I’ve tried to be smart only to end up doing dumb things in the crypto market. I’m not proud to say I’ve made some really awful trades and lost a lot of money, be it “unrealised gains”, they still hurt in a way. These trades scar and they leave you with lessons!

I learned very quickly that I am not a trader, but what I can do is stack! I can stake and play bigger, slower trends than scalp the daily, weekly or monthly charts.

To me, that’s TOO much work and TOO much risk. I can focus my time earning fiat in my job, and I can let my money go to work for me.

Let your money go to work along with side you

When you put your money to work, just like you, it can get underpaid; it can get fired; it can get be working at a place that shuts down.

That’s why we hedge our risk with a job. If any of that happens, there’s very little you can do. In investing, you can split up your money to work in a range of places.

That little worker money goes out and earn their keep and bring you back a pay packet. The longer they work, the more experience they get, the bigger the pay packets they return each month.

Labour amplification

If you think about it, investing is just taking your labour and multiplying it to make more mini workers or at least that’s my strategy.

Let’s say I work, and now I have $500 to save at the end of the month. I can sit on that money, or I can tell that money to go out and earn its own keep. Each month that I can save $500, that’s a new staff member in my team willing to go to work for me.

I need to find a job placement. They could start out working in my savings account, and then when I find a job I think they can do, I will take them out and put them in a new job where they can earn more.

So when you’re only working for money, you never amplifying it. The wealthy have taken their labour and amplified it 10, 100, 1000 times more, and that’s why they seem to have a never-ending pile of resources that keep getting bigger.

Dollar-cost averaging

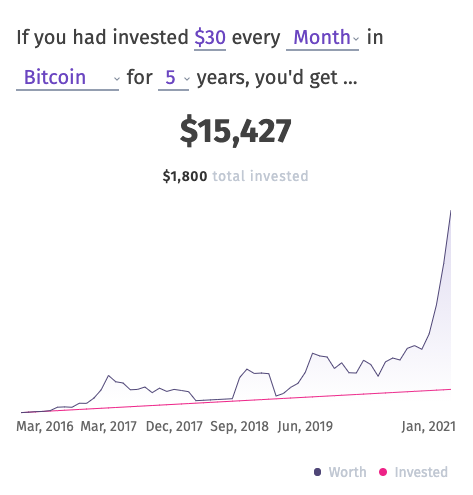

When you invest in Bitcoin, you are subject to price volatility and the price you got in at leaves you exposed to a lot of downside risks. When you dollar-cost average, you buy in at different prices, some lower, some higher, but because the amount you buy in is the same, you smooth out the volatility over time.

Buying daily sounds like a mission, but you don’t have to do it manually, with several apps available that can assist you in setting up automatic buying orders.

Dollar-cost averaging into Bitcoin is a powerful strategy, and I’ve been using it for 3 years now; I started buying monthly, then weekly now I am down to daily. So why do I buy daily?

Let’s have a look at the data, shall we?

If I invested $30 a month into Bitcoin over the last 5 years, I would have invested $1800 at the end of the time period.

But I would have Bitcoin worth $15 427; that alone is a 757.06% increase on your investment which is a stupid increase to get, but it doesn’t stop there.

Graph from Bitdroplet

However, if I took that same $30 and split it daily, over 5 years, I would have spent $1825, but I would have $25 930 simply because I could capture sats at more price levels than if I bought only once per month.

If you switched your buying to daily, you’d make a return of 1320.82% over the past 5 years.

Graph from Bitdroplet

Dollar-cost averaging daily versus monthly

If we compare the 2 results with roughly the same amount of capital, give or take a $25 extra doing it daily, you would have had an improved return of 68%

Now you can see how powerful dollar cost averaging is, but you don’t have to stop there. You can bring down your averaging even further by layering interest rates on top of that.

Supercharging DCA with interest

If we factor in that you can gain an additional interest rate on your Bitcoin now, let’s go with the average industry rate of these CE-FI platforms of around 4%.

- If you did the monthly buy-in and sat at $15 427, your monthly return would be $51. In your final month or month to date, you’re effectively capturing a 1 and a half months of dollar-cost averaging, lowering your buy-in even more.

- If you did the monthly buy-in and sat at $25 930, your monthly return would be $86.43. In your final month or month to date, you’re effectively capturing almost 3 months of dollar-cost averaging, lowering your buy-in even more.

Not discounting compound interest rates

In the calculation above, I only calculated the final month; if we could backdate each sat purchase and overlay the additional 4% you acquire over that time, your returns would be even higher. This is not financial advice; it’s only what I’ve been doing with my Bitcoin.

All I want is more satoshis at a lower price, and as the price rises, it gets harder for me to capture sats as my wages remain flat.

The only way I can make up for this growing divide is to dollar cost average and combine it with an interest rate return.