future where Bitcoin could play a significant role in national and international financial strategies. Think of it as giving Bitcoin a VIP pass to the big leagues.

Crypto Enthusiasm

The crypto community, always eager for validation from prominent figures, latched onto Trump’s speech like a kid finding out their favourite superhero is real. This added a lot of buzz and excitement around the concept of strategic reserves.

Media Frenzy

Of course, the media loves a good headline, and Trump talking about Bitcoin was like giving them the golden goose. This led to an influx of articles, blogs, talking heads, influencers, and tweets about Bitcoin’s strategic reserves, keeping the buzz alive.

fmr president trump spoke for 49 minutes on saturday at bitcoin 2024 in nashville, a truly historic speech

— Alex Thorn (@intangiblecoins) July 29, 2024

here’s a condensed 12min version w/ his most important statements on bitcoin & crypto — click the times below to jump around

0:00 hello bitcoiners

0:23 bitcoin legends… pic.twitter.com/90hBX1icUy

Challenges of Building a Bitcoin Strategic Reserve

Now that we’re done with the hopium let’s look at the reality of building a Bitcoin strategic reserve and how it presents a unique set of challenges that differ significantly from traditional reserve assets like gold.

Volatility:

- Bitcoin’s price is highly volatile, making it difficult to accurately assess and manage its value over time.

- This volatility can lead to significant fluctuations in the reserve’s worth, impacting the overall economic strategy.

Security Risks:

- Safeguarding a large amount of Bitcoin requires robust security measures.

- The risk of hacking, theft, or loss is significantly higher compared to physical assets like gold.

- Developing secure storage and custody solutions is crucial; it’s not like gold, where you have a physical limit on how much you can carry in your pocket; if security is breached, a single person could walk out with all the country’s Bitcoin on a thumb drive or a few piecess of paper.

Regulatory Uncertainty:

- The regulatory landscape for Bitcoin is still evolving in many jurisdictions.

- Lack of clear regulations can create challenges in acquiring, holding, and managing Bitcoin reserves.

- Changes in regulations can impact the reserve’s value and legal status.

Valuation and Accounting:

- Determining the fair market value of Bitcoin for accounting purposes can be complex due to its volatility.

- Consistent valuation methodologies are essential for financial reporting.

Market Manipulation:

- The relatively small Bitcoin market compared to traditional financial markets makes it susceptible to manipulation.

- Large-scale purchases by a government or institution could significantly impact the Bitcoin price.

Lack of Liquidity:

- Compared to traditional assets, Bitcoin can be less liquid, especially in large quantities.

- Selling a significant portion of the reserve might be challenging without impacting the market price.

Energy Consumption:

- Bitcoin mining consumes substantial energy to support a global network; if you’re generating blocks to confirm a rival country’s transactions, is that a good use of your national resources? Hmmm

- Holding a Bitcoin reserve supports energy consumption, which might raise environmental concerns. When you’ve been shilling ESG for so long, it’s kind of a bad look, and some of your key stakeholders might not support it.

Technological Risks:

- Bitcoin’s technology is relatively new and evolving, and governments are slow-moving and not known for their tech; that’s what the private market is all about, and governments are likely to be late to the party.

- There’s a risk of unforeseen technical issues affecting the Bitcoin network or individual wallets.

Public Perception:

- The decision to hold Bitcoin as a strategic reserve might face public scrutiny and criticism from your tradFi benefactors, who still need to acquire a position and see it as a threat.

- Explaining the rationale and benefits of such a move can be challenging for the public; if you’re telling them their tax dollars are going towards buying up Bitcoin versus whatever problem of the day arises, it’s a tough sell. When you have more people begging for financial support from the government, you won’t have those same people supporting any type of hodl strategy.

Why Should You Care?

So, why should you, the average person who’s just trying to navigate the confusing world of crypto, care about Bitcoin strategic reserves? Well, here’s why:

Investment Insight

Understanding strategic reserves can give you a clearer picture of how seriously investors and institutions treat Bitcoin; if countries are considering acquiring Bitcoin, you have a whole new source of buying pressure as these countries seek to acquire a percentage of the total supply.

Future Trends

Observing trends influenced by high-profile endorsements can help you anticipate market shifts. If Bitcoin strategic reserves are normalised, countries will have to showcase their positions on-chain, and traders could try to piggyback on the positive or negative sentiment of a country’s Bitcoin positions.

Political Dynamics

Since Bitcoin is increasingly intersecting with global politics and economics, knowing about these reserves can provide insight into how governments and institutions might integrate cryptocurrency into their strategies.

Countries playing around with the idea of a Bitcoin strategic reserve

Several governments worldwide claim some amount of Bitcoin by hook, crook, seizure, or by embracing the incentives the Bitcoin network offers those who wish to participate in supporting this network.

The prime example would be El Salvador, the first country to make Bitcoin legal tender; since the announcement, the country has started mining and acquiring Bitcoin through taxes and the sale of passports and has built up a reserve it has made public.

The other example is the Kingdom of Bhutan, which decided to start mining Bitcoin to monetise the surplus energy the country’s hydropower plants provide. Since this operation became public knowledge, the country has decided to expand its mining operations.

Lastly, an energy-rich country in turmoil, Venezuela has its own holding of Bitcoin, which it acquired through mining. It strong-armed local miners to submit their hash rate to their national mining pool, took a cut, and seized Bitcoin mining operations in the country.

While not household names on the world stage, it’s interesting to see how these countries have taken to Bitcoin and how these early acquisition strategies will turn out should more countries decide to add a little bit of Bitcoin to their national reserves.

The US is already sitting on a bunch of Bitcoin

The primary way the U.S. government has acquired Bitcoin is through seizures. Law enforcement agencies, particularly the Department of Justice and the FBI, have seized large amounts of Bitcoin from criminal activities related to darknet markets, drug trafficking, and other illicit operations.

This woman is single-handedly responsible for supplying the U.S. Government with half of the bitcoin for the national strategic reserve. pic.twitter.com/2R3YU8depQ

— Daniel Sempere Pico (@BTCGandalf) July 28, 2024

Single-issue bag pumpers, I mean, voters

Bitcoin is now a trillion-dollar asset, and this is the first major U.S. election in which lawmakers and candidates are paying attention to cryptocurrency.

While it’s still unclear whether there truly is a significant mass of single-issue crypto voters, politicians feel there are enough wealthy people in this space to justify pandering to them for votes and financial support.

The only thing I’ll reserve is my judgement.

In a nutshell, a Bitcoin strategic reserve is like a high-stakes game of Monopoly where Bitcoin is the property everyone’s after. With Trump’s speech injecting some presidential pizzazz into the mix, the concept has become a hot topic of discussion, blending finance, politics, and a dash of crypto drama.

Now, before you run off and start buying up a potential moon bag because your favourite red hat-wearing politician yells Bitcoin, consider that one man’s speech to gain your vote doesn’t automatically translate into an on-chain transaction.

This is nothing but a pipe dream until the US government develops a concrete plan and the treasury plays ball.

So, next time you hear someone drop the term “Bitcoin strategic reserve,” you’ll know it’s not just jargon—it’s an idea percolating around the world and part of the evolving financial landscape. And if you’re ever in a crypto trivia contest, you’ll have a leg up—or at least you’ll know why people suddenly treat Bitcoin like the latest must-have asset.

Happy Bitcoin-ing!