I often find it strange that gold bugs and Bitcoin bugs have so much hate for one another when they say the same thing. They want to return to hard money principles. Now the idea is something we all agree on, but the implementation is completely different. Gold is an analogue tool; it is heavy, it is hard to mine, it’s costly to find and create, and it reduces ones ability to manufacture money out of thin air, but it doesn’t stop it completely.

Going for Gold

You see, if gold prices were to shoot up to Bitcoin levels, everyone and their grandmother would be trying to mine this stuff, looking for it and trying their best to dilute the supply. Gold cannot be destroyed, so there are probably tons lost somewhere, on the earth, in the ocean, and we cannot really account for the supply.

Backing for Bitcoin

Bitcoin, on the other hand, is a digital asset; it can be destroyed by losing your keys; there is never going to be more than 21 million. There are tonnes lost; the supply cannot be changed or diluted when the price increases due to the difficulty adjustment.

Stock to flow

Now the reason I bring up supply is that it’s a major factor in the price of an asset; the more the supply, the lower the value…in theory.

The Stock to Flow (S/F) Ratio is a popular model that assumes that scarcity drives value. It is defined as the ratio of the current stock of a commodity and the flow of new products and is applied across many asset classes.

So gold roughly increases its supply by around 2% a year while Bitcoin’s inflation rate is around 1.76%, so yes, in both regards, buyers are being diluted. But with Bitcoin, we know the full dilute rate is 21 million; with gold, we don’t know; it could be higher than the numbers we have now or lower.

If we consider money supply alone, South Africa’s money supply grows at around 12% a year while the US is reported to be around 15% a year, averaging the current rates.

So, in theory, if you’re getting out of cash’s stock to flow and you’re getting into gold or bitcoin, you’re getting into something with a lower ability to dilute its value.

Bitcoin versus gold

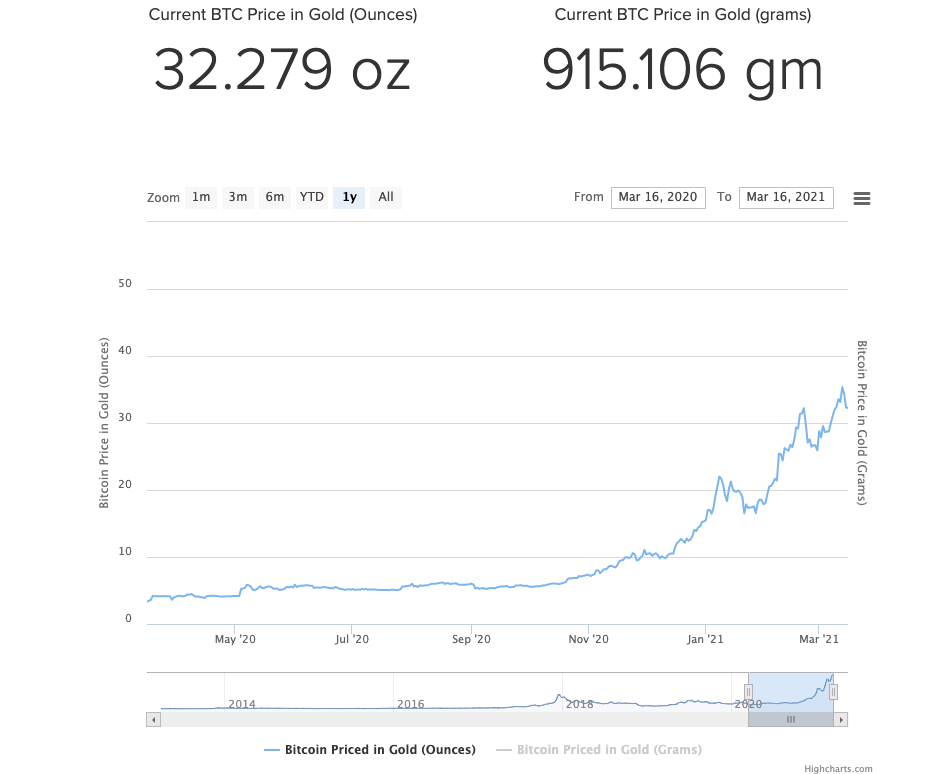

Gold has a 5000-year history while Bitcoin has 1 decade and some change under its belt, but if we compare the two over the last 8 years, we can see that in terms of price, Bitcoin is crushing the gold market if we only factor on scarcity. In 2013/14, 1 Bitcoin got you around 3 ounces of gold; today, it’s around 32, having hit an all-time high of 33 ounces.

If we look at this chart in isolation, we can see that gold is actually breaking down against Bitocin by a factor of 10 over a space of 8 years. Bitcoin is about less than one-tenth of the gold reported market cap and has some way to go to reach that 12 trillion level.

So there’s room to catch up and grow, and with new money, supply created all the time, there’s plenty of fiat around to bid up both assets.

Bitcoin has already shown that it can take on gold, so how will this play out when Bitcoins inflation is cut in half once again?

Gold along with bonds have been euthanised

I am not saying gold is a rubbish investment; I am just comparing the numbers. I do think gold also gets a bad rap because, like bonds, it has been euthanised. Gold and Bonds were the systems way of regulating value, but with the paper markets of gold contracts increasing the “supply of gold” by a factor of many times its supply and no one taking claim on their gold banks and governments have been able to suppress the price of gold.

This way, they keep confidence in the value of their currency; I mean, if gold were to be $5000 or even $50 000 you can be sure citizens would be foaming at the mouth trying to get out of fiat or even insist on being paid in gold.