Rampant inflation has taken hold worldwide; it’s no longer an economic affliction relegated to the banana republics of the global South but has seriously begun to pinch the consumer in the biggest markets in the world.

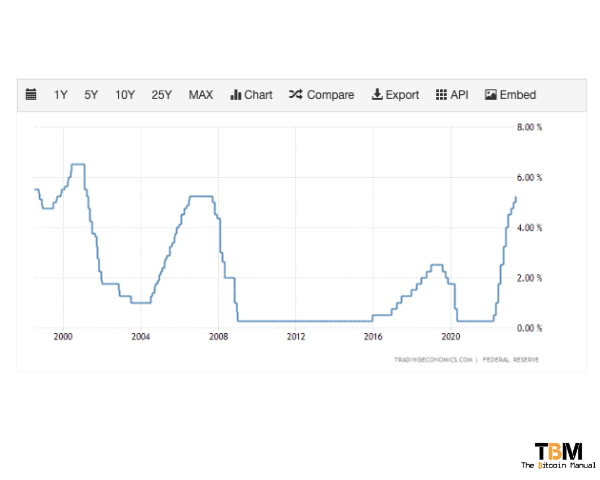

In response, central banks around the world have had to raise interest rates and follow the Federal reserves hawkish outlook. The last year has seen the Fed raise interest rates ten times — the fastest pace of tightening since the early 1980s — yet inflation remains well above its 2% target. As a result, the outlook remains higher for longer until inflation rates return to whatever the Fed feels is a palatable range.

As a result of the longest rate hike cycle in years, market incentives have driven more towards savings accounts and money market funds. These higher interest rates have rekindled the allure of saving, promising increased returns on cash reserves. Getting a yield on your savings is one thing, but what to do with that additional capital is another issue.

When the US raises, the rest usually follow.

The United States, with the dollar being the world’s primary reserve currency, significantly influences global economic conditions as they set the price of money or the “risk-free rate”. When the U.S. raises its interest rates, it affects other economies in several ways, which may prompt other countries to follow suit.

- Capital Flows: Higher interest rates in the U.S. can attract international investors seeking better returns on their investments. This could result in capital outflows from other countries, particularly emerging markets, as investors move their money to U.S. assets. To prevent significant capital outflows that can destabilize their economies, these countries might raise their own interest rates to maintain the attractiveness of their markets.

- Exchange Rates: Higher interest rates in the U.S. can cause the U.S. dollar to appreciate compared to other currencies. An appreciating dollar can lead to depreciation in other currencies, which can increase the cost of imports and fuel inflation. To counteract these effects and stabilize their currencies, other countries may raise their own interest rates.

- Debt Repayments: Many countries and international corporations borrow in U.S. dollars. When U.S. interest rates rise, the cost of servicing these debts increases. Countries might need to raise their own interest rates to strengthen their currencies and mitigate the increased debt servicing costs.

- Trade Balance: Higher interest rates in the U.S. can slow down the U.S. economy, leading to a decrease in U.S. demand for imports. Countries whose economies depend heavily on exports to the U.S. may be impacted negatively. Raising their own interest rates might be one way to manage this impact.

It’s worth noting that not all countries automatically follow the U.S. interest rate changes. Decisions about interest rates are typically made by each country’s central bank and are based on various factors, including the health of the domestic economy, inflation rates, employment levels, and more.

Why Having a Cash Buffer is Important

The relatively high-interest rate environment is a new paradigm for Bitcoin, which has spent most of its life in a low, zero or negative interest-rate economy, where risk assets were the darling of the moment. In such an environment, Bitcoin has benefited from cheap capital and accompanying risk appetite. Now that we’ve reversed, Bitcoin has seen liquidity flow out of it and into “traditional” safe bets like cash.

In times of uncertainty, people tend to sit on the sidelines in cash, and with interest rates on the rise, parking some of that cash to pick up a yield while you wait to deploy is a sensible option.

Many of us require a certain amount of cash to live, along with a cash buffer as a financial safety net. Holding cash is a psychological protection against unexpected expenses, income loss, or market downturns.

During a rate hike cycle, the charm of this buffer is intensified as it promises more returns. A healthy cash reserve provides peace of mind and offers the flexibility to seize unexpected opportunities, be it a discounted investment or an unforeseen expense.

High-Interest Rates Doesn’t Mean a Positive Return

While higher interest rates seem attractive, they do not guarantee a positive real return. It’s essential to consider inflation, which can significantly erode the purchasing power of your savings.

If inflation outpaces the interest you’re earning, then the real value of your savings is decreasing, despite the high nominal returns. Therefore, looking beyond the nominal interest rates and considering the broader economic landscape when assessing real interest rates for potential returns is crucial.

Having cash on hand has its obvious benefits. Still, if you’re getting compensated with capital that only partially stems from the losses against inflation, it would stand to reason that using your interest payments for something more productive would be your next step.

Transitioning Interest Rate Payments into Bitcoin – A Low-Risk DCA Strategy:

Here’s an interesting strategy: rather than keeping all your savings in cash, consider moving a portion of your interest earnings into Bitcoin using a Dollar-Cost Averaging (DCA) approach. DCA involves regularly purchasing a fixed dollar amount of an asset, regardless of its price, which can potentially lower the average cost per share over time.

This method is a way to hedge against inflation and potentially achieve higher returns in the long run. Moreover, as it involves only the interest earned and not the principal, it limits the risk while providing exposure to Bitcoin’s potential upside.

It might also be an option to get people off zero by using the psychology of not spending your own money. For those who still see Bitcoin as a “risk asset” but wish to have some allocation without feeling like they’re risking their own capital, peeling off their interest payments and using that to DCA into Bitcoin could be an attractive stacking option.

Your principle remains untouched, and you could even add to your principle to increase your monthly interest rate returns. Then by DCA’ing your interest payments into Bitcoin, you take advantage of the volatility by having multiple price entry points each month.

In fact, this could even be formalised into a product by financial institutions, allowing users to convert their interest payments into Bitcoin automatically, which could open up a whole new market that drives demand for Bitcoin and remain regular buyers. If the product’s performance produces the results that DCA’ing has done for those of us who save in Bitcoin, that track record would only encourage more users to opt for a product like this.

Give them a taste of hard money.

While higher interest rates make cash savings more appealing, it’s essential to consider the bigger picture. With the ever-present shadow of inflation, diversification, even into unconventional assets like Bitcoin, can offer an effective hedge.

As the rate hike cycle continues, and if you are fortunate enough to have savings that can generate some cash flow, you are presented with a unique opportunity. You get to generate an income that you can divert into Bitcoin without the need to time the market or make large, risky investments all at once. Instead, this approach offers a way to take advantage of the cumulative power of consistent, incremental investments over time.

It will give you exposure to Bitcoin without the psychological hangover of trying to turn a profit in the short term or the burdensome feeling of trying to trade or feeling overwhelmed by your decision to purchase Bitcoin at the right “time” and being an active participant in the market.